QBE shrinks cat aggregate reinsurance, non-renews some drop-down covers

Australian primary insurer and global re/insurance group QBE is set to retain more risk through 2023, as its reinsurance renewal saw the resulting coverage shrink, with the catastrophe aggregate smaller, certain layers non-renewed and all at higher costs.

QBE has clearly faced tougher reinsurance renewals this year, as the losses suffered in its home territory continue to harden rates there, while global reinsurance rates have also risen in response to challenging conditions, catastrophes and concerns over inflation and climate change.

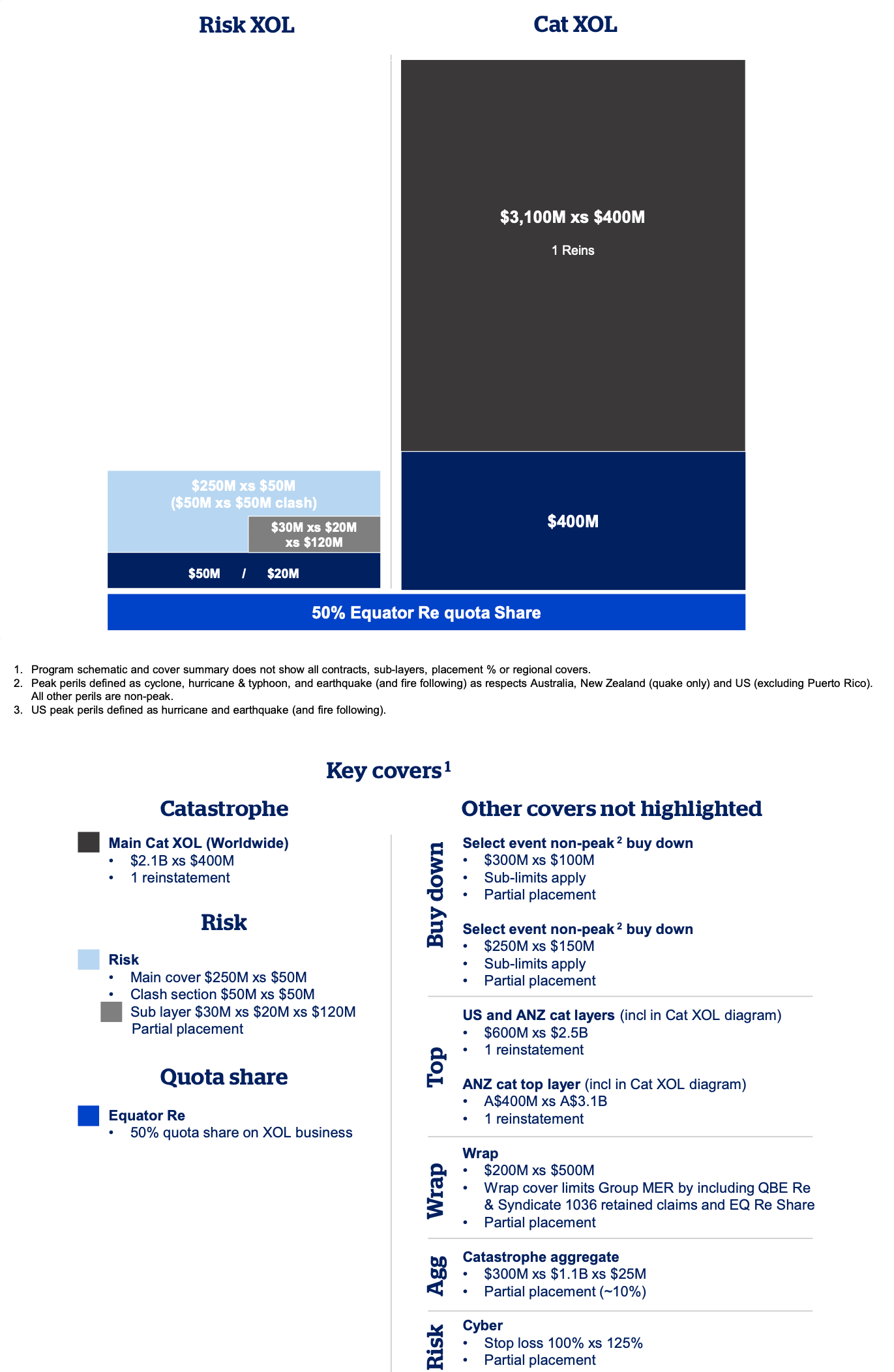

As a result, QBE’s renewed reinsurance tower looks a little different, with the company having to reduce its catastrophe aggregate protection, likely due to decreased demand from reinsurance capital for these frequency type covers.

QBE said that overall its reinsurance renewal was completed “largely as expected.”

The company said that this reflects growth in exposures, as well as the non-renewal of certain catastrophe reinsurance drop down covers.

As well as the non-renewal of certain drop down reinsurance arrangements, that in previous years provided valuable subsequent event cover as underlying layers would have been eroded from the tower by losses, QBE also said that some of its divisional reinsurance retentions have been increased, in particular for the US which rises to $200 million.

However, overall, QBE has been able to maintain its attachment point for its main catastrophe excess-of-loss reinsurance cover, at $400 million.

As a result, QBE anticipates retaining more risk in 2023, which could drive an additional headwind of as much as $200 million.

Because of the reduced reinsurance, the catastrophe budget has been increased for 2023, with QBE lifting it to $1.175 billion from $962 million.

The company had recently reported that it anticipates going over its catastrophe budget for fiscal year 2022, because of weather related losses.

One notable change to the QBE reinsurance tower for 2023 is the reduction in aggregate cover available, due to the non-renewal of the drop downs and also a shrinking of its catastrophe aggregate reinsurance cover as well.

The catastrophe aggregate reinsurance will provide $300 million of protection, excess of $1.1 billion, with a $25 million per-event retention as well for 2023. In addition, for 2023, the aggregate was not fully-placed, QBE said “Partial placement (~10%)” in a presentation this morning.

A year ago when we reported on QBE’s January renewal, the catastrophe aggregate reinsurance tower provided $500 million of cover, excess of $800 million, with a $10 million per-event retention.

So the aggregate reinsurance cover has significantly reduced for QBE, as the re/insurer responded to market conditions.

On reinsurance costs paid, QBE said this morning that the spend was roughly the same as prior years, with around $800 million spent on catastrophe and per-risk covers, out of a total roughly $4.3 billion spend including quota shares.

Andrew Horton, CEO of QBE, told the Wall Street Journal this morning that, “Although the expense looks the same, the actual program is not identical. What we’ve actually got is we’re retaining more risk. In effect, we’ve ended up getting less cover for the same price.”

Because of the higher retention and budgeted allowance for catastrophes, QBE now says that its catastrophe budget allowance for 2023 would have been sufficient in 7 of the last 10 years, so fewer reinsurance recoveries would be anticipated.

Looking ahead, QBE expects the higher reinsurance costs will be passed on to its customers.

CEO Horton told the WSJ, “We’re going to be putting through pricing on catastrophe-exposed insurance and reinsurance that we actually write. So, we will be putting rate increases through to try and cover some of the costs that we’ve incurred.”

You can see a simplified view of QBE’s new reinsurance tower below, as well as details of individual covers.

.