Jamaica due US $16.3m CCRIF payout, as Beryl triggered parametric cyclone cover

Jamaica is set to benefit from an approximately US $16.3 million payout from the CCRIF SPC (formerly known as the Caribbean Catastrophe Risk Insurance Facility) after hurricane Beryl triggered its parametric tropical cyclone insurance policy.

The country’s Minister of Finance Dr. Nigel Clarke explained that the CCRIF event report has been delivered, indicating that major hurricane Beryl breached the parameters of its disaster insurance contract with the facility.

“I have received the Preliminary Modelled Loss and Policy Payment Report from the Caribbean Catastrophe Risk Insurance Facility (“CCRIF”) in respect of Tropical Cyclone Beryl,” Clarke explained.

The event report communicated that, “The GOJ’s Tropical Cyclone policy with the CCRIF has been triggered with a payment amount of approx US$16.3 million or approx. J$2.5 billion,” Clarke said.

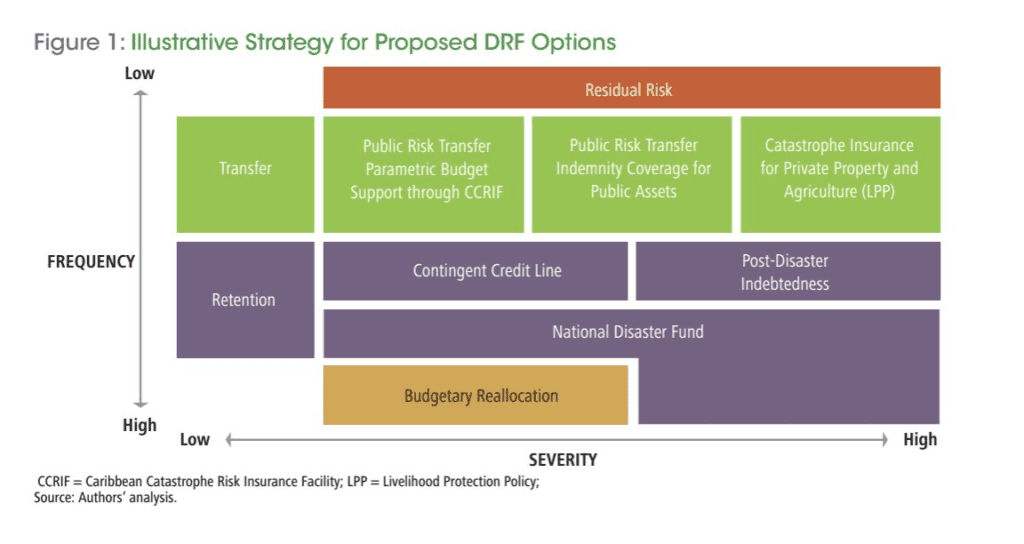

Adding that, “Our policies with the CCRIF represent the 4th layer in the GOJ’s multilayered disaster risk financing framework.”

As we reported last week, there has been an anticipation that some CCRIF SPC parametric capacity would be paid out after hurricane Beryl, certainly for some of the Windward Islands of the Caribbean that were most impacted by the storm, but possibly also for Jamaica.

Readers will be aware that Jamaica’s $150 million IBRD catastrophe bond was not triggered by the passage of Beryl close to the island, but the country has a range of disaster risk contingency financing arrangements, a number of which were due to disburse capital, as we’d reported Clarke himself had explained.

It’s not yet known whether Jamaica’s excess rainfall parametric insurance from the CCRIF has also been triggered, at this time.

Jamaica’s Finance Minister has gone to great lengths to explain the country’s disaster risk financing arrangements in the wake of hurricane Beryl, including the layered approach and the fact the catastrophe bond sits in the top layer to provide coverage for the most extreme events.

The CCRIF SPC parametric insurance sits in layer four, just beneath the residual risk that the IBRD cat bond provides protection for.

Clarke shared the image above which shows this layered approach to disaster risk financing and transfer, including where the parametric insurance sits and the layer that the cat bond covers above that.

With another payout set to come due, the CCRIF SPC continues to demonstrate the benefits of its parametric insurance coverage.

Also read: Not every risk transfer instrument designed to trigger for every storm: Jamaica MoF.