Letitia James challenges Knight Specialty insurance over Trump bond

Letitia James challenges Knight Specialty insurance over Trump bond | Insurance Business America

Insurance News

Letitia James challenges Knight Specialty insurance over Trump bond

“Vague, incomplete, and inconclusive” claim threatens Trump’s assets

Insurance News

By

Matthew Sellers

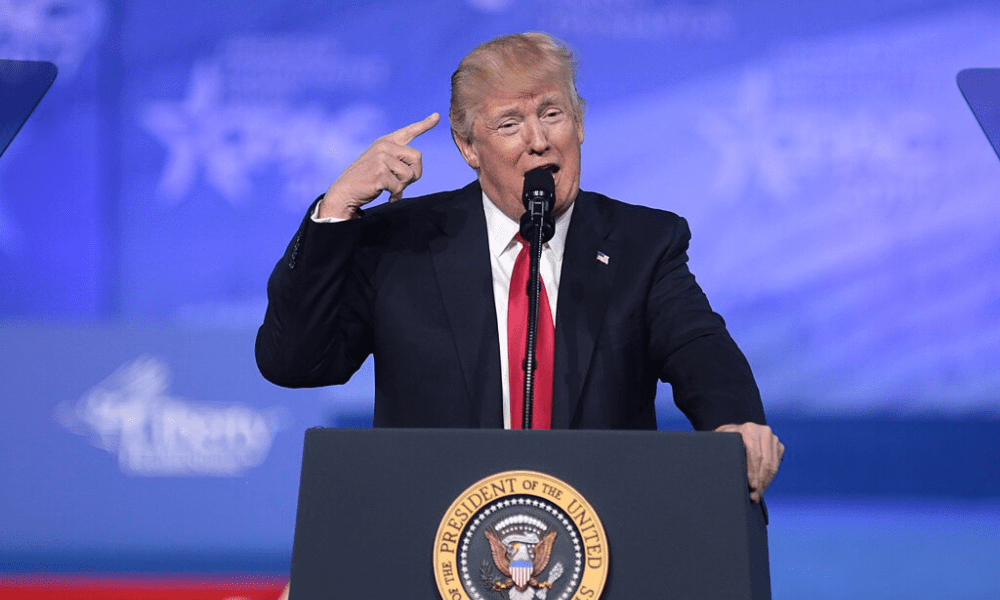

The New York Attorney General, Letitia James, is challenging the validity of a $175 million bond secured by Donald Trump as he attempts to appeal a verdict that found him guilty of fraud. This legal maneuver is designed to pause the enforcement of a judgment that could potentially cost him nearly half a billion dollars.

James claims that the bond in question, underwritten by Don Hankey’s Knight Specialty Insurance Company, is not supported by adequate collateral nor issued by a properly licensed entity. On Friday, James’s office filed documents with the court describing the evidence provided as “vague, incomplete, and inconclusive” regarding the funds being readily available to prevent the bond’s default.

James’s legal team has argued that the court should declare the bond insufficient and has requested that Trump secure a new guarantor within a week. Failure to comply could lead to immediate property seizures to settle the financial judgment. The court is expected to address this request in a hearing set for today, Monday, April 22.

The attorney-general’s office also said that Knight’s management had been “found by federal authorities to have operated affiliated companies within KSIC’s holding company structure in violation of federal law on multiple occasions within the past several years”.

The AG’s staff was referring to cases in which the CFPB ordered Westlake Services and Wilshire Consumer Credit, two of billionaire Don Hankey’s companies, to collectively pay almost $50 million in restitution and fines, and a settlement federal prosecutors reached in 2017 with another two Hankey Group companies, which had to pay over $750,000 to settle claims that they had unlawfully repossessed dozens of vehicles owned by former members of the US armed forces.

Further complicating the matter, Knight Insurance has reportedly outsourced “100% of its retained insurance risk” to subsidiaries which are offering what the AG calls “shadow insurance” in the Cayman Islands, which Jones’ office says could be an attempt to exploit lax regulations to artificially enhance the company’s financial standing.

Despite claims from Knight that it is a “respected, well-capitalised insurer”, its lack of a New York qualification certificate puts the bond’s validity in jeopardy, which could mean that Trump will be forced to sell assets to pay the fine. Trump is currently in court facing criminal charges on a separate matter, and has already had another insurance backed surety bond through Chubb, being used while appealing a multi-million dollar payment after being found liable for sexual abuse .

Knight Specialty Insurance Company was established in 2003 and is a subsidiary of Knight Insurance Group. Registered in Delaware, KSIC functions as a surplus lines insurer across the United States and the District of Columbia. The firm offers a range of insurance products including casualty, property, commercial auto, and general liability among others, though availability varies by state.

Rated A- by AM Best, the company is part of a larger insurance conglomerate, Knight Insurance Group, which also includes entities like KnightBrook Insurance Company and Guilderland Reinsurance Company, encompassing a broad spectrum of insurance services.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!