Non-life alternative capital hits record $99bn high: Gallagher Re

Investor inflows to the catastrophe bond market have helped to drive non-life alternative reinsurance capital to a new record high of $99 billion, according to the latest data from Gallagher Re.

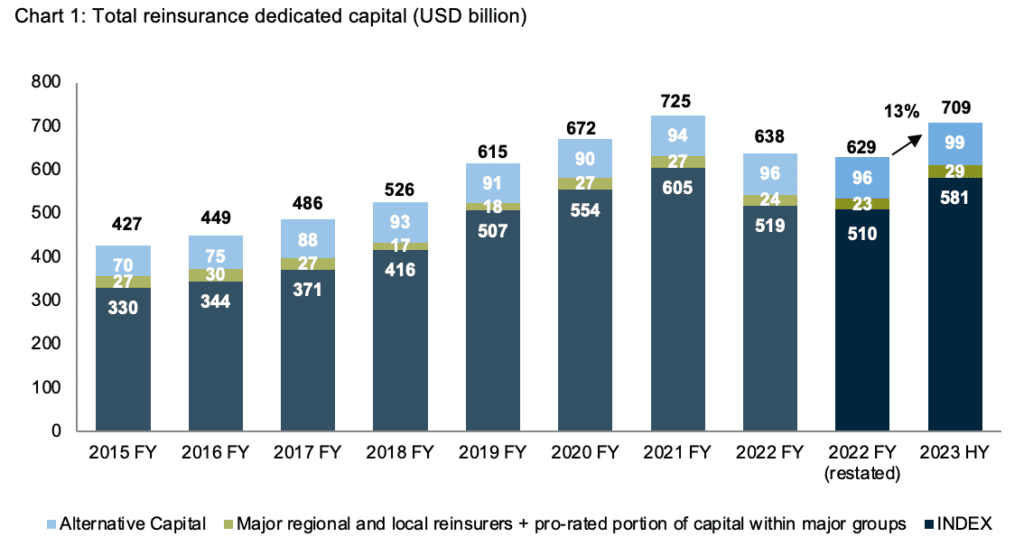

The reinsurance broker said that overall dedicated global reinsurance capital grew by 13% since the end of 2022.

This took the total for global dedicated reinsurance capital to US $709 billion at the middle of 2023, according to Gallagher Re.

Traditional reinsurance capital grew fastest, adding 14.5% to reach US $610 million at June 30th 2023.

Meanwhile, non-life only alternative capital, so non-life catastrophe bonds, insurance-linked securities (ILS) and other alternative reinsurance capital structures, reached a new high of US $99 billion, by Gallagher Re’s data.

That’s a 4% increase in non-life alternative reinsurance capital since the end of 2022, which Gallagher Re noted has been largely driven by flows to the catastrophe bond market.

Add in the life ILS market and it’s clear alternative capital in reinsurance is well above $100 billion, by this measure. As extreme mortality and health insurance-linked catastrophe bonds make up another billion plus alone.

Gallagher Re said that the catastrophe bond market recorded a $5 billion increase in capital in the first-half, with net inflows and mark-to-market gains the key drivers of assets under management (AUM).

Conversely, Gallagher Re notes that collateralized reinsurance has continued to shrink, on a relative share basis.

Driving traditional reinsurance capital higher has been strong investment performance and steadily improving underwriting results, Gallagher Re said.

But the reinsurance broker noted a “notable lack of new capacity despite continued favourable market conditions.”

Tom Wakefield, CEO, Gallagher Re, commented that, “Global reinsurers have shown strong performance in the first half of this year, reporting increased capital alongside improved underwriting profitability and ROEs.

“On an economic basis, capital adequacy also remained robust and indeed generally improved. Higher interest rates and rate increases booked at renewals YTD provide a tailwind and the potential for reinsurers to improve ROE further.”