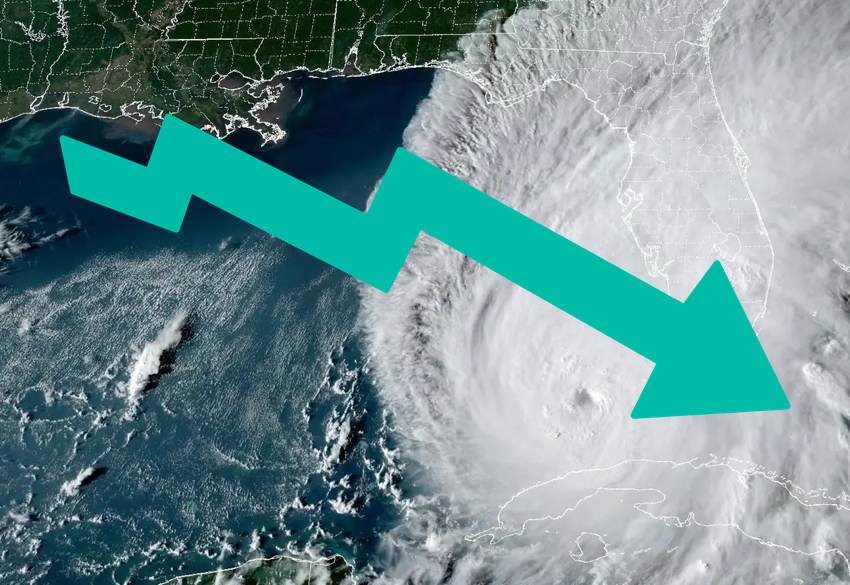

Mutual ILS funds slide on hurricane Ian, Stone Ridge Interval down 3.8%

With major hurricane Ian approaching its Florida landfall, the main mutual insurance-linked securities (ILS), catastrophe bond and reinsurance linked mutual investment funds have experienced some declines, with Stone Ridge Asset Management’s strategies leading the way.

Before we get into the numbers, it’s important to note that with hurricane Ian having intensified to near Category 5 strength as it approaches landfall in Florida, these declines are only likely to increase when these mutual ILS and reinsurance investment fund net asset values are next marked.

It’s still way too early for industry loss estimates, although sources continue to say anything up to $40 billion appears possible, with large caveats around the potential for a damaging blow to Orlando, if hurricane Ian doesn’t weaken as quickly as expected, or a second landfall in Georgia or South Carolina, should Ian make it back into the Atlantic and restrengthen there.

So there’s a still a great deal of uncertainty in play, with the only really certain thing being that Florida is set for a very difficult time as hurricane Ian will cause catastrophic damage to a wide area, with loss of life sadly seeming inevitable given the storm’s intensity now.

Of the mutual ILS and reinsurance funds, it is Stone Ridge’s Reinsurance Risk Premium Interval Fund that has been worst affected so far.

This fund has now declined by 3.8% since mid-September, with a first dip on the 19th as it became apparent there was a meaningful Gulf of Mexico hurricane threat, then a second sharp decline over the weekend which has continued this week.

This interval style mutual ILS strategy has probably the broadest exposure to hurricane Ian, having a moderate risk-return profile, with investments across many private reinsurance quota shares, sidecars, collateralized reinsurance arrangements and other ILS instruments, including some catastrophe bonds.

Stone Ridge Asset Management’s other mutual ILS fund, the Stone Ridge High Yield Reinsurance Risk Premium Fund, which is not an interval structure, has experienced a much smaller decline on the threat of hurricane Ian.

The Stone Ridge High Yield Reinsurance Risk Premium Fund is down 2.6% since mid-September, with most of that decline coming this week, as hurricane Ian’s severity was better understood.

Being a largely cat bond focused strategy, this may prove to be a largely mark-to-market decline for this fund, unless there are some actual losses of principal triggered by hurricane Ian, which we won’t know immediately.

After that, we have the Pioneer ILS Interval Fund, managed by asset manager Amundi Pioneer. This fund is a difficult one to interpret, as it’s barely declined, even though it does have a broad exposure to an event like hurricane Ian. As a result, the real net asset value movement may be seen after the landfall in the coming days.

Similarly, the industry loss warranty (ILW) focused City Nationa Rochdale Select Strategies Fund has not declined, but its NAV rise has plateaued which could be a sign.

Being a largely ILW focused fund strategy, investing in cells of the NB Re reinsurer operated by Neuberger Berman, with some cat bond exposure as well, it will be a little time till we’ll know if there’s any more meaningful impact to this strategy.

The final mutual ILS fund we can track is the relatively new Ambassador Fund, which comes under investment advisor Embassy Asset Management and is portfolio managed by Tangency Capital.

While this was due to be a cat bond focused strategy, it’s actually largely invested in re/insurer debt, but still this fund has seen its NAV fall over 2% since mid-September, albeit hard to tell if hurricane Ian is really the driver here.

Hurricane Ian is precisely the type and magnitude of catastrophe event that the ILS market provides its reinsurance capital to protect against. As a result, some losses to certain positions are to be expected, with a major hurricane like this.

Being pre-landfall, these declines are likely based on mark-to-market impacts to certain catastrophe bonds, as well as some of the manager’s in question proactively marking other private collateralized reinsurance positions down.

Because of this, some of the value may be recovered, against positions that improve positively over the coming weeks, as the extent of the damage is understood.

But there will be more concrete impacts to come to certain ILS positions held in these portfolios, as loss clarity is gained from cedants and the overall movement, at the moment, looks more likely to be downward than up for the funds with the most significant Florida exposure.