Mixed fortunes again for UCITS cat bond funds in week to Dec 16th

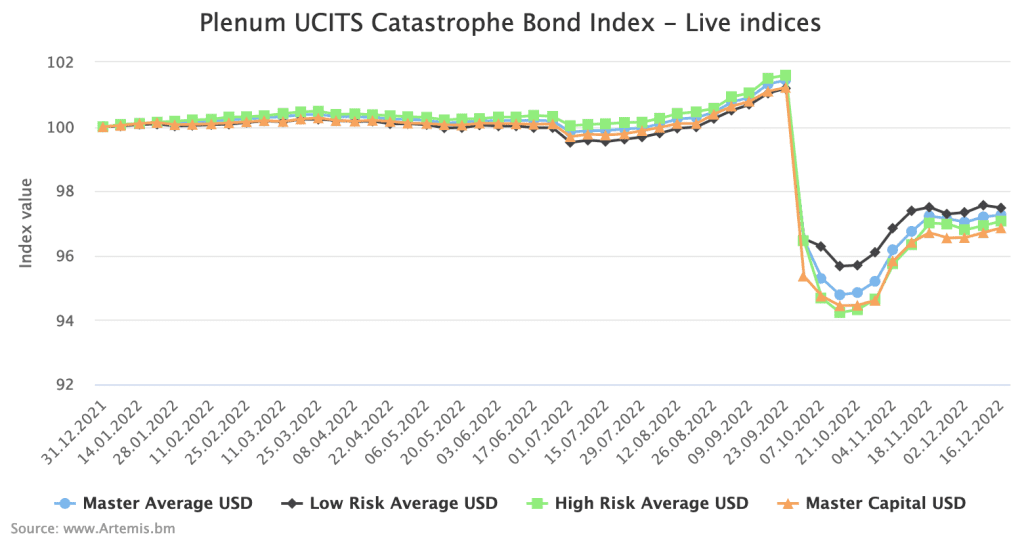

The Plenum CAT Bond UCITS Fund Indices, an index that provides a reasonable proxy for cat bond fund performance across the market, saw mixed fortunes again between the lower and higher risk strategies in the last week of record, while the overall year-to-date performance has continued to improve.

In the last week of reported date, to December 16th, it was the higher risk cohort of UCITS cat bond funds that delivered the strongest performance, while the lower risk cat bond funds actually fell to a decline on continued market spread widening.

As the direct impacts of hurricane Ian have moved further behind the cat bond market and recoveries become less significant each week, while the market finds a pricing level for its anticipated losses from the storm, we’ve seen some fluctuation in the Plenum calculated UCITS catastrophe bond fund indices.

Having gained an average of 0.17% in the week to December 9th 2022, these UCITS catastrophe bond fund indices gained another 0.07% on average in the week to December 16th.

But the lower-risk UCITS cat bond funds experienced the worst performance in that last week of record, falling to a -0.08% decline for the week.

While, the group of higher-risk UCITS cat bond funds were positive for the week, delivering a 0.14% return.

You can analyse the performance of the Plenum CAT Bond UCITS Indices with Artemis (click the image below to view an interactive chart):

These catastrophe bond fund indices, calculated by specialist insurance-linked securities (ILS) investment manager Plenum Investments AG, offer a useful source of real cat bond fund return information, focused on the UCITS cat bond fund category, with 14 live cat bond funds currently tracked.

The index provides a broad benchmark for the actual performance of cat bond investment strategies, across the risk-return spectrum.

Once again, valuation strategies matter (in terms of how positions are valued and the timing of marks), as too do broader market movements as spreads have continued to widen in some area of the cat bond market.

The overall cat bond market is still recovering since hurricane Ian, with the average decline since the storm now reduced to -4.3%, with the lower risk cat bond funds down -3.67% since Ian and the higher risk cohort of funds down -4.46%.

Year-to-date, the continued positive performance means even the higher-risk cat bond fund index is now down less than 3%.

The average across the indices year-to-date is a decline of -2.74%, while the higher-risk cat bond funds are down -2.93% on average and the lower-risk cat bond funds are a little better off at a -2.52% decline.

Analyse interactive charts for this UCITS catastrophe bond fund index.