LIA Singapore unveils new guide to medical underwriting

LIA Singapore unveils new guide to medical underwriting | Insurance Business Asia

Life & Health

LIA Singapore unveils new guide to medical underwriting

Members of 2024-25 management committee also unveiled

Life & Health

By

Roxanne Libatique

The Life Insurance Association of Singapore (LIA) has introduced a new consumer resource, the LIA Guide to Medical Underwriting for Life Insurance.

The guide is designed to assist consumers in understanding the criteria and processes life insurers use to evaluate insurance applications, which are based on the applicant’s health disclosures and medical evidence.

The release of the guide marks a significant step toward demystifying the underwriting process for consumers by using a variety of case studies and visual aids to illustrate the process for conditions ranging from high blood pressure and diabetes to autism and cancer.

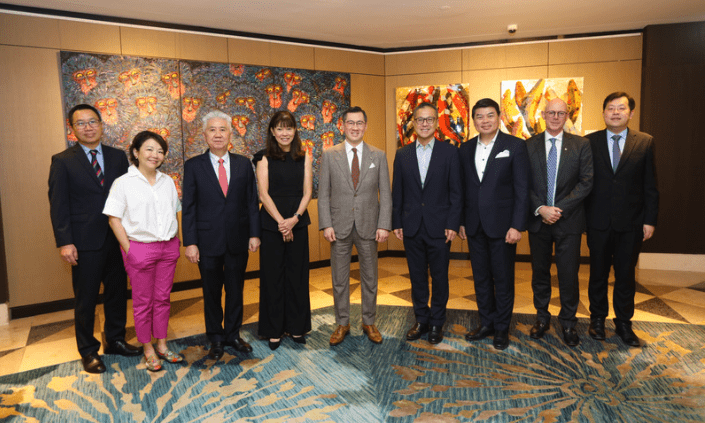

LIA Singapore’s committee for 2024-25

The announcement came alongside the presentation of LIA’s Management Committee for the 2024-2025 term during the association’s yearly gathering. The meeting was graced by the presence of Ho Hern Shin, deputy managing director (financial supervision) of the Monetary Authority of Singapore.

For the term of 2024-2025, LIA welcomes its new Management Committee members, with Dennis Tan of Prudential Assurance Company Singapore (Pte) Limited taking on the role of president.

Joining Tan are deputy presidents Wong Sze Keed from AIA Singapore Private Limited and Raymond Ong from Etiqa Insurance Pte Ltd, along with secretary Khoo Kah Siang of Manulife (Singapore) Pte Ltd, and treasurer Andrew Yeo of Income Insurance Limited.

The committee also includes Khor Hock Seng from The Great Eastern Life Assurance Company Limited, Harpreet Bindra from HSBC Life (Singapore) Pte Ltd, and Pearlyn Phau from Singapore Life Ltd.

LIA Singapore committee goals

The team is set to focus on increasing financial literacy related to life insurance, closing the protection gap in Singapore, fostering innovation in insurance products, and supporting the country’s journey towards achieving a net zero economy by 2050.

Commenting on the leadership overhaul, LIA president Dennis Tan stressed the strength and progress of the life insurance sector in Singapore through the economic trials of 2023.

“There was an increase of 1.9% in total sum assured last year to $145.5bn, and approximately 60,000 more Singaporeans and permanent residents were covered by Integrated Shield Plans (IPs) at the end of 2023 compared to the previous year. In total, 2.93 million lives – approximately 70% of Singapore Residents – are protected by IPs and IP riders which provide additional coverage on top of MediShield Life,” he said.

Tan voiced a measured optimism for the year ahead, stressing the importance of collaborative action to navigate the challenges posed by economic flux, geopolitical unrest, and the local concerns of living and healthcare costs.

Additionally, LIA released its industry results for the full year ending Dec. 31. It is also preparing to launch an updated version of its protection gap calculator. This update, informed by feedback and the findings from the 2022 Protection Gap Study, will introduce both a simplified and a comprehensive version of the calculator to enhance user experience.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!