Japan M7.5 earthquake insured loss to reach $6.4 billion: KCC

Insurance industry losses from the January 1st magnitude 7.5 earthquake that struck the Noto peninsula on Japan’s west coast could reach $6.4 billion, with residential property seen as the major contributor, according to risk modelling firm Karen Clark & Company (KCC).

“According to the high‐resolution KCC Japan Earthquake Reference Model, the total insured losses will reach $6.4 billion, with residential losses accounting for over two thirds of the total,” KCC explained in an update.

It’s important to note that KCC does not explicitly state whether this figure includes residential quake losses that fall to the government quake reinsurance program, although some of these can come back to the private market through retroceded risks.

Typically though, KCC’s industry loss estimates are focused on the private insurance market impact.

As we reported earlier today, rating agency AM Best cautioned that the loss will hit proportional reinsurance arrangements and said that if it impacts excess-of-loss reinsurance layers, this could push catastrophe renewal rates up at April 1st for Japanese reinsurance buyers.

Early unofficial estimates seen by Artemis had been suggesting a low to mid-single digit US billion cost for the global insurance and reinsurance market, so KCC’s estimate appears right within that range.

At the level of industry loss suggested by KCC’s modelling and analysis, catastrophe bonds and most other excess-of-loss insurance-linked securities (ILS) positions would be expected to avoid direct impact from this Japan earthquake event.

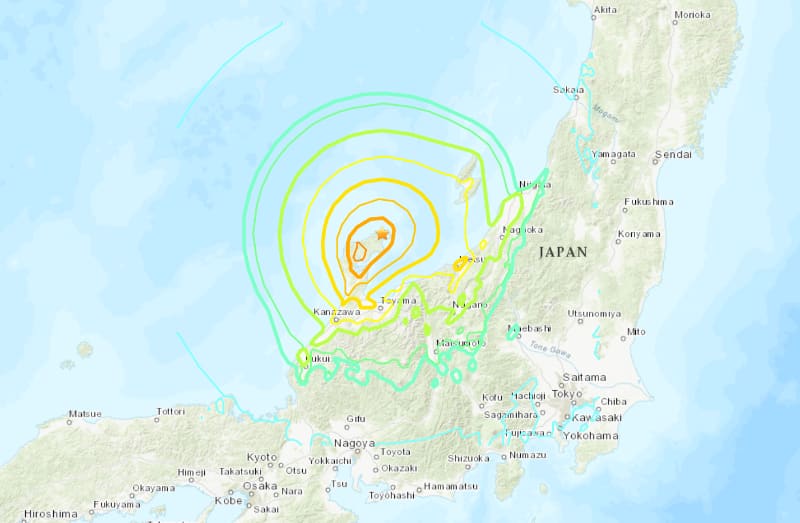

Explaining the impacts of the damaging earthquake, KCC said, “The 2024 Noto Peninsula Earthquake impacted the four prefectures of Ishikawa, Niigata, Toyama, and Fukui. Several cities and towns experienced very high ground motion, including Shika, Nanao, Wajima, Suzu, Anamizu, and Noto. KCC scientists estimate over half a trillion USD of exposure in the ground motion footprint (0.3 sec SA ≥ 0.2g), including residential, commercial, and industrial properties.

“Machiya homes make up more than a third of the residential inventory in Ishikawa Prefecture, and they can be especially vulnerable during earthquakes because their heavy earthen walls, traditional timber construction, and tiled roofs are more prone to collapse than modern materials like steel and reinforced concrete. In addition, the long narrow layout of Machiya homes can make the structures more susceptible to lateral forces during strong shaking.

“Most of the remaining residential buildings are 1‐ and 2‐story wooden buildings. These buildings possess better earthquake resistance than Machiya buildings because they have wooden frames partially reinforced by light metal and are anticipated to have suffered lower levels of damage. However, in the areas of significant ground motion, these wood buildings can be severely damaged.

“Age plays a role as well. Across Ishikawa, a third of all residential buildings date from before 1981. Commercial and industrial buildings in the affected cities are predominantly steel construction, which has significantly higher earthquake resistance. Residential property losses are expected to exceed those of commercial and industrial properties.”

Also read:

– Japan quake could fuel April 1 rate increases if excess layer reinsurance hit: AM Best.

– Direct losses from Japan quake unlikely, but damage widespread: Twelve Capital.

– No immediate cat bond impact expected from Japan earthquake: Plenum.

– Japan hit by magnitude 7.6 earthquake, structural damage and tsunami reported.