Long term care insurance in New Zealand: Everything you need to know

Long term care insurance in New Zealand: Everything you need to know | Insurance Business New Zealand

Guides

Long term care insurance in New Zealand: Everything you need to know

With aged care subsidised by the government, is there a need for private long-term care insurance in New Zealand?

Citizens cannot currently access private long-term care insurance in New Zealand, where aged care is primarily financed by the government. But with the senior population, along with care costs, expected to increase significantly in the foreseeable future, questions have arisen regarding the sustainability of this healthcare model.

In this article, Insurance Business delves deeper into the country’s residential aged care system to find out where long-term care insurance in New Zealand fits into the system. We will also discuss the different costs involved and how older Kiwis can access funding.

If you’re one of those planning for their future care or making arrangements for an older loved one, this piece can help educate you about the process. Insurance professionals are likewise encouraged to share this guide with their clients to inform them of the different options available when it comes to aged care. for insurance professionals being asked about long-term care insurance in New Zealand, this can be an excellent article to pass on to your clients to help them understand more.

The US is among the largest market for long-term care insurance across the globe. Here, senior citizens can go directly to private providers to take out this type of coverage, which can help them cover the cost of services when they can no longer care for themselves because of their age.

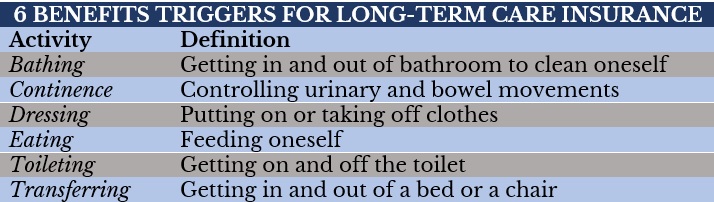

To qualify for coverage, however, one must be unable to perform two out of the six activities for daily living (ADLs) listed in the table below, also known as benefit triggers, without assistance.

Long-term care insurance also often comes with an elimination or waiting period. This is the timeframe when you need to pay for care services out of pocket before insurance picks the tab. This period usually lasts 30 to 90 days, after which you can begin receiving reimbursements from your provider. In addition, coverage usually pays out a capped amount each day until you reach the lifetime maximum.

Married couples are sometimes given the option to purchase a shared care policy. This type of coverage allows them to share the overall coverage amount and draw from each other’s pool of benefits once one of them hits their policy limit.

The New Zealand government administers funded long-term residential care through the Ministry of Health Manatū Hauora. In its latest booklet, the department defines residential care as ongoing care needs that are found to be best provided in any of the following after an assessment:

Rest home

Continuing or long-term care hospital

Specialist dementia care unit

Specialised hospital care, such as psychogeriatric unit

There are more than 650 certified providers of hospital and rest home care services across the country. You can search for one in your region using the Ministry of Health’s database.

Respite or short-term care and convalescent care may also be given in these facilities, although, unlike long-term care, these do not require income and asset testing, which we will discuss in detail later. Another thing to take note of is that long-term residential care does not cover those living independently in retirement villages.

The district health boards (DHBs), which were established under the Public Health and Disability Services Act 2000, hold the responsibility of funding and providing long-term residential care for older people in their district. They must also ensure that there are sufficient contracted care beds available to those requiring residential care.

To qualify for government-subsidised residential care, you must be:

Aged 65 years or older, or between 50 and 64-years old without dependent children

Found to be requiring ongoing residential care in a hospital or rest home indefinitely after a needs assessment

Found to have assets equal to or below applicable thresholds after a financial means assessment, which also determines how of your income will go towards care costs

Receive contracted services from a certified residential care facility

One more thing to remember is that if you’re aged 50 to 64 years, single, and do not have dependent children, a financial means assessment will be done for your income only – not for your assets – to determine how much you can contribute to your care costs. Those with partners or dependents do not have to go through asset and income testing and are not required to contribute until they reach 65-years old when they must apply for a financial means assessment.

Asset thresholds

During asset testing, there are two asset thresholds that apply, depending on a person’s circumstances:

A higher threshold of $256,554

A lower threshold of $140,495

For singles and couples who are both in care, the higher limit of $256,554, which includes all assets, applies. Your assets can include:

Your home

Your personal vehicles

Any cash or savings

Investments and shares

Life insurance policies with a surrender or cash value

Loans made to others, including family trusts

Boats, caravans, and campervans

Investment properties

Couples with one partner in care and the other staying in their family home can choose between using the higher threshold or the lower threshold of $140,495, which will exclude how much their home and personal vehicle are worth.

Income assessment

The residential care subsidy system operates on the principle that if you can afford to pay for your own care, then you should. This means that any benefits or pension, including your New Zealand Superannuation, along with any other income available must go towards your residential care. But there are exceptions such as:

Weekly personal and yearly clothing allowance, Consumers Price Index (CPI) adjusted every April

A portion of gross income from your annual income from assets, CPI-adjusted every July

In simple terms, you are allowed to keep the following income annually:

$1,114 for singles

$2,228 for couples when both have been assessed as needing care

$3,341 for couples where one partner has been assessed as needing care

If the results of your financial means assessment show that your assets are below the defined asset threshold, then you are eligible for government subsidy. Your income will then be tested to determine how much you need to contribute to your care costs. But if the financial means assessment reveals that your assets exceed the defined asset threshold, you are ineligible for the subsidy and must pay the cost of residential care up to the maximum amount set for your area.

The DHB requires contracted care services providers to cover the following:

Accommodation with access to toilet and shower

Nursing care

Food services

Laundry

General practitioner visits

General equipment for mobility and personal care

Prescription medication, usually from the official Pharmac list

Continence products

Diversional activity

Any health care services prescribed by a GP

Care services fees are set by the DHBs, so that all service providers in a region will charge the same amount. Depending on your district health board, you may be paying about $1,270 for long-term care each week. Services provided by hospitals and dementia units are often more expensive than those in residential care, but the Ministry of Health pays the difference, meaning the amount you will need to pay remains the same.

Care fees are also updated in July each year. You can find out the current rates set by your DHB on this website.

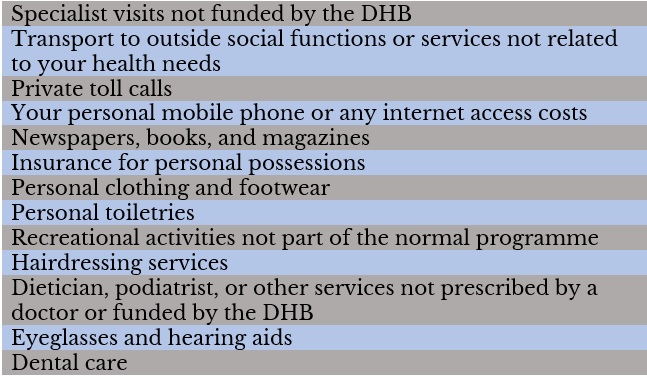

If you wish to receive extra services and personal items, you will need to pay for these yourself. These include:

The payments can be done directly to the service provider or given to the hospital or rest home to be paid to the provider on your behalf. In addition, these services must be itemised in your admission agreement. Should you want to opt out of receiving these services, you must inform the rest home or hospital and have your admission agreement amended.

New Zealand citizens and permanent residents already have access to government-funded long-term care coverage, although certain eligibility requirements apply. But there is also the question of how sustainable the current model is given the predicted rise in the country’s ageing population, as well as aged care costs.

In an analysis of the fiscal sustainability of long-term care funding in the country published by the New Zealand Treasury Te Tai Ōhanga, it maintains that there is a “sound rationale for some government involvement in the long-term care sector” as private long-term care insurance “left to its own devices” will not be capable of delivering a society-wide “sensible response.”

“Private savings, and probably also private insurance, seem unlikely to provide effective mechanisms for pre-funding long-term care, partly due to unpredictability of need at an individual level,” the Treasury noted.

The department also explored compulsory social insurance – similar to how the Accident Compensation Scheme works – and tax levies to ease the pressure on the government but questioned its overall impact on long-term care and whether it comes with other benefits other than simply increasing taxes.

In the end, the report said that resuming contributions to the New Zealand Superannuation Fund seems a more straightforward approach to pre-funding future liabilities.

If you want to keep abreast of the latest developments in the healthcare insurance sector, including if long-term care insurance will be accessible in the future, you can check out our Life & Health insurance section for breaking news and industry updates.

Do you think there are advantages to having long-term care insurance in New Zealand? Feel free to share your thoughts in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!