Private ILS fund returns accelerate in May, beat cat bonds for first time in 2023

The returns of private ILS funds, so those that invest in privately transacted insurance-linked securities (ILS) including collateralised reinsurance and retrocession, have outpaced pure catastrophe bond funds for the first time this year in May 2023.

This is according to the Eurekahedge ILS Advisers Index, which reported an average ILS fund return of 1.17% for May, the strongest month of ILS fund returns so far this year, by its measure.

It takes the average ILS fund return for the first five months of 2023 to 5.48%, which is just slightly behind the record for this stage of the year set in 2007.

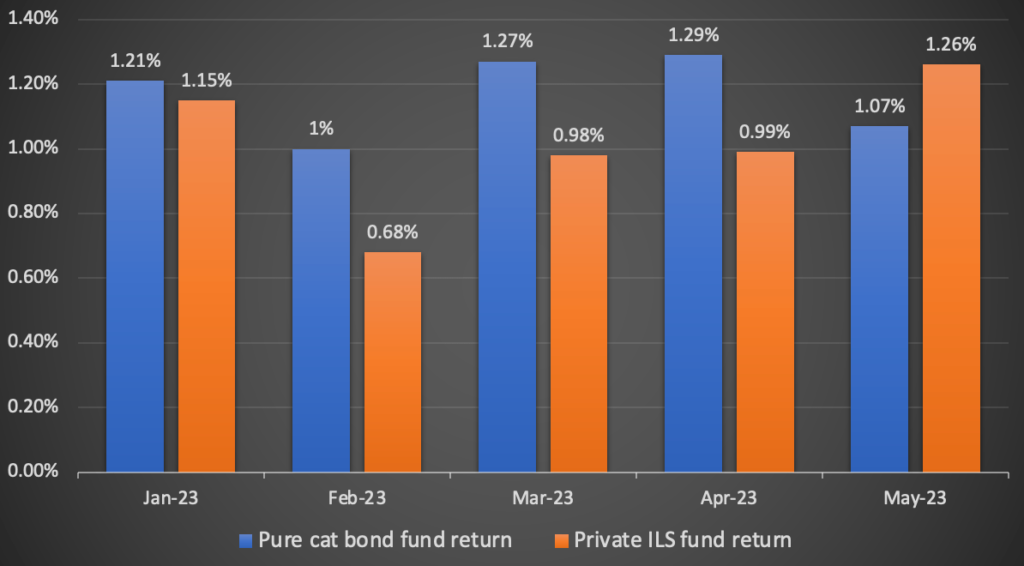

Through the first four months of this year, the pure catastrophe bond funds have outpaced private ILS and collateralized reinsurance fund strategies, coming in ahead each month reported so far.

But, May 2023 has seen the return of the private ILS fund strategies as a group accelerate, resulting in them beating pure cat bond funds for the first time this year.

You can see the performance of the two ILS fund segments by month below.

Every fund tracked by ILS Advisers for this Index reported a positive return for May 2023.

The lowest performance reported was a 0.50% return for the month, while the highest performance came from an ILS fund that delivered 1.83% for May 2023.

As private ILS funds begin to deliver seasonal performance we should see returns rising higher, on average, as long as there are no major catastrophe losses.

As we recently reported, numerous insurance-linked securities (ILS) fund strategies have delivered decadal high returns, at least, so far in 2023, as the higher reinsurance rate environment and elevated spreads for instruments like catastrophe bonds boost their performance.

The Eurekahedge ILS Advisers Index continues to track at its highest level of performance since 2007 and if catastrophe loss activity were to remain benign through the rest of this year, it could easily hit a record return.

![]()

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 26 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.