Non-life alternative capital grew 11.5% to $107bn in 2023: Gallagher Re

Investor inflows to the catastrophe bond market and other areas of insurance-linked securities (ILS) helped non-life alternative reinsurance capital rise by 11.5% to a new record high of $107 billion by the end of 2023, according to the latest data from broker Gallagher Re.

Non-life ILS and alternative capital grew particularly strongly in the second-half of the year, having sat at $99 billion at the end of June 2023, according to Gallagher Re’s last figures on the market.

In dollar terms, non-life alternative capital grew by $11 billion over the course of 2023.

Gallagher Re estimates that the catastrophe bond market alone added approximately $6 billion of the total growth in non-life alternative capital last year.

Which means the broker believes that a further $5 billion in incremental ILS capital was raised for structures other than cat bonds, which is an encouraging figure.

“The key drivers were retained earnings resulting from reduced loss activity and higher collateral yields, net inflows and mark-to-market gains,” Gallagher Re said.

But also noted that, “Collateralized reinsurance continues to reduce on a relative share basis, in line with developments seen in 2022.”

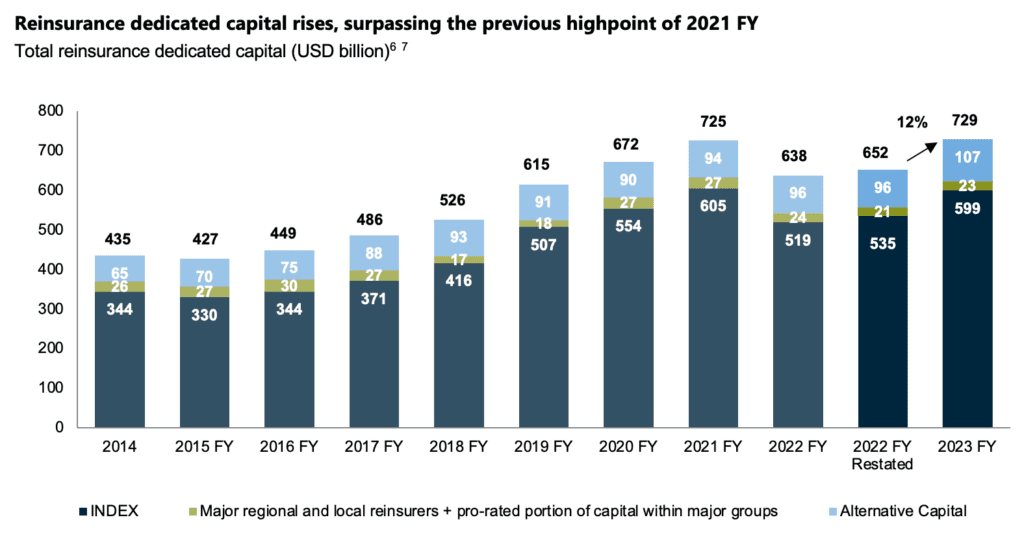

Overall global dedicated reinsurance capital grew by 12% to $729 billion by the end of 2023, surpassing the previous high set at the end of 2021, according to Gallagher Re’s data.

Traditional reinsurance capital across reinsurers tracked, which make up roughly 82% of global capital, totalled $535 billion at the end of 2022, but grew to reach $599 billion over the course of 2023, Gallagher Re estimates.

In addition, regional and local reinsurers pro-rated capital grew from $21 billion to $23 billion.

However, the reinsurance broker noted that, “Although reinsurance dedicated capital reached a new peak in 2023, capital growth over the past three years (+8%) has been outpaced by premium growth (+18%) as a result of both underlying demand and inflationary pressures.”

The industry is well-capitalised now, with high solvency levels, to which Gallagher Re said, “As well as increasing on an accounting basis, global reinsurers’ capital adequacy remains strong on an economic basis, the measure which Gallagher Re views as more relevant for management teams’ decision making. Average solvency for the top four European reinsurers was 261%, up from 255% at 2022 FY, which is at the upper end of, and in most cases above, management target levels.”

The broker also noted that new capital entry to reinsurance remains predominantly via the insurance-linked securities (ILS) market.

“Despite continued favorable market conditions there were no material new market entrants,” Gallagher Re said, explaining that, “The net balance of capital raises versus debt reduction accounted for only USD2B.”

Gallagher Re’s estimate of non-life alternative capital at $107 billion as of the end of 2023, is now very close to Aon’s estimate of $108 billion.

With significant new catastrophe bond issuance so far in 2024, a record year possible in that market as well as high-levels of cash generation to be reinvested, plus recovering investor appetites and interest for other types of ILS investments, there is a good chance of further strong growth in alternative capital by the end of this year.