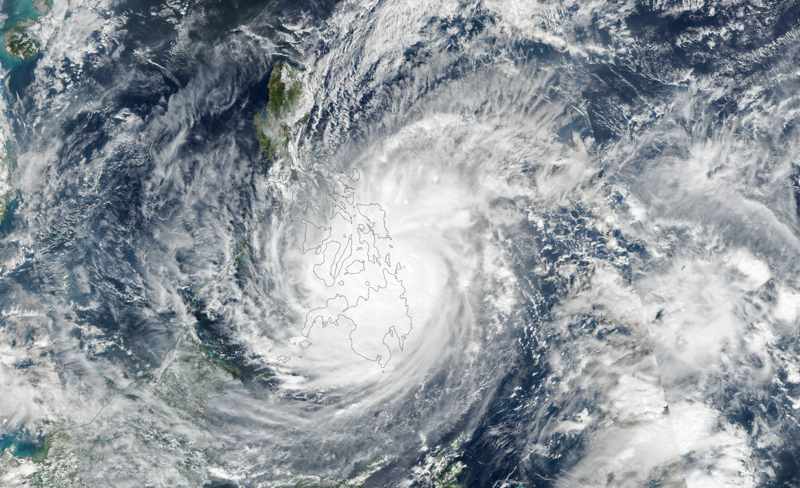

No additional Philippines cat bond pay out for typhoon Rai’s rains

Having already been triggered and paid out US $52.5 million, we’ve now learned the Philippines governments World Bank issued IBRD CAR 123-124 catastrophe bond will not face any additional loss of principal because of the rainfall from super typhoon Rai (locally known as Odette).

We reported back in January that the Philippines government would make a $52.5 million recovery under the terms of its World Bank issued catastrophe bond, as typhoon Rai was determined by the calculation agent to have breached the cat bonds trigger.

The final determination was that super typhoon Rai (locally known as Odette) breached the parametric trigger for wind, resulting in a 35% payout of principal of the $150 million Class B cyclone risk exposed cat bond notes.

But that determination of a payout did not let the cat bond off the hook, as a calculation process was also launched to determine whether the rains from typhoon Rai could also have triggered a payout.

The Philippines World Bank catastrophe bond covers both cyclone related winds and rainfall and in the case of typhoon Rai, a calculation has been undertaken for both.

The wind component is a far quicker process to calculate for, given the wind recordings are available relatively quickly and the modelled loss calculation can be undertaken quite soon after the storm itself.

The rainfall component takes longer and we can now report that the calculation process for typhoon Rai’s rains has now been completed and there is no additional payout to be made.

A precipitation event report has now been published for typhoon Rai, related to the Philippines government’s catastrophe bond and no additional principal reduction has been triggered, we have been told by sources.

So that closes the chapter on typhoon Rai and this catastrophe bond, with just the $52.5 million payout made.

However, it’s not the end of the story for the cat bond from recent typhoons and tropical storms, as another calculation process is still ongoing related to a more recent event.

As we reported in April, the Bureau of the Treasury of the Republic of the Philippines had issued a notice to the calculation agent of the World Bank issued catastrophe bond after the impacts of tropical storm Megi (locally known as storm Agaton).

As we understand it, with storm Megi not attaining high typhoon strength winds, this is also a precipitation event report situation, so it could take some time to be completed, as we’ve now seen related to super typhoon Rai’s rains.

So, the Class B tranche of the Philippines cat bond was eroded by the $52.5 million payout from super typhoon Rai, leaving $97.5 million in disaster insurance coverage remaining.

We’ll update you should we hear anything further about tropical storm Megi’s rainfall and how that cat bond calculation process pans out.

You can read all about the landmark Philippines catastrophe bond, the IBRD CAR 123-124 issuance from the World Bank’s IBRD, in our comprehensive catastrophe bond Deal Directory that includes details on more than 850 transactions.