Most Innovative Insurance Companies in Australia and New Zealand | 5-Star Insurance Innovators

Jump to winners | Jump to methodology

Intelligent disruptors

Innovation is why the insurance industry continues to push boundaries and at the forefront of this movement are the 5-Star Insurance Innovators of 2024.

As a group, the winners have embraced the transformation to Insurance as a Service (IaaS) with their bespoke and embedded solutions. This customer-focused approach aligns with what the modern client demands and expects, and ultimately creates a more responsive industry.

“Over the last two years, the insurtech sector has seen a massive boom, being a big catalyst for innovation in insurance, a sector that’s been ripe for disruption for some time,” says Richard Klipin, CEO of the National Insurance Brokers Association. “Customers demanding more efficiency in an environment of abundant choice, and having clarity regarding what they want, is driving the industry to embrace digital transformation that can help improve customer experience and outcomes.”

AI is another significant element of the innovation movement as it empowers insurers to offer increasingly personalised products and optimise processes, handing them a competitive advantage. It’s also set to become more common as AI is adopted across the market, led by IB’s 5-Star Insurance Innovators.

Marcello Negro, principal and head of product management and marketing at strategic analytics firm Finity, highlights the key areas of innovation.

“In particular, across commercial insurance lines, we have seen an increase in investment into automation, particularly for tasks like document extraction of quote slips and asset schedules,” he says. “Insurers are recognising the value of freeing up their teams from tedious manual processes, allowing them to focus on making better underwriting decisions and building relationships with clients, ultimately leading to a better experience for insurers, brokers and customers alike.”

An example he presents is Finity’s recently developed Uniwriter product, which streamlines underwriting processes into one end-to-end system.

To genuinely innovate and stand out, Negro asserts, a firm needs to cultivate a culture of pioneers, reflected in the following approaches:

fostering an environment that encourages employees to explore new technologies such as generative AI (GenAI)

identifying opportunities for improvement

embracing proof-of-concepts and the inevitable failures or “learnings”

“This entrepreneurial mindset and forward-thinking approach were central themes at a recent Finity technology event, where speakers shared their experiences with building and maintaining digital ecosystems,” he adds. “Senior industry leaders emphasised the importance of bringing together people, processes, and technology to create a competitive advantage.”

IB’s 5-Star Insurance Innovators have embraced these principles to be at the forefront of challenging the status quo and pioneering new advancements.

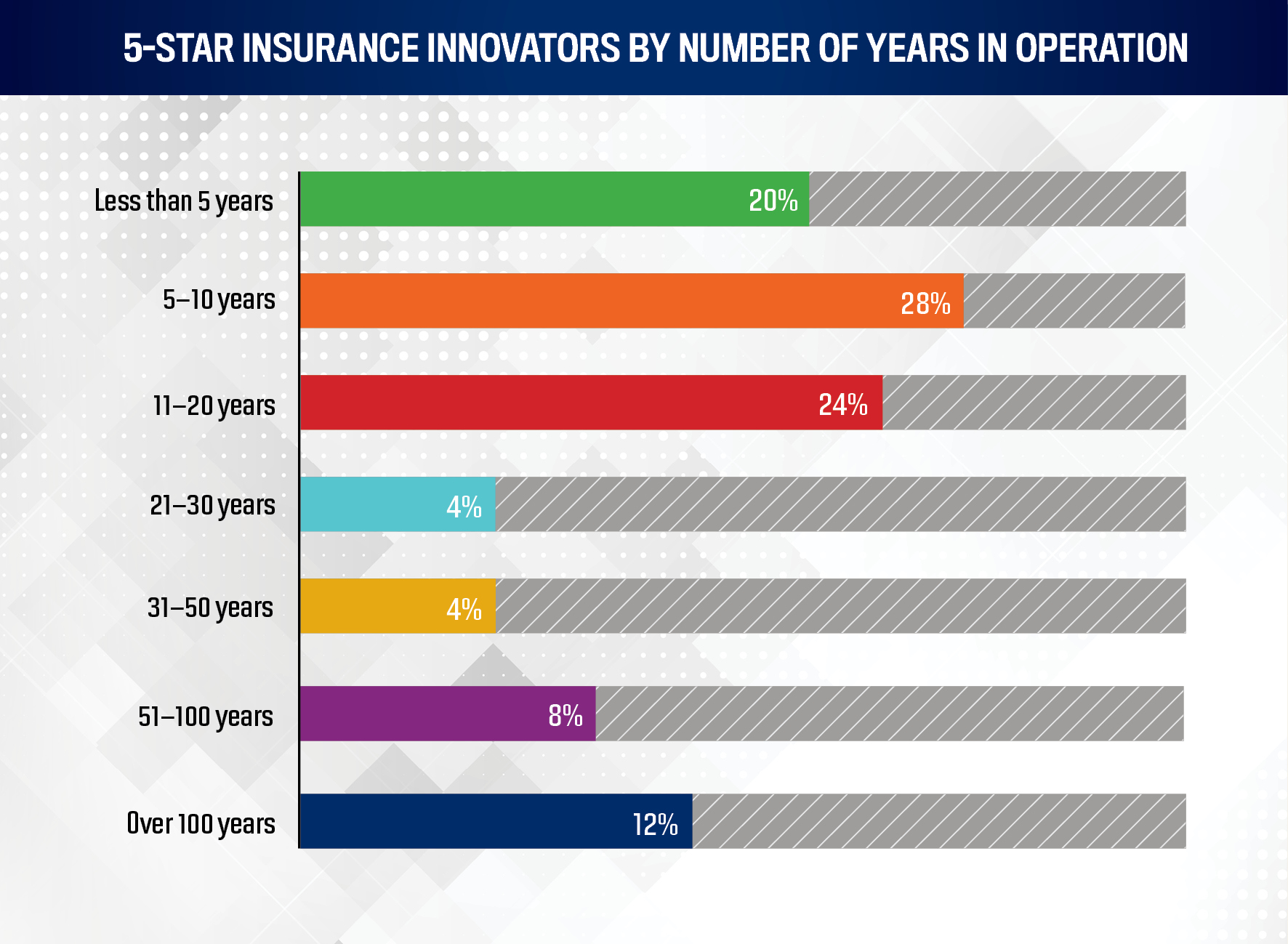

The IB team objectively assessed 38 entries from insurers, brokerages, and service providers across Australia and New Zealand, focusing on initiatives and results achieved in 2023. The top 25 innovative insurance companies that demonstrated extraordinary impact in propelling the industry forward were crowned 5-Star Insurance Innovators.

With more than half of global insurance CEOs confident in achieving returns on investment within five years of implementing GenAI, the most innovative insurance companies in Australia and New Zealand are positioning themselves as pioneers leading the way.

Below, three of this year’s 5-Star innovative insurance companies disrupting the industry with groundbreaking innovations share their insights on how they are shaping the future of insurance.

Klipin adds, “Consumers are getting much clearer about what they need and what they want. From an insurance broking point of view, when the world gets faster and more complex, the need to have a trusted advisor becomes even more important to help navigate through that complexity. A mindset that helps cultivate trusted advice that’s provided by an educated and capable professional will be in high demand to stand out in the future.”

Disruptive technologies are transforming the future of insurance

The 5-Star Insurance Innovator is a forward-thinking provider of claims and risk management solutions. Its approach to innovation focuses on leveraging advanced technology and thought leadership to enhance service delivery and provide actionable insights to the industry.

IB recognised the company for two key initiatives:

introducing an AI-driven telephony system that redefines claims management

publishing a strategic roadmap for insurers, “The Carrier Perspective: 2024 Claims Insights” whitepaper, which addresses critical industry challenges through expert insights

Deputy CEO of personal injury and COO, Lionel Charmetant, shares his observations and notable findings from both of these.

Q: How has the AI-driven telephony system specifically improved claimant outcomes, and what key insights have you gained from the real-time analysis of calls?

A: “Our early work with this system has shown strong potential to improve claimant outcomes by enhancing our ability to understand customer interactions and improve the processes that underpin our service delivery.

Qualitative analysis of customer calls is a manual and labour-intensive process. By utilising the AI-driven telephony system, we can access deeper insights faster than ever and on a larger scale. This provides data that is critical to providing high levels of customer service and frees up our service team’s time to have those personal interactions with claimants.

The call sentiment analysis tool rapidly transcribes calls, evaluates performance, and improves quality assurance standards, all contributing to enhanced productivity and better results.

By doing this at a large scale, we’re better able to identify trends in customer conversations, sentiment, intent and other key metrics. These actionable insights empower us to make data-driven decisions, ultimately enhancing our customer service and improving claimant outcomes.”

Q: What challenges did you face while piloting the AI-driven telephony system, and how do you plan to scale this technology across your operations?

A: “The most important challenge in implementing new technology is ensuring we retain and enhance the human touch. Our claims managers’ role in the claims process is indispensable, reassuring claimants, providing guidance and helping them navigate complex situations. Our AI tools are intended to support our people and complement the great service they already offer.”

Q: What feedback have you received from industry leaders on “The Carrier Perspective: 2024 Claims Insights” whitepaper, and how do you see it shaping future claims management strategies?

A: “The response to the paper has been fantastic. The whitepaper has been recognised for its valuable insights into the pressing challenges and emerging opportunities within the insurance sector.

We’re particularly proud that ANZIIF acknowledged the paper as part of the recent ANZIIF Awards, but we’ve also seen it spotlighted by Insurance Business, UAC and other leading industry bodies.

We’ve also had great feedback from clients and our connections in the industry. We’re planning the 2025 survey, and we’ve been able to expand the topics covered to address new and evolving areas of interest based on the feedback we’ve received.”

“As we launch and then scale new tools such as the AI-driven telephony system, our focus is always on how we engage our staff, incorporate their feedback, and bring them on the journey”

Lionel CharmetantGallagher Bassett

Breakdown: AI-driven telephony system

Why: Its adjusters handle about 20,000 phone calls daily, each potentially significantly impacting claimants’ lives. Given the sheer volume, no organisation can supervise every call, leading to potential inconsistencies in service quality.

How: Its AI system analyses each call for quality assurance, gauges sentiment, transcribes and summarises conversations, and aggregates results for performance management. The system ensures adjusters follow best practices, flags risks in real-time and provides comprehensive call data for continuous improvement.

Results: Significant improvements in its call handling processes, including enhanced quality of its claims management, improved adjuster training, strengthened relationships with claimants, and timely interventions, leading to better overall outcomes.

Differentiator: While some companies use AI for call analysis, its comprehensive system’s ability to gauge sentiment and summarise calls for broader data analysis is unique, setting it apart from competitors who may still rely on manual supervision.

“The Carrier Perspective: 2024 Claims Insights” by the numbers:

150: businesses surveyed globally to gather data on challenges, such as employee retention, AI utilisation, and the impacts of demographic and climate changes, offering a deep dive into these topics and actionable insights for insurers in Australia, New Zealand, the United Kingdom, and North America

10,000: downloads achieved within the first month of its release, earning it a reputation as a go-to resource for industry leaders who want to stay ahead of the curve and deliver value to policyholders

The 5-Star Insurance Innovator’s flagship risk maturity assessment online (RMA Online) platform is a first-of-its-kind enterprise risk management solution tailored for the care, education, faith, community and not-for-profit sectors.

IB recognised Ansvar Insurance for its groundbreaking innovation in the specialty sectors, which empowers organisations to take charge of their risk frameworks with easy-to-use technology backed by a comprehensive maturity model.

Its early-into-market release has seen uptake from multiple peak body groups, insurance networks, broker groups and individual clients, who benefit from the unique risk maturity model and integrated online system designed specifically for organisations governing vulnerable communities.

General manager of risk solutions, Anthony Black, shares his insights on the tool’s effectiveness in reshaping risk management practices and enhancing client and broker engagement.

Q: How has the introduction of RMA Online transformed the approach to risk management for organisations in the care, education, faith, community and not-for-profit sectors?

A: “Because it’s built by sector experts with extensive experience in governance and risk management, it’s widely accepted as credible and valuable. Its uniqueness also presents excellent opportunities for brokers to differentiate themselves from the more general risk management support traditionally offered to customers.

In essence, we are disrupting the high-cost and corporate-orientated risk models that these sectors have been forced to rely on, shifting to one that speaks to their context, in their language, for their purposes. Plus, it’s available to all organisations at no cost, which many find remarkable.

This approach is shifting the culture from a low-value compliance focus to one that measures the effectiveness of the risk framework and identifies ways to strengthen it – and that’s what maturity is all about.

This transformation enables organisations to drive their own improvement, build long-term risk management capabilities, and benchmark outcomes with other organisations, an option previously unavailable to these sectors.

For brokers, it’s a point of difference. New avenues for supporting clients and deepening relationships in these sectors have opened, fundamentally changing how brokers engage with their clients.”

Q: What feedback have you received from clients and brokers using RMA Online, and how has this new tool changed their risk management practices?

A: “We have had a much higher take-up than anticipated, given how new it is. We hear that it is reshaping how organisations think about their risk frameworks. RMA Online’s questions push into areas commonly left out when considering risk management approaches. Because each client receives a ‘maturity score,’ it helps them to understand their development on a maturity scale and gives them practical advice on how to move up that scale.

We hear from boards and executives that they are under more pressure to validate the effectiveness of their risk frameworks and that RMA Online provides a valuable contribution to their assessments.

A client at the National Care Organisation told us this has been a great way for their executive team to come together and assess their risk management approach practically and holistically.

Broker interest has also been positive. We have created ways to assist brokers in distributing information about RMA Online. We have provided education sessions for brokers to understand the value in the approach for business growth and retention and supported them in client meetings to step through the system and explore the outcomes together.”

Q: What are the next steps for RMA Online, and how do you envision this tool evolving to further support your specialty sectors in managing emerging risks?

A: “We will continue to reshape thinking using risk maturity as the model for improvement and direct efforts into strengthening risk frameworks. By doing this, we will likely see better governance and risk management standards, more confident risk management capabilities, and reduced insurable loss exposures. Losses and harm in these sectors can have terrible individual and community consequences.

In addition, we will expand its reach to as many sector organisations as possible with the assistance of our broker networks and capture background data to provide insights on risk maturity within sectors, which does not currently exist, and use this information to tailor programs to support risk capabilities and inform benchmarking.”

“We will prioritise linkage of sector risk maturity information with sector claims information to identify patterns and relationships in practices, data and trends for improved decision-making for clients, brokers and insurers”

Anthony BlackAnsvar Insurance

RMA Online by the numbers:

three years spent designing, developing and testing RMA Online

the ERM team is a top 3 finalist in the 2023 Risk Management Institute of Australasia Risk Team of the Year awards

five sectors benefit from the solution tailored to their unique needs

zero cost to all insureds

The 5-Star Insurance Innovator fosters a culture of innovation and entrepreneurship around disruption, particularly in the automotive channel.

Employees are empowered to take ownership of the business and challenge the status quo, proactively disrupting their business processes rather than waiting for external forces to drive change.

Allianz Australia achieved recognition from IB for its Indicative Quote (IQ) system, which replaces the traditional process of purchasing home and vehicle insurance with a one-click estimate. The IQ system uses a combination of data from partners, customers, and the insurer, seamlessly integrated via APIs, to deliver an estimated price for insurance in real-time.

General manager, consumer partners, Dan Tully, unveils the inspiration for the innovation, which other insurers have not replicated in the Australian market, and how it significantly enhances customer experience.

Q: What inspired the development of the IQ system?

A: “The inspiration was if we don’t do it, someone else will disrupt us. And secondly, we’re constantly asking if there’s a better way to do what we do today.

Buying a car, for example, is a cumbersome process that hasn’t changed much in a decade. We’re genuinely trying to transform the business model.

The power has always been with the dealership and the business manager selling you the car; they have all the power. We’ve tried to break that power, not in a bad way, but to give the customer control of the process. Let them choose how they want to interact.

I’ve encouraged my team by saying, ‘I know you don’t want to upset the dealer; they’ve been doing things a certain way for 10 years. But if we don’t disrupt, someone else will, and they’ll do it to both us and the dealer.’

So, let’s do it in a way that takes them on a journey. They’re already a trusted partner; if we don’t take them with us, someone else will. They’ll ask why Allianz didn’t do that for them, and they might not have any choice but to leave us, even if they don’t want to.”

The other big thing, which I know is cliché now, is the omni-channel approach. That was the big breakthrough with the IQ, but the real game changer is how the omni-channel setup puts the customer in control.

The IQ is a massive innovation, but we almost take the fact that we are plugged into the omni-channel for granted. It takes the power away from the business manager and puts it on the customer.

We’ve got the data, and that’s our competitive advantage. We’ve got partners who want to collaborate with us and figure out what we can do to improve the sales process for the customer. Our vision was to exceed customer expectations: push a button, get a price, and be done. It’s a game changer.”

Q: What were the biggest challenges faced during the implementation of the IQ system, and how were they overcome?

A: “The first big challenge was getting funding, and we self-funded the project. Another challenge is dealing with third parties and the unknown. And you never know how implementation will go.

We overcame that by working closely with our partners and assembling a dedicated project team to work with our business partner weekly. Then, we went live with a pilot test to ensure it worked and eliminated any bugs, and then we went national.”

Q: How does Allianz plan to evolve the IQ system, and what new technological innovations are on the horizon?

A: “What I’d love to do next is leverage AI chatbots to keep the customer in the digital journey. That’s my next innovation: the role of AI for customer experience.”

“You hear it everywhere: data is the new oil, but not many use it. What inspired me was figuring out how to leverage our data. Now, we integrate with partners in real time, instantly pricing what used to take 10 minutes”

Dan TullyAllianz Australia Insurance

Indicative Quote by the numbers:

From 19 to 3: IQ reduces the number of questions for lenders and customers, streamlining the process significantly

30%: reduction in the average time it takes to complete a home insurance quote

60%: increase in the quote-to-sale conversion rate

Pain points addressed for customers and lenders:

reduces processing time for staff members and customers by pre-filling available information from partner systems

generates a price estimate to customers without having to complete a full quote within the Allianz insurance platform

eliminates double handling of data and the possibility of data-entry errors

500+ employees

Crawford & Company

Tower Insurance

201–500 employees

101–200 employees

26–100 employees

Agile Underwriting Services

Codafication

FreightInsure

New Zealand Financial Services Group

SafetyCulture Care

10–25 employees

Coalition Insurance Solutions

Curium

Grappler

InsuredHQ

Kanopi

Simfuni

Strata Insurance Solutions

<10 employees

Advisr

AUZi Insurance

BizCover New Zealand

Insurebot

RedBook New Zealand