Life insurance agent salary: Everything you need to know

Life insurance agent salary: Everything you need to know | Insurance Business America

Guides

Life insurance agent salary: Everything you need to know

How much do life insurance agents make? Is it higher or lower than others in the industry?

How much do life insurance agents make? Do life insurance agents have the highest-paying sales job in the industry? Is being a life insurance agent a good career path? These are just some of the topics Insurance Business will discuss in this article.

Apart from pay, we will delve deeper into what it takes to be successful in the profession, along with the benefits and drawbacks. If you’re considering being a life insurance agent as a potential career, then this piece can serve as a helpful guide. For those already in the profession, this article can give you an idea of how much your counterparts across the country are earning. Read on and learn more about a life insurance agent’s earning potential.

The average annual salary of life insurance agents ranges from $62,000 to $76,000. These figures are based on the estimates of several employment websites Insurance Business used for research. The Bureau of Labor Statistics (BLS) has also released its latest occupational employment and wage statistics (OEWS), estimating the yearly average to be almost $77,000, although this figure pertains to all types of insurance agents.

For this piece, we will refer to the data compiled by this website, which ranks the states and major cities according to the average salary. You can also check out BLS’ OEWS projections for additional information. The table below reveals the percentile wage estimates for life insurance agents across the country.

How much life insurance agents make, pay scale

PERCENTILE WAGE ESTIMATES (LIFE INSURANCE AGENTS)

Percentile

Annual wage

Monthly wage

Hourly wage

10th

$39,000

$3,250

$19

25th

$49,000

$4,083

$24

50th (Median)

$62,552

$5,213

$30

75th

$79,000

$6,583

$38

90th

$99,000

$8,250

$48

How much life insurance make agents make based on experience level

WAGE ESTIMATES PER EXPERIENCE LEVEL (LIFE INSURANCE AGENTS)

Experience level

Annual wage

Monthly wage

Hourly wage

Entry

$37,500

$3,125

$18.03

Mid

$64,100

$5,342

$30.84

Senior

$73,100

$6,092

$35.12

You also can view the wage estimates for insurance agents in general, along with the highest- and lowest-paying states and regions in the US, in this guide on how much insurance agents make.

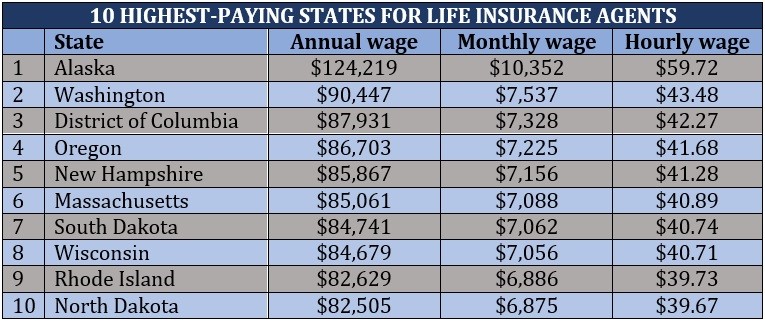

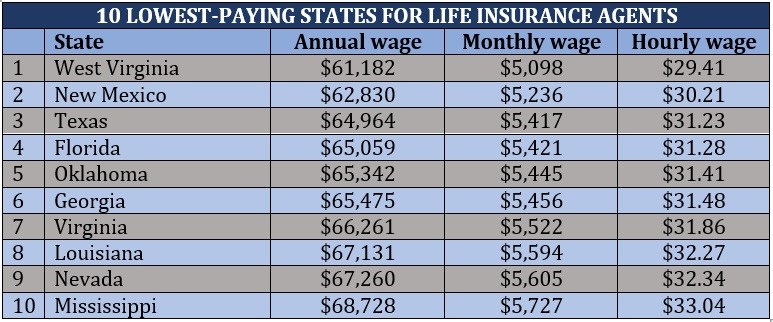

There are several factors that impact how much life insurance agents make – and among these is location. Because each state implements different rules on how insurance products are sold and who sells them, including licensing requirements, the average pay agents receive also varies. Here are the top- and least-paying states for life insurance agents ranked.

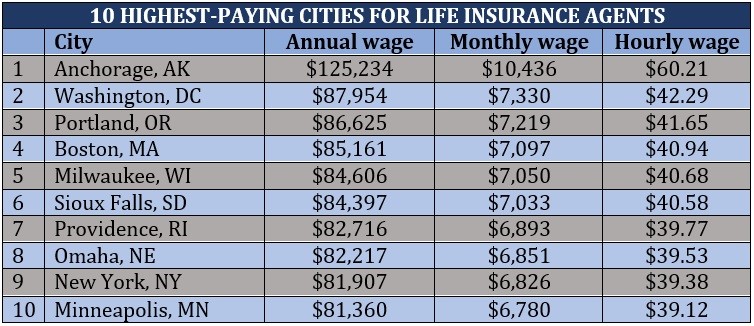

These are the highest-paying cities in the US when it comes to life insurance agent salaries.

The most common way life insurance agents make money is through commissions. Generally, agents receive front-loaded commissions of 40% to up to 115% of the policy’s first-year premiums, although the figure for renewals falls steeply to about 1% or 2%. Some agents stop receiving commissions after the third year of the policy.

Commission rates, however, are also dependent on the type of life insurance policies sold.

Whole life insurance commission rates

Insurance agents receive the highest commission rates for whole life insurance plans, often more than 100% of the total premiums for the policy’s first year. The exact percentage depends on the age of the policyholder.

Universal life insurance commission rates

Agents typically receive a commission equivalent to at least 100% of the premiums the policyholder pays in the first year up to the amount of the target premium for universal life insurance plans. However, the rate decreases for any premiums the insured pays above the target level in the first year.

Term life insurance commission rates

Term life insurance plans pay the lowest commissions, often a percentage of the annual premiums ranging from between 30% and 80%.

Life insurance plays a crucial role in providing families with a certain level of financial security after the death of a loved one. With the right policy, this type of coverage can help families pay off loans and debts and meet daily living expenses. You can learn more about how this form of protection works by checking out our comprehensive guide to life insurance.

Life insurance agents can also be salaried employees of an insurance agency. These agents receive a base salary and employee benefits but are often required to meet a monthly sales quota.

There are three main variables that impact how much life insurance agents make. These are:

1. Type of agent

Captive life insurance agents, which work exclusively with one insurance carrier, typically earn lower commissions than independent life insurance agents, who represent several insurance companies. The catch is independent agents are often responsible for their own business expenses like rent, office supplies, and advertising costs.

2. Type of policy

Commission rates for whole and universal life insurance plans are often significantly higher than those for term life policies. Agents, however, must ensure that their clients are able to meet premium payments. If the policyholder stops paying and lets their policies lapse within the first few years, insurers may require agents to pay back some of the money they earned in commissions.

3. Location

Each state has different requirements and regulations for those who want to sell life insurance policies, and these can affect how much agents earn in that state. In addition, a large city with a bigger population offers more opportunities for life insurance agents to sell policies compared to a small town with fewer residents.

Choosing to pursue a career as a life insurance agent has its own share of pros and cons. Here are some of the advantages and disadvantages:

Advantages

Minimal entry barriers

While there are some insurance companies and agencies that prefer candidates with a college degree, being a life insurance agent doesn’t necessarily require one. Most employers have training programs in place for new agents to prepare them for their jobs. All insurance agents, however, are required to obtain licenses to sell insurance products.

Multiple job opportunities

Do a quick online search for insurance jobs and websites will yield hundreds, if not thousands, of vacancies for life insurance agents. Agencies will always look to hire new people as long as there is demand for policies that can provide families with financial protection.

Strong earning potential

Because life insurance agents are paid mostly through commissions, those who have a great work ethic and are willing to go above and beyond to establish relationships with clients are presented with more opportunities to earn a higher income.

Opportunity to make a positive impact

Losing a loved one is never a pleasant experience, and it can be satisfying to know that you have played a key role in helping ease the financial burden on families while they grieve.

Chance to work with the biggest names

By pursuing a career as a life insurance agent, you can also have the opportunity to work with some of the country’s most prominent brands. You can check out our latest rankings of the largest life insurance companies in the US to find out the biggest names in the industry.

Disadvantages

Commission-based earnings

This can either be a benefit or a drawback depending on a person’s situation. Life insurance agents who have an established client base and years of industry experience have more opportunities to close more sales, resulting in higher income. Industry novices, meanwhile, may struggle to find clients in a fiercely competitive market despite working long hours.

Life insurance is not a particularly easy product to sell. Most people don’t like to acknowledge their own mortality, so talking about life insurance and what it covers can be a difficult task. Add this to the fact that such policies do not provide immediate gratification, unlike car insurance for example, and you have a product that can be challenging to sell.

Independent life insurance agents do not often have access to a full range of employee benefits, meaning they also have limited paid time off. Additionally, taking time off means they will have to spend time away from building client relationships and looking for leads, which can cost them part of their income.

Rejection and disrespect

Being a life insurance agent is not for the faint of heart and thin-skinned. During the course of their jobs, insurance agents will encounter people who will treat them with disdain and disrespect. They may also experience a lot of rejections before they can sell one policy. That is why having strong people skills and an impervious nature are crucial to achieving success in this field.

Your success as a life insurance agent is highly dependent on the type of relationship you build with potential clients. Here are some strategies from industry experts that can help you establish a good professional relationship with customers.

Practice good customer service: This is key to getting potential clients to buy your products. Successful life insurance agents understand the unique needs of customers and consistently provide a high-quality of service.

Establish a strong professional network: Selling insurance is all about establishing strong relationships with clients, so it is vital to focus on this aspect first before turning your attention to sales. As you slowly build your network, sales may follow.

Identify clients’ needs: Life insurance agents must possess the empathy to identify the coverage that their clients need. Most people already know that they need some form of financial protection, although they may not necessarily know what type of policies they need specifically.

Leave a professional impression: Dressing and communicating in a professional manner can help a lot in establishing clients’ trust. For independent agents working outside the office setting, the choice of venue when meeting customers plays an important role in establishing professionalism.

Understand that selling life insurance is a long game: Trying hard to sell policies right away is a sure-fire way to ruin clients’ trust. Focus on building relationships instead. Agents who are patient and play the long game are more likely to secure a long-term customer who may be willing to refer you to other potential customers.

Life insurance is a dynamic field, with changes that occur in a snap. If you want to keep abreast of the latest happenings and developments, be sure to visit and bookmark our Life and Health news section, where you can find breaking news and industry updates. Also, don’t forget to subscribe to our newsletters to get fresh updates from the entire insurance industry as you develop your career.

Were you surprised to find out how much life insurance agents make? Do you agree with the figures above or not? Type in what you think in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!