Milton forecast for Florida hurricane landfall. Cat bond & ILS market on watch

The Gulf Coast of Florida is facing another hurricane landfall, as tropical storm Milton has formed and is set to head quickly towards Florida, with rapid intensification forecast and a major hurricane Milton landfall possible that could have the potential to cause meaningful insurance and reinsurance market losses.

Tropical storm Milton formed yesterday in the south western Gulf of Mexico and is expected to travel across the warm Gulf waters gaining strength as it heads for a Florida landfall somewhere between Marco Island in the south to Cedar Key north of Tampa, based on a range of forecasts we’ve seen.

However, the GFS and a number of the most widely viewed forecast models have a strong hurricane Milton making landfall near to Tampa Bay, potentially at major Category 3 or greater intensity.

The NHC forecast cone center line is currently focused on Tampa Bay as well, but there is some uncertainty as the cone is relatively wide still at this time. The NHC says “steady to rapid strengthening is forecast during

the next few days,” and Milton could be a major hurricane early this coming week.

It’s worth noting that the forecast path, based on the NHC cone center line, would take Milton’s strongest winds and highest surge into Tampa Bay, affecting one of the most populous regions of Florida, after which inland impacts in areas such as Orlando would be expected, if the current forecast holds.

There remains a good deal of uncertainty, Milton is still a tropical storm after all. But, forecast models are gaining agreement on the rapid intensification to a strong to major hurricane Milton before landfall somewhere on the Florida Gulf Coast on Wednesday or Thursday, with most seemingly opting for a Tampa area landfall, some further south between Sarasota and Cape Coral.

On which basis, it’s already clear this is not looking like another situation where a significant hurricane strikes a low population region of Florida coastline, like the Big Bend, as we’ve seen of late resulting in single-digit billion dollar industry losses.

This is a storm that models suggest is more likely to hit a region with far greater population density and exposure concentration, with the potential to take a path inland over similarly high concentrations of insured property, raising the spectre of potentially meaningful losses for insurance and reinsurance markets, with possible ramifications for the catastrophe bond and insurance-linked securities (ILS) market.

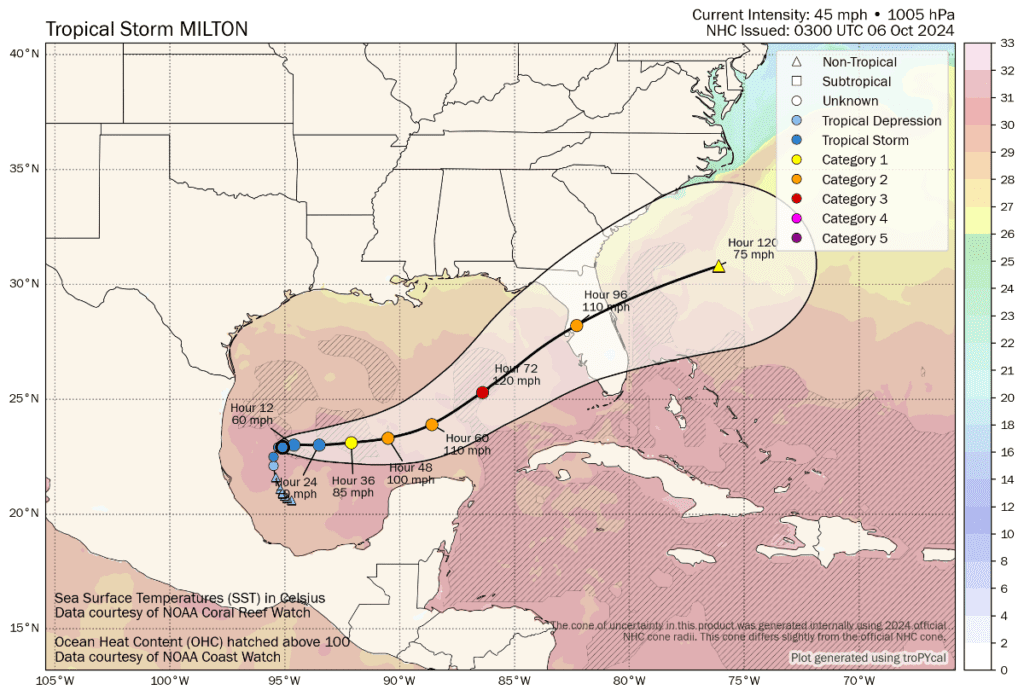

Tropical storm Milton’s latest location and the forecast cone and wind speeds can be seen in the graphic below from Tomer Burg:

The NHC’s forecast advisory suggests sustained winds of around 120 mph prior to landfall with gusts to 150 mph, so major Category 3 strength and extremely damaging for areas that experience the strongest winds. Some models suggest a slight weakening prior to landfall, but as we’ve seen in recent years this often doesn’t really pan out. Still, other forecast models call for strengthening to Cat 4 wind speeds, so there remains some uncertainty at this time over how impactful a hurricane Milton landfall could be.

Storm surge is expected to be a significant issue with a hurricane Milton landfall and the region targeted is high-value and well populated. The NHC has not begun supplying storm surge height indications yet. But when they do begin, if the track has not changed, we should expect to see figures that suggest major impacts to Tampa Bay, its surrounds and some other high-value coastal areas.

Coming on the heels of Helene, a hurricane Milton landfall at or near major strength threatens a potentially far more significant financial cost for Florida, with the potential to drive commensurately higher insurance and reinsurance market impacts. The forecast models, as they stand today, would all suggest something well into the double-digit billions of dollars.

Already, what will become hurricane Milton is being likened to hurricane Ian from 2022, a storm that drove insurance market losses into the $50 billion region and resulted in reinsurance losses, collateralized reinsurance and retrocession impacts, and some catastrophe bond principal losses as well.

It’s worth noting though, that the impact to the cat bond and ILS market from hurricane Ian was not significant, despite it being a $50 billion loss event. With reinsurance, cat bonds and ILS now attaching higher still, in many cases, the primary market’s share of a similarly sized loss would be significant, although as with any major loss in Florida reinsurance support would be meaningful as well.

Milton has the potential to have similarly far-reaching and meaningful impacts for the reinsurance and ILS industry, should the forecasts remain unchanged and the landfall location remain either within the Tampa Bay region, or in a high-value area somewhere down to the Naples region.

As with every Florida hurricane landfall though, there are certain areas of the coast that Milton could make landfall, based on the cone we see currently, where losses could be lower. But there are also locations that equal something closer to worst case scenarios, such as an intense Milton taking its strongest winds and surge into Tampa Bay.

It’s important to highlight again that, at this time, Milton is still a tropical storm and there is plenty of uncertainty in its eventual intensity and track.

But, every forecast model we’ve seen suggests Milton will be upgraded to hurricane status by tomorrow, then steadily intensify, while the models do have a relatively strong agreement on a track towards a landfall from Cedar Key to Marco Island, but with most opting for somewhere around the Tampa Bay region at this time.

There’s time for things to change over the next day or so, but beyond that hurricane Milton will likely be relatively locked-in and the forecast models should have a much stronger view of where landfall will be and what category its intensity is likely to reach.

Given it’s Sunday today and by Monday we might have some of the first forecasts for potential losses flowing from modellers to their clients, there really isn’t much time for hedging or live cat trading with Milton, it seems.

Already, Milton has attracted the attention of the catastrophe bond and insurance-linked securities (ILS) market, given some forecast model runs suggest a storm that could impact certain positions.

It’s worth also noting though, that the industry is perhaps better prepared, in attachment and structure terms, than it was even prior to Ian in 2022 and the proportion of losses shared, from primary to reinsurance and cat bonds or ILS, may have adjusted slightly more in the favour of the ILS market unless the industry loss was higher than hurricane Ian.

Finally, it’s also worth pointing out that with many cat bond and ILS funds already running with returns year-to-date of close to or in the double-digits, there is a good chance that many cat bond funds and other ILS funds focused on private reinsurance and retro can absorb a relatively meaningful hurricane loss event within their annual earnings.

The cat bond market fell by roughly 10% after hurricane Ian’s landfall in 2022, but already many cat bond funds have delivered a 10% or greater return in 2024, so the buffer against losses is clear.

Of course, no one wants to lose the returns already made. But this clearly shows why the market needs to hold onto pricing at the levels we see today, given investor returns can be wiped out very quickly by a single major storm event.

As we once more reiterate that there is a lot of uncertainty over Milton and its eventual hurricane intensity and track, it does seem this is the biggest threat of the hurricane season so far for insurance, reinsurance, cat bond and ILS interests.

All eyes will be on the Gulf over the coming three days, with the industry nervously watching Milton’s intensification and path.

For those on the Florida coast the time to make preparations is already here, with the NHC forecast calling for Milton to strengthen and bring “life-threatening impacts to portions of the west coast of Florida next week.”

The NHC urges residents to have a hurricane plan in place and watch as the forecast develops. They also warn of a meaningful predecessor rainfall event, with heavy rainfall to impact parts of Florida through Sunday and Monday before Milton even reaches land. Storm surge and wind impacts could begin from Tuesday as well.

You can track this and every Atlantic hurricane season development using the tracking map and information on our dedicated page.