Property cat prices likely to rise in 2023, with “true” hardening possible: AM Best

Prices for property catastrophe reinsurance are likely to continue to rise into 2023, especially as concerns over inflation and the global economic environment persist, rating agency AM Best has said.

There is a general feeling across reinsurance and insurance-linked securities (ILS) markets that pricing has been insufficient to cover risks being taken on for a number of years.

That, alongside losses suffered, the growing financial impact of secondary peril events, climate change fears, macroeconomic stresses, the pandemic and other issues, have all driven a desire for more rate, resulting in hardening of property catastrophe reinsurance at recent rounds of renewals.

But still, even after the recent rate hardening seen at the mid-year 2022 reinsurance renewals, AM Best questions, “Is it enough?”

“No one questions the sustained improvement in global reinsurance rates since 2018,” AM Best explains.

The rate of reinsurance price increases has varied, according to line of business, region covered, how loss affected (or otherwise) a cedent or program has been.

But, in general, reinsurance rates are thought to have lagged behind both primary insurance and retrocession, meaning they needed to catch-up.

“The pace at which pricing continues to harden for property catastrophe exposures, however, seems to be accelerating,” AM Best notes.

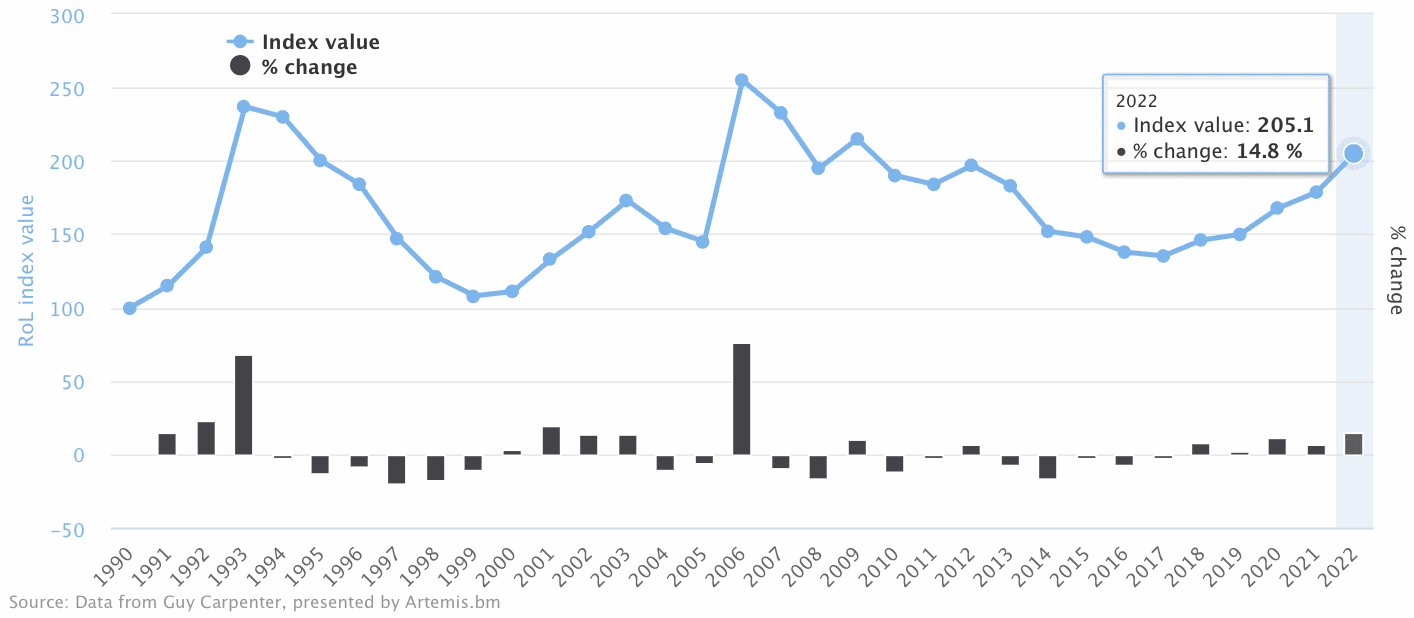

The rating agency uses the Guy Carpenter U.S. Property Catastrophe Rate-On-Line Index to evidence the acceleration, which has risen almost 15% this year so far.

“Such an increase has not been seen since 2006 and is leading to speculation that the end of year renewals may witness a “true” hardening that eventually turns the corner for reinsurers,” AM Best said.

But the Index is still catching up with property catastrophe reinsurance pricing levels seen in 2009, AM Best notes, while the Florida market has dominated the recent steep increase to it.

“Conditions in Florida–where problems stem from the low credit quality of cedents, concerns about widespread fraud, litigiousness, and a challenging regulatory environment—cannot be wholly attributed to the increased volatility of property catastrophe perils,” AM Best explained.

Adding that, “As such, Florida’s pricing movements are not necessarily a good indicator of what may happen in other cat-exposed territories during the next renewal cycle.”

But the rating agency believes, “Pricing for property cat seems likely to continue rising into next year.”

However, there are some big questions defining how much property catastrophe reinsurance rates could rise, the potential impact of inflation and also the occurrence of major catastrophe industry loss events.

“A combination of climate-related trends, and economic and social inflation, is driving reinsurers to reconsider whether rates are indeed allowing for sufficient margins, and to what extent cedents are pricing inflationary risks at source,” the rating agency said.

At the same time, while dedicated reinsurance capital levels have dropped somewhat, the overall capacity of the global reinsurance and ILS markets remain adequate, so any increase in capital could also pressure rates to a degree.

Leading AM Best to say. “Will the 2023 renewals mark a turning point for a “true” hardening market, able to attract new capital in droves and expand supply?

“Will third-party capital providers move first, as they have in previous cycles, taking advantage of the current retrenchment from traditional players and driving a new softening trend?”

But concluding that, “Trying to predict the future is even more complicated nowadays, because how the year-end renewals go will depend heavily on actual claims activity and on where the global economy goes.”

——————————————————————— Tickets are selling fast for Artemis London 2022, our first ILS conference in London. Sept 6th, 2022.

Tickets are selling fast for Artemis London 2022, our first ILS conference in London. Sept 6th, 2022.

Register soon to ensure you can attend.

Secure your place at the event here!

—————————————