Jamaican farmers get partial payout as Beryl triggers Skyline & Munich Re backed parametric policy

Skyline Partners, a full-service provider in the parametric insurance supply chain, and global reinsurer Munich Re have revealed that a partial claim under a parametric insurance policy triggered by Hurricane Beryl has been paid out to the Jamaican Co-operative Credit Union League (JCCUL).

Back in April 2022, Skyline Partners, Munich Re, and broker Howden collaborated on the development of a parametric hurricane insurance product for Jamaican farmers. The policy was later renewed by Munich Re, and the very close passing of Beryl to Jamaica on July 3rd, 2024, triggered a partial payment.

Skyline and Munich Re highlight the fact that as Beryl failed to make landfall, numerous event-triggered coverages simply didn’t respond as a result of “the binary nature of their radius, windspeed, and/or minimum pressure triggers.”

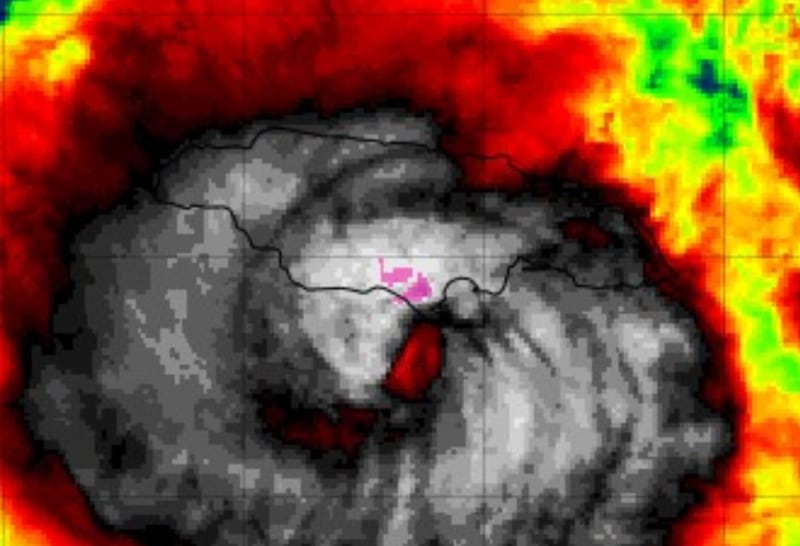

However, Skyline’s unique FatTrack™ trigger mechanism, which “responds to the dynamic nature of hurricane events”, better reflected conditions on the ground, ultimately leading to a payout under the Howden-brokered parametric insurance policy.

The parametric policy was designed to stabilise Jamaica’s financial system for its farming community, and protects the JCCUL, which provides loans to hundreds of thousands of smallholder farmers against non-repayment of micro-loans from farmers after severe hurricanes.

The pair explain that FatTrack™ triggered payouts of varying proportions of their total limit according to the number of insured location-tiles hit by the storm, and also to Beryl’s category as it enters the tile.

In the case of Hurricane Beryl, 45% of the total JCCUL policy value has been paid, which reflects the lower, but still significant damage caused by the hurricane’s close proximity to the country.

Skyline’s Co-Founder, Laurent Sabatié, commented, “The insurance product responded exactly as intended. The fact that this policy triggered clearly with a partial payment for Beryl in Jamaica is a strong endorsement of FatTrack for everyone involved – the underwriters, the insured lenders, and of course the beneficiaries. While those covered under industry loss warranties and loss-index-driven cat bonds must wait to learn if their coverage will kick in, we have already paid our insureds.”

Skyline’s Co-Founder, Gethin Jones, added, “The payment should provide confidence to lenders who require borrowers to secure insurances to protect loan-funded assets, but are not yet comfortable with parametric solutions.

“We are proud to support the Jamaican farming community in a time of terrible crisis. For our clients it shows that parametric insurance need not be a purely pay-or-don’t-pay proposition. When parametric is carefully tailored to the exposures, basis risk can be lower than under conventional policies, and its efficiency is undoubtedly very much higher.”