Macquarie Bank takes lead in rate adjustments

Macquarie Bank takes lead in rate adjustments | Insurance Business Australia

Insurance News

Macquarie Bank takes lead in rate adjustments

There were more cuts than hikes in fixed rates last week

Insurance News

By

Mina Martin

In a dynamic week for interest rates, Macquarie Bank has emerged as a front-runner by implementing changes across both fixed and variable rates for new customers, according to RateCity.com.au.

Macquarie, experiencing a surge in its loan book according to APRA data, notably reduced advertised variable rates by up to 21 percentage points on Jan. 31.

The bank also executed cuts on all fixed rates on Jan. 25, with the most significant reduction applied to its three-year term for owner-occupiers paying principal and interest. New customers with a 30% deposit are now eligible for a rate as low as 5.99%, or 6.09% for those with a deposit of 20% or more.

Throughout the week, the trend leaned towards more reductions in fixed rates than hikes.

“Borrower appetite seems steady for variable rates, but banks may be hoping to woo new customers over with lower rates on fixed terms,” said Sally Tindall (pictured above), RateCity.com.au research director.

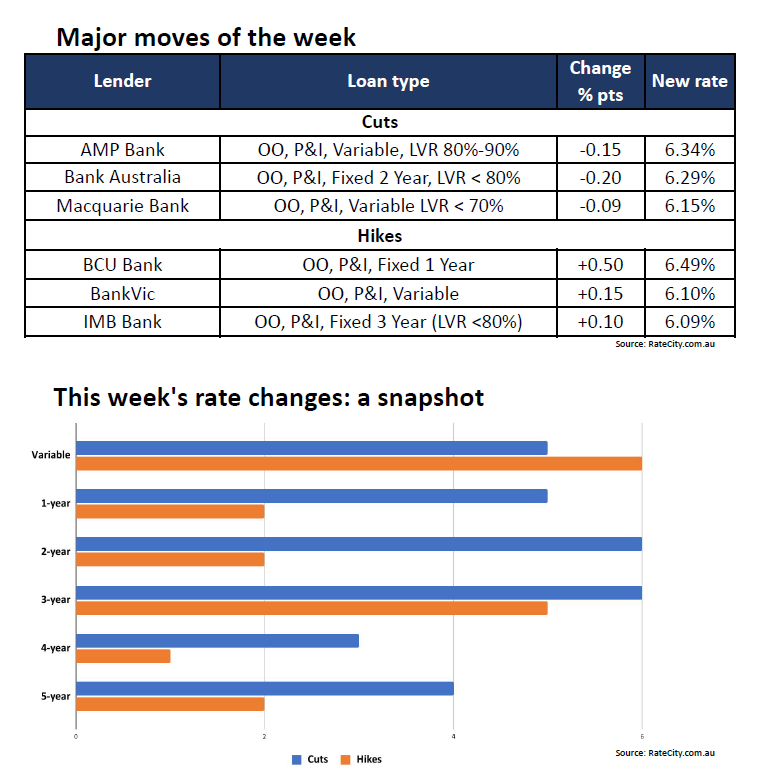

See table below for the major rate moves of the week and the graph for a snapshot of the variable rate adjustments.

To compare with the previous week’s rate changes, click here.

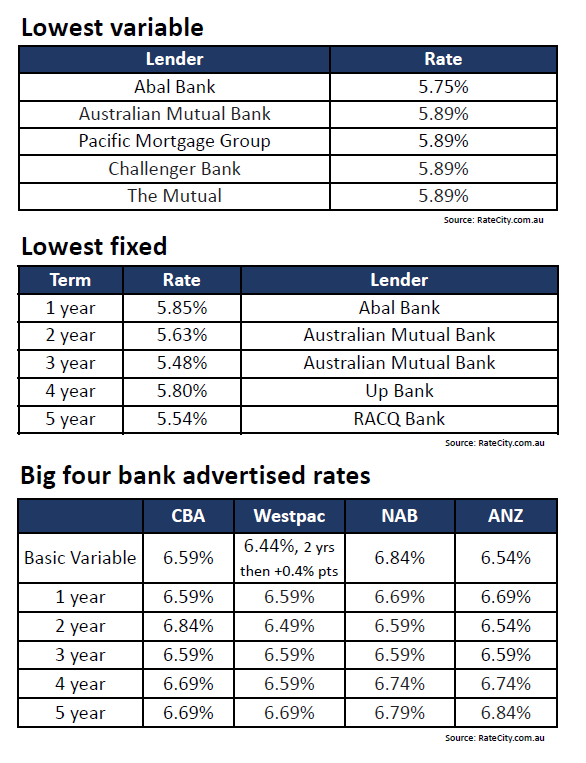

See first two tables below for the lowest variable and fixed rates after last week’s rate adjustments. The third table shows the big four banks’ current advertised rates.

Looking ahead, the first Reserve Bank of Australia (RBA) meeting of the year is anticipated, with expectations leaning towards a cash rate hold. This expectation aligns with lower-than-expected quarterly inflation data, a 2.7% decline in retail trade, and no change in unemployment at 3.9% in seasonally adjusted terms.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.

Keep up with the latest news and events

Join our mailing list, it’s free!