Lloyd’s on navigating risk, seizing opportunities in reinsurance

Lloyd’s on navigating risk, seizing opportunities in reinsurance | Insurance Business Australia

Reinsurance

Lloyd’s on navigating risk, seizing opportunities in reinsurance

Transforming chaos into opportunity

Reinsurance

By

Mina Martin

The re/insurance industry must be ambitious in its response to an increasingly volatile and rapidly expanding risk environment if it is to successfully transform potential chaos into concrete opportunity, according to Bruce Carnegie-Brown, chairman of Lloyd’s.

Leading through uncertainty

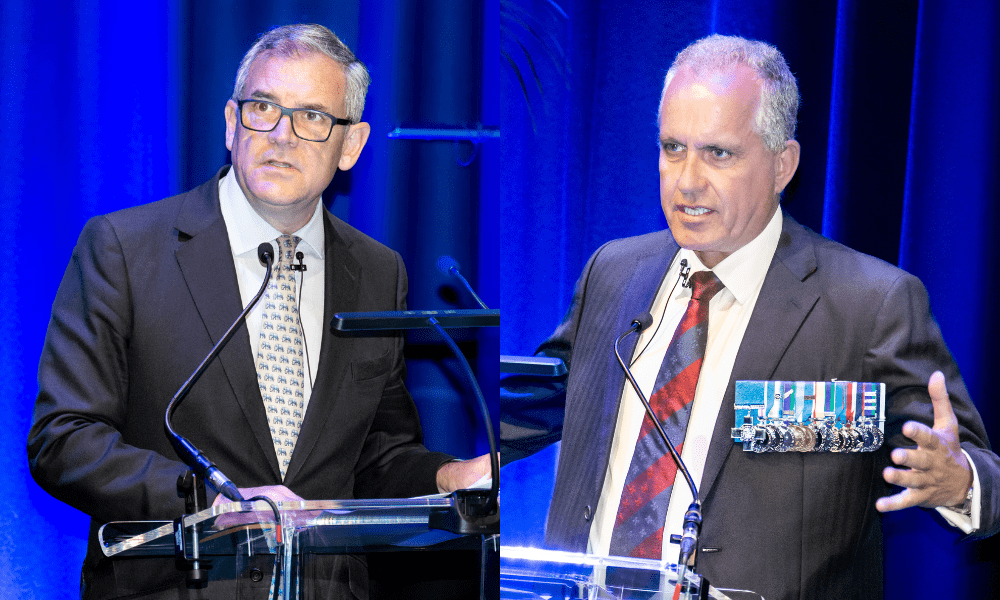

Speaking to attendees at the Marsh McLennan Rising Professionals’ Global Forum in London, Carnegie-Brown (pictured above left) emphasized the importance of developing good judgment.

“Developing good judgment is about creating a disciplined framework against which to evaluate an opportunity or a challenge,” he said. “Remembering that, successfully navigated, your biggest challenges will become your biggest opportunities.”

Carnegie-Brown highlighted the significant events of the first quarter of the 21st century, such as the 9/11 terrorist attacks, the Global Financial Crisis, the COVID-19 pandemic, and the war in Europe. He cautioned against underestimating the recurrence of similar events in the future.

Addressing modern risks

Distilling down the scope of risk, Carnegie-Brown identified climate change, evolving cyber and technology risks, geopolitics, political violence, and financial risk as the greatest challenges of our time.

“In London, we have the talent, capital and capability to provide solutions to these problems,” he said.

Lloyd’s currently allocates 25% of its capital to underwriting natural catastrophe risks, holds a 25% share of the global cyber insurance market, and underwrites around US$4 billion in political risk across various classes.

“We’re right in the middle of these global challenges,” Carnegie-Brown said. “The correlation and aggregation of these risks could be truly vast.”

The role of reinsurance

Carnegie-Brown emphasized the critical role of the reinsurance industry in managing incredible risk potential.

“The scale of these risks requires an ambitious response as brokers and insurers,” he said. “We need to collaborate to innovate and share risk.”

The Lloyd’s boss called for partnerships not only with traditional clients in the private sector but also with governments and supranational bodies to advocate for necessary behavioral changes and resilience.

Future leadership

Carnegie-Brown concluded with a challenge to the next generation: “The future is in your hands, and society’s resilience will depend on you. So, my question to you is, ‘are you up for it?’”

Insights on effective leadership

Carnegie-Brown was joined by Dominic Troulan (pictured above right), retired British Army major and ex-royal marine commando, who shared his views on effective leadership.

“As leaders and rising professionals, know your team,” Troulan said. “Meet with them, engage with them so that you can ‘see the whites of their eyes’. Remember that every war that I have been involved in ended in a negotiation.”

Troulan stressed the importance of approachability and humility.

“Be personable and approachable,” he said. “Don’t forget that some of the best ideas might come from the most junior members of your team. And also, be humble and willing to take advice and to take these ideas onboard. Be decisive, anticipate and react.”

Keep up with the latest news and events

Join our mailing list, it’s free!