MNRB highlights strong start with net profits surge for Q1

MNRB highlights strong start with net profits surge for Q1 | Insurance Business Asia

Reinsurance

MNRB highlights strong start with net profits surge for Q1

Double-digit increase achieved through stronger service results

Reinsurance

By

Kenneth Araullo

Malaysian National Reinsurance Berhad (MNRB) Holdings Berhad has announced its financial results for the first quarter ending June 30, 2024 (Q1 FY2025).

The group reported a 32.7% increase in net profit, rising to RM92.2 million from RM69.5 million in the same period last year. This growth was attributed to stronger insurance and takaful service results, largely driven by improved claims experience.

During Q1 FY2025, MNRB’s revenue remained stable at RM941.1 million, slightly down by 0.4% from RM945.3 million in the previous year. The stability in revenue was achieved through significant growth in general takaful and reinsurance/retakaful businesses, which offset a decline in family takaful revenue.

The group also reported an increase in investment income, reaching RM109.4 million, compared to RM96.5 million in the same period last year. This was driven by a 10% increase in asset size, particularly in fixed income, deposits, and equity.

MNRB’s annualized return on equity (ROE) improved to 12.6%, up from 10.1% in Q1 FY2024, reflecting the Group’s enhanced performance during the period.

Malaysian Re results

Malaysian Reinsurance Berhad (Malaysian Re), the reinsurance/retakaful arm of MNRB, continued its positive momentum from the previous year’s hard market. Malaysian Re recorded a net profit of RM86.1 million in Q1 FY2025, marking a 38.2% increase from RM62.3 million in Q1 FY2024.

This growth was supported by an improved insurance service result due to better claims experience, as well as the company’s strategic focus on international and non-voluntary cession (VC) businesses.

Malaysian Re also expanded its international business during Q1 FY2025, with gross written premium and gross written contribution (GWP/GWC) growing by 5.4% to RM586.7 million, up from RM556.8 million in the same period last year.

Takaful IKHLAS results

Takaful IKHLAS, consisting of Takaful Ikhlas General Berhad and Takaful Ikhlas Family Berhad, reported a 39.2% increase in net profit, reaching RM16.7 million, compared to RM12.0 million in the same period last year. This rise was driven by higher wakalah fees, despite a 1.2% decline in takaful revenue to RM406.6 million, mainly due to results in the family takaful segment.

The general takaful’s fire and motor businesses, along with the family takaful’s regular contributions, showed steady growth, supported by an increase in individual new businesses.

MNRB outlook

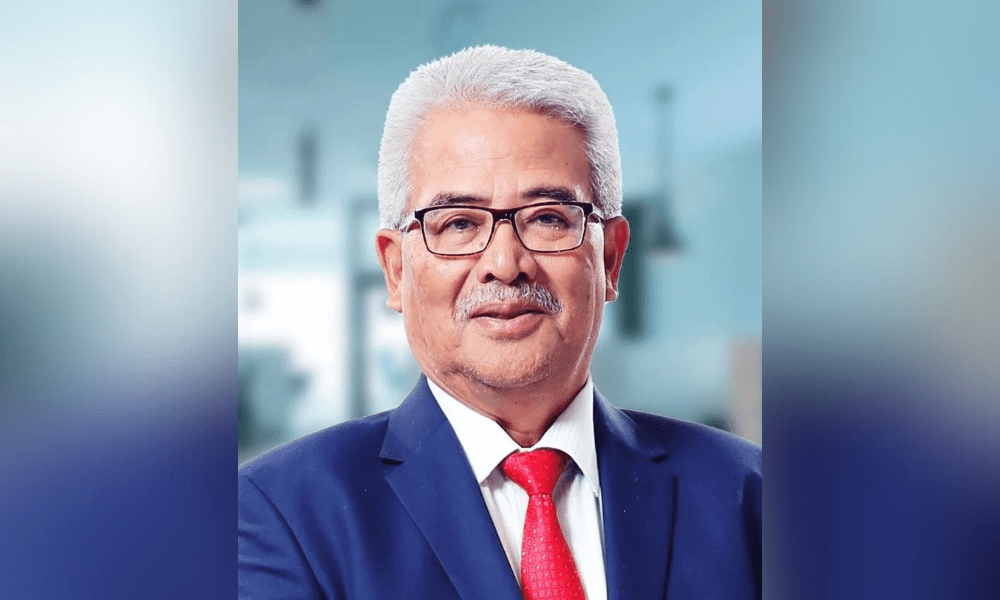

MNRB chairman, Datuk Johar Che Mat (pictured above), commented on the group’s outlook for the financial year, stating that MNRB is committed to driving revenue growth and enhancing profitability while managing capital efficiently.

He highlighted that strategic initiatives are being implemented across both wholesale and retail segments, including reinsurance/retakaful and general takaful businesses, as well as adjustments to the family takaful business model.

Datuk Johar further emphasized that while the group has a comprehensive strategy in place, each business unit will also focus on executing specific strategies to support long-term sustainable growth and deliver value to stakeholders.

What are your thoughts on this story? Please feel free to share your comments below.

Keep up with the latest news and events

Join our mailing list, it’s free!