Newsom vetoes bill increasing CDI investigator pay amid staffing shortages

Newsom vetoes bill increasing CDI investigator pay amid staffing shortages | Insurance Business America

Insurance News

Newsom vetoes bill increasing CDI investigator pay amid staffing shortages

Department reports critical issues due to pay disparities with DOJ agents

Insurance News

By

Kenneth Araullo

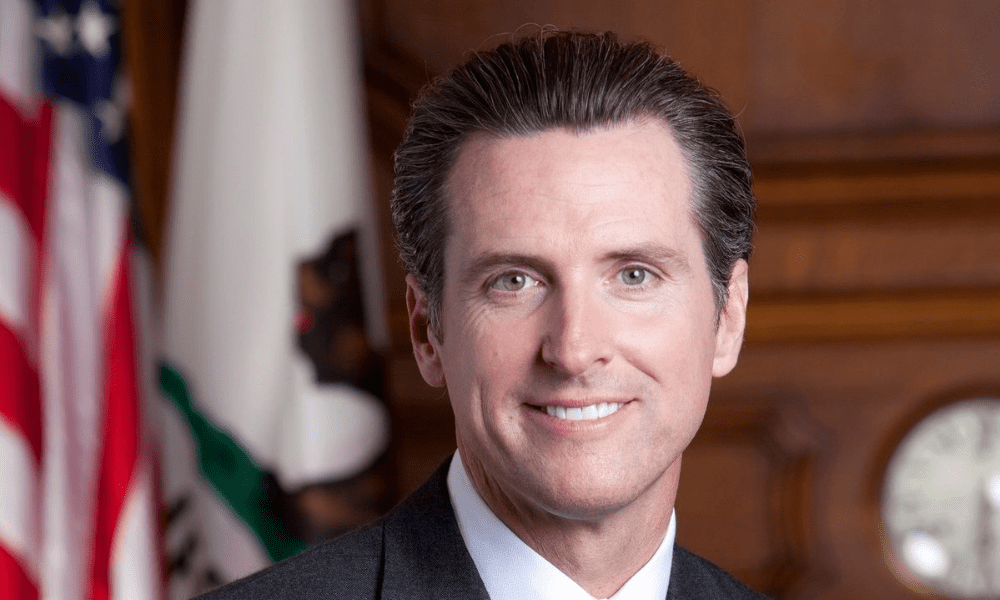

Governor Gavin Newsom has vetoed a bill that aimed to increase the pay rate for insurance fraud investigators at the California Department of Insurance (CDI).

The bill, Assembly Bill 2872, sought to align CDI fraud investigator pay with that of similar rank-and-file peace officers at California’s Department of Justice (DOJ).

DOJ agents received pay increases of 12% in 2021 and 5% in 2023, while CDI investigators saw only one increase of 5% during the same period, according to previous reports.

In his veto message, Newsom expressed concern that the bill would undermine the collective bargaining process and the salary-setting authority of the California Department of Human Resources.

“By setting a salary for one state department’s employees, in statute, the bill limits the state’s ability to consider factors that impact the state or other state employee bargaining units when proposing compensation packages through collective bargaining,” Newsom said, according to a report from AM Best.

Supporters of the bill, including the CDI, have argued that the pay disparity has led to significant staff shortages. According to CDI press secretary Gabriel Sanchez, 75% of insurance investigators who leave the department transfer to the DOJ to become special agents, creating a “cascade effect” that has left the CDI critically understaffed.

California Insurance Commissioner Ricardo Lara emphasized the impact of insurance fraud on the state’s economy and communities, noting that organized crime and complex financial schemes, including those targeting vulnerable populations, contribute to the problem.

“Stopping and preventing insurance fraud is critical to our state’s economy and community safety, and it is vital that we recruit and retain our committed, hard-working investigators charged with protecting consumers,” Lara said.

The Coalition Against Insurance Fraud estimates that insurance fraud has a national economic impact of $308.6 billion annually. In California, the CDI reports that the state experiences approximately $17.2 billion in economic losses each year due to insurance fraud.

What are your thoughts on this story? Please feel free to share your comments below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!