Lara struggles to reform California insurance market

Lara struggles to reform California insurance market | Insurance Business America

Environmental

Lara struggles to reform California insurance market

“There’s going to be push and pull,” says an industry lawyer

Environmental

By

Mark Schoeff Jr.

Irene Sabourin used to be able to find insurance policies for customers before they left her office. Now, she has trouble identifying insurers who will offer homeowners’ coverage in California.

The state has been hammered by wildfires, storms and other extreme weather events over the last few years that have roiled its insurance market. Since 2022, seven of the top 12 insurance companies in California have paused or restricted new business, according to the state’s Department of Insurance. The latest example was State Farm’s recent announcement that it would stop renewing 72,000 homeowners’ and other policies.

For Sabourin, a personal lines manager for HUB International Services, the situation is wrenching.

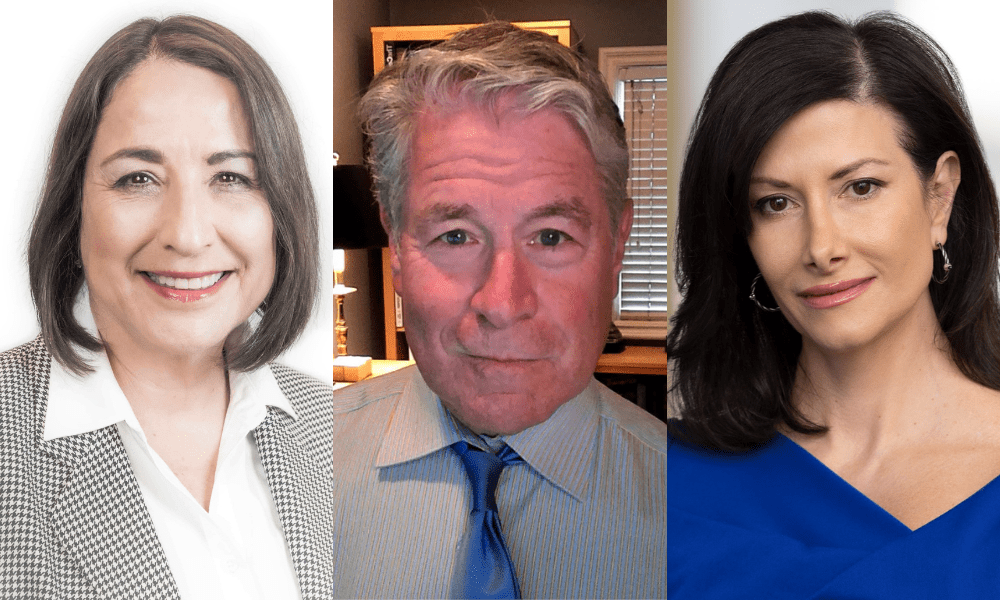

“It’s probably the biggest crisis I’ve seen in 45 years,” said Sabourin (pictured above, far left), who is now working part-time for HUB after a long career with the firm. “I’m used to having a plethora of options for clients. If they call in for homeowners’ insurance today, I have two admitted markets that might take them.”

California Insurance Commissioner Ricardo Lara has launched a reform program, which he calls the Sustainable Insurance Strategy, to try to make the California market more attractive for insurance companies while ensuring that they offer policies in most areas of the state.

The package of initiatives includes one designed to streamline the state’s rate approval process. It would require insurers to submit comprehensive and clear information when they submit rate applications. A public hearing on the proposal is scheduled for Tuesday.

Another proposal, announced earlier this month, would expand the use of catastrophe models. It would allow insurers to predict possible wildfires and base rates on those predictions. The majority of the most destructive wildfires in the state have occurred in the last decade.

Lara is touting the reforms as the strongest in the last 30 years. They aim to modify Proposition 103, the law approved by voters in 1988, that required insurers to obtain state approval for rate hikes and opened the process to greater public scrutiny and opportunities for consumer groups to challenge the requests.

Prop 103 accused of disrupting insurance market

Lara, who was elected in 2018, is being buffeted, as he navigates the policy changes.

Some see Prop 103 as a disruption to the insurance free market. They want to allow insurers freer rein to set prices.

“Why don’t you give these companies the rate they need to stay in business?” Sabourin said. “I’d rather have a rate than no [coverage] in this interim until something gets fixed.”

Harvey Rosenfield (pictured above, center), founder of Consumer Watchdog, said that Lara is leaning too far in the direction of the industry with his reform proposals – at the expense of California insurance customers.

“The reality is that the insurance industry has been trying to escape Prop 103 since the voters kicked their ass in 1988,” Rosenfield said. “All of this is designed to restore to the insurance industry through Commissioner Ricardo Lara what [it] lost at the ballot box…a system in which there is no accountability, no public review, oversight or control of insurance rates or premiums or discriminatory practices.”

Lara’s office did not respond to several interview requests.

The reforms Lara is proposing are needed to make insurers reconsider the California market, said Lilit Asadourian (pictured above, right), a partner in the insurance recovery practice group at Barnes & Thornburg.

“You have to give something to the insurance industry to get them back to the bargaining table,” Asadourian said. “I’m sure there’s going to be a healthy dose of criticism for him yielding to some extent to the industry. But what’s the alternative? You can’t make everyone happy.”

Mixed feelings about Lara’s efforts

Mixed feelings may be the most popular emotion when it comes to Lara’s initiatives.

“Commissioner Lara and his staff deserve credit for recognizing, finally, that rates must go up if California wants to restore a healthy, competitive marketplace,” said Steve Young, senior vice president and general counsel at the Independent Insurance Agents and Brokers of California.

But Young (pictured above) is not a fan of the proposal to require insurers to beef up their rate-increase applications.

“The first set of proposed regulations would add even more uncertainty, ambiguity and time delays to the process of submitting a rate change application,” Young said.

Mark Robinson, co-founder of the law firm Michelman & Robinson, said Lara’s proposal is a needed move toward streamlining rate setting.

“They have to do something to reform the rate review process,” Robinson said. “It is taking longer than everyone would have hoped.”

Rate approvals in California have been slowing down for years – from about 150 days in 2018 to about a year in 2023 — making it difficult for insurers to react nimbly to changing market conditions, said Robert Gordon, senior vice president of policy research and international at the American Property and Casualty Insurance Association.

“Insurers are trying to play catch up,” Gordon said. “California is a huge outlier in terms of how long they take.”

Cat modeling likely to catalyze debate

Lara’s office wants to enact his reform proposals by the end of the year. That could be an ambitious schedule, given the complexity of changing insurance regulation. For instance, there likely will be a lot of input on the cat modeling proposal at a public hearing about the measure on April 23.

“It’s very clear from the proposed regulations they’re agreeing that cat modeling can be used for rate-setting purposes,” Asadourian said. “There’s going to be debate about the models and which one is the right one.”

Consumer Watchdog likely will reiterate at the public hearing its warning that the proposed cat model would be a “black box” that spews out inconsistent and unreliable data. It also criticized Lara’s proposal of extending cat modeling to flooding and allowing their use in any line of insurance.

Rosenfield will be a fervent voice in opposition to Lara’s plans.

“The industry, I’m sure, is thrilled to have an insurance commissioner willing to take on the voters and undo as many protections as the industry can get,” Rosenfield said.

Lara is facing a heavy political lift to accomplish his goals.

“There’s going to be push and pull,” Asadourian said. “Hopefully that yields to some kind of compromise that no-one is happy with but can live with.”

Sabourin is not optimistic.

“Lara’s proposal is too little, too late,” she said. “We can’t stop the bleeding.”

Timeline for California Insurance Commissioner Ricardo Lara

November 2018 – Ricardo Lara wins election as California Insurance Commissioner

January 7, 2019 – Lara assumes office

August 2019 – Lara comes under fire for various reasons – “Allegations that Lara used his office to reward donors raise serious legal questions that he will have to answer completely and quickly. Pandering to a bunch of industry executives at a luncheon isn’t unlawful but it is troubling.”

October 2, 2019 – Ended court battle with Mercury Insurance Company

December 23, 2019 – Proposed regulations for auto insurance group discounts for members of affinity groups

April 13, 2020 – Ordered refund of premiums to those affected by COVID-19

July 1, 2020 – “Invest in Our Diverse Communities” Initiative

2020 – Wildfire continues

September 24, 2021– FAIR Plan increased coverage options

February 25, 2022 – New regulations on wildfire

April 18, 2022 – Push for more investment in solutions to fight climate change

September 27, 2022 – Auto insurance crisis

May 27, 2023 – State Farm pulls out

September 21, 2023 – Lara publicizes his Sustainable Insurance Strategy

February 9, 2024 – First wave of proposed regulatory reforms

March 14, 2024 – Lara releases catastrophe modeling regulatory proposal

Keep up with the latest news and events

Join our mailing list, it’s free!