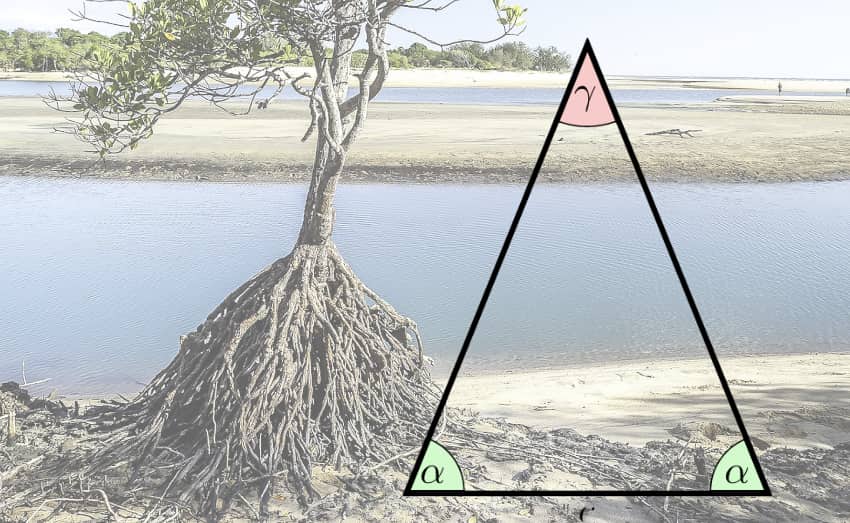

Marsh renames Isosceles private cat bond platform to Mangrove Risk Solutions Bermuda

Isosceles Insurance Ltd., a Bermuda-domiciled platform operated by Marsh McLennan and reinsurance broker Guy Carpenter that has been used for the issuance of private insurance-linked securities (ILS) and catastrophe bonds, has been renamed to Mangrove Risk Solutions Bermuda Ltd.

A Class 3 Bermuda registered insurance company, Isosceles has been well-used for issuance of private catastrophe bonds and other insurance-linked securities (ILS) offerings over the years.

It was called the Isosceles Re platform and was launched by Marsh McLennan with its reinsurance broker Guy Carpenter back in 2020.

It was a rebranding of the Isosceles Insurance Limited transformer and rent-a-cell captive structure that had previously been owned by JLT Insurance Management, which was subsequently acquired by Marsh as part of its JLT acquisition.

The goal was to develop a platform that would make issuance of 4(2) or 4(a)(2) securities more simple, with a focus on Isosceles becoming an ILS focused platform, to help clients access sources of capital markets reinsurance capacity and investors securitize their reinsurance deals.

Isosceles Insurance was actually a multi-domicile structure, with offerings in Bermuda, Guernsey, Barbados and also onshore in Vermont.

This renaming only applies to the Bermuda Class 3 vehicle, which was the one responsible for all of the private catastrophe bonds that were issued under Isosceles Re. We’re not sure whether any of the other entities have been renamed at this time.

Over the years since it has been active in issuing private catastrophe bond notes, we have tracked over $317 million in issuance from Isosceles Insurance.

You can filter our Deal Directory to view only private catastrophe bonds and you can also analyse private cat bond issuance by year using our interactive chart.

The most recent Isosceles private cat bond issuance we had seen was an $87.6 million offering of six tranches of privately placed catastrophe bonds by Isosceles Insurance Ltd. in September 2023.

Since then, the only time Isosceles came to light in Artemis’ coverage was a mention in relation to the Vesttoo saga, as the vehicle had been used to house at least one transaction that featured in court documents we had seen.

Now named Mangrove Risk Solutions Bermuda Ltd., it will be interesting to see if the structure becomes more active again in the private catastrophe bond space.

With just $172.75 million of private catastrophe bond issuance tracked so far in 2024, that market segment is running behind the levels of issuance seen of late with a notable reduction in activity this year.