LA wildfires: Over 10k structures destroyed. Insured losses up to ~$20bn, economic $150bn

Overnight, more details on the scale of the devastation caused by the wildfires burning in the Los Angeles region of California have emerged, with officials saying 10,000 structures have been destroyed across the two main fires, while estimates of losses continue to rise.

Wildfires are still burning and containment percentages remains very low for the main fires burning in the region, while weather forecasters are calling for more red flag fire weather through today (Friday) and also strong winds again next week, raising the spectre of further damage occurring.

There are numerous estimates for insurance market losses circulating, but in general the range appears to be moving towards between $10 billion and $20 billion.

At the same time, some are cautioning that if the wildfires continue to spread over the coming days, with the continuation of critical fire weather, then some are citing a chance that the ultimate insurance and reinsurance industry loss rises above $20 billion.

As we reported yesterday, analysts from J.P. Morgan doubled their estimate for insurance market losses from the Los Angeles wildfires to around $20 billion, perhaps exceeding it yesterday.

In that article we explored some of the exposure sitting in insurance-linked securities (ILS) such as catastrophe bonds, but continued to explain that ILS market losses would likely be a relatively smaller share of the overall.

We can add an estimate from RBC Capital Markets equity analysts to our list, as they have said, “Since the fires are still burning, it is difficult to obtain a full assessment of the damage, but we think this could produce losses of at least $10–20 billion (could be even higher depending on the longevity of the situation).”

It’s worth noting now that all of the estimates seen yesterday were based on figure for the number of structures destroyed by the fires of around 2,000.

Now, fire officials in Los Angeles County have released new information on the number of structures burned by the wildfires and you can multiply that by five.

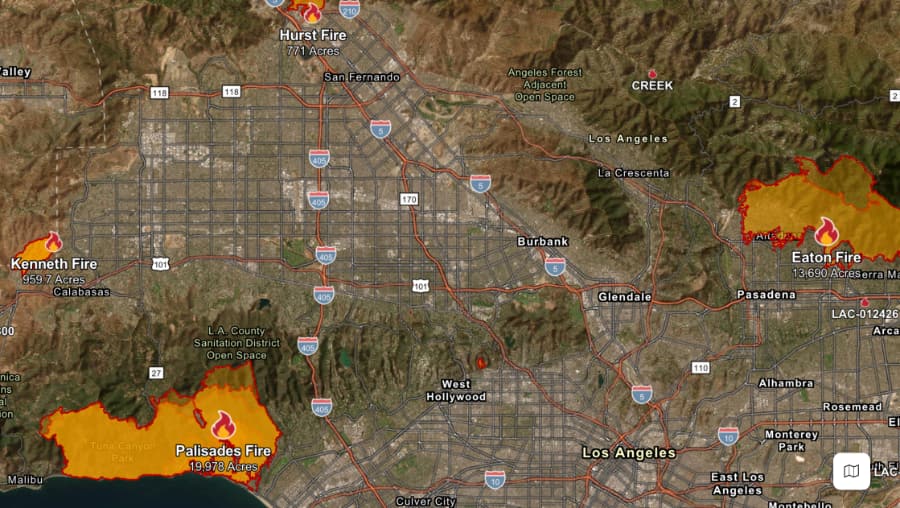

The two main wildfires that have caused the most damage are the Palisades and Eaton fires, with each now responsible for an enormous and devastating toll.

The Palisades fire, which is around 6% contained, has burned around 20,000 acres and is now deemed responsible for the destruction of over 5,300 structures, according to the LA fire authorities.

That is based on estimates made after aerial surveys of the Pacific Palisades area and damaged structures include houses and businesses, as well as smaller buildings like motorhomes and sheds.

Meanwhile, the Eaton fire has spread to more than 13,000 acres and Los Angeles County Fire Chief Tony Marrone said that it remains at 0% containment, but there is now confirmation that potentially more than 4,000-5,000 structures could be damaged or destroyed.

Later, Jon O’Brien, chief deputy emergency operations of Los Angeles County Fire Department, said the Eaton fire has destroyed an estimated 5,000 structures.

The Cal Fire website now displays 10,000+ structures destroyed, when just yesterday it said zero, as counts were just beginning. It’s going to be important to watch how these figures increase, as currently they are one of the best ways for insurance reinsurance market interest to gauge the scale of the damage and the potential impact to them, alongside the use of aerial or satellite imagery, until damage inspections can begin and adjusters can get in on the ground.

Three other fires are burning in the Los Angeles region, Kenneth, Hurst and Lidia, but so far no information is available on any damage caused, although they are known to have caused some.

Meanwhile, forecaster Accuweather has now near tripled its estimate for the economic loss these Los Angeles, California wildfires will cause.

Yesterday in one of our reports we cited Accuweather’s early economic loss estimate for the wildfires that continue to burn out of control in Los Angeles suburbs, having put the total at between $52 billion and $57 billion.

Now, the company has updated its estimate to say, “AccuWeather has updated and increased its preliminary estimate of the total damage and economic loss to between $135 billion and $150 billion.”

“These fast-moving, wind-driven infernos have created one of the costliest wildfire disasters in modern U.S. history,” AccuWeather Chief Meteorologist Jonathan Porter explained. “Hurricane-force winds sent flames ripping through neighborhoods filled with multi-million-dollar homes. The devastation left behind is heartbreaking and the economic toll is staggering. To put this into perspective, the total damage and economic loss from this wildfire disaster could reach nearly 4 percent of the annual GDP of the state of California.”

The forecasting company said its estimate could be revised further upwards in the coming days, given the fire situation continues and damage reports are just emerging.

As well as the damage to property, Accuweather’s estimate also factors in numerous other inputs, from damage to infrastructure and utilities, to interruption related costs, rebuilding, relocation, cleanup lost wages and displacement, among others.

Which also brings to mind business interruption, as these wildfires are set to cause significant and potentially long-term interruption for the affected parts of California, which could drive additional insurance market losses.

Accuweather also said that these wildfires could worsen California’s insurance crisis, as the cost for coverage may increase further and companies exit the region.

“This wildfire disaster is going to be yet another major challenge for the insurance industry, and for home and business owners who are struggling to secure adequate insurance coverage in high-risk areas,” Porter said. “Families and businesses need to be able to purchase insurance at a reasonable rate, but insurance companies cannot continue absorbing huge loss after huge loss. This is a major issue that society needs to actually address in a world of increasing extreme weather impacts.”

The outlook is for continued dangerous fire weather in the region over the coming days.

Today, Friday, is expected to see strong winds that could further fan flames, but then Saturday is forecast to see more typical seasonal weather. But Sunday on and into next week, the red flag warnings return with weak to moderate Santa Ana winds expected and a chance of stronger winds on Tuesday.

It’s worth also noting that while the damage is extreme and losses set to be perhaps the most costly wildfire outbreak ever for the insurance and reinsurance market, rating agencies and analysts say it will be manageable for the sector.

Losses are expected to fall to the primary insurers and California’s FAIR Plan first, with reinsurance capital picking up a share.

On the FAIR Plan side, it has $2.63 billion of occurrence reinsurance, as well as co-reinsurance and assessments, while once all that is exhausted the market may pick up more and California policyholders the rest.

For reinsurance companies, it is expected they will see losses through excess-of-loss, quota share and per-risk arrangements as well.

For the insurance-linked securities (ILS) market, private collateralized reinsurance transactions in lower-layers of towers are the most exposed, naturally, while collateralized quota shares will take their pro-rata amounts.

As we said yesterday, there is one privately placed catastrophe bond that is exposed, but as ILS investment managers have pointed out the main threat to the cat bond market appears to be from aggregate deductible erosion (see articles linked at the bottom of this piece).

While there are numerous multi-peril catastrophe bonds that feature wildfire as an exposure, on a proportion of expected loss basis it is not a significant contributor in the main.

There are a couple of outstanding occurrence multi-peril cat bonds with wildfire exposure in California, those will be harder to understand any threat to at this stage, although our sources say they are currently not concerned about the potential for these fires to attach any occurrence 144A cat bonds that feature the peril. Greater clarity over the losses and exposure for specific cat bond sponsors will be needed to be certain though.

On the aggregate cat bond side, there are a number of aggregate indemnity bonds viewed as most at-risk of facing deductible erosion and a handful of index-trigger aggregate cat bonds seen as most exposed. It is the index bonds that are seen having the greatest risk of impairment, but this would require the industry loss to come out around the top-end of current ranges, we are told.

Another fact worth considering, when it comes to reinsurance and ILS market loss exposure to these fires, is that Palisades and Eaton will be considered two separate catastrophe loss events, which could have some bearing under certain structure wordings, we’re told.

S&P said that insurers and reinsurers can easily absorb the losses from the wildfire within their catastrophe budgets, but cautioned that an event at this early stage of the year of this magnitude will deplete the resources available to absorb cat losses through the rest of 2025.

Rated primary insurers are expected to bear the brunt of the wildfire losses, while for global reinsurance firms S&P said the impact of the wildfires is expected to be manageable.

Analysts have also explained that the residential homeowner nature of many of the destroyed areas, such as Palisades, means the FAIR Plan can be expected to take a significant proportion of the losses and that this may reduce the scope of losses for the reinsurance and ILS market somewhat. Should the commercial component of the loss prove higher than anticipated, then the reinsurance capital impact may prove higher.

Also read:

– LA wildfire losses unlikely to significantly affect cat bond market: Twelve Capital.

– LA wildfires unlikely to cause meaningful catastrophe bond impact: Plenum Investments.

– JP Morgan analysts double LA wildfire insurance loss estimate to ~$20bn.

– LA wildfires: Analysts put insured losses in $6bn – $13bn range. Economic loss said $52bn+.

– LA wildfires bring aggregate cat bond attachment erosion into focus: Icosa Investments.