Is heavy equipment insurance right for your business?

Is heavy equipment insurance right for your business? | Insurance Business Canada

Guides

Is heavy equipment insurance right for your business?

Heavy equipment insurance is key if your business depends on specialized machinery to keep operations running. Find out how this type of coverage works

If heavy equipment is an essential part of your business, then you know that any loss or damage to your machinery can prove costly. To keep your operations running smoothly, getting the right coverage is a must.

This is where heavy equipment insurance comes into play.

This type of coverage is often included in a standard tools and equipment policy. Insurers, however, may call it different names and offer varying levels of protection. Because of this, a deep understanding of your coverage needs and the kind of protection insurers provide is key in helping you find the best deal.

In this article, Insurance Business explains everything you need to know about heavy equipment coverage. We will discuss how it works, what it covers, and what you should consider when choosing a policy. If your business relies on specialized machinery to get the job done, this guide can help. If you’re an insurance professional, this article could serve to help potential clients understand why they need coverage; share it with them!

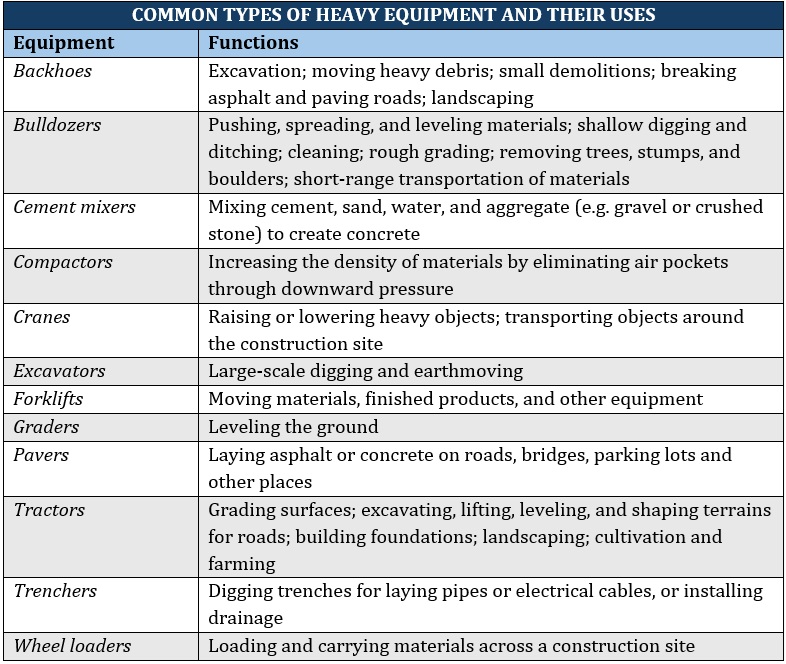

As the name suggests, heavy equipment is a specialized type of machinery that’s designed to perform heavy duty work. Although mostly associated with the construction industry, heavy equipment is used in many sectors. These include forestry, agriculture, mining, and other industrial operations.

Heavy equipment comes in several forms, each designed to perform different functions. Here are the most common types and their uses.

Heavy equipment insurance is a part of a tools and equipment policy that covers the repair or replacement cost of damaged or lost machinery. Coverage includes rental equipment and those you own and rent out.

The policy is sometimes called contractors’ or construction equipment insurance, although coverage may also include equipment used for farming, mining, manufacturing, and other industries.

Just like in tools and equipment insurance, your machinery often needs to meet three criteria to be eligible for coverage:

1. The equipment must be mobile

One part of a heavy equipment policy functions like inland marine insurance. It provides coverage for machinery while it’s being transported on land. This means that it covers only equipment that can be moved from one location to another, usually from your head location to the job site.

2. The equipment must be less than five years old

Heavy equipment insurance pays for the repair and replacement costs in two ways:

actual cash value (ACV): covers for the fair market value of the equipment at the time of the loss; this is the value of the unit when it was bought minus depreciation

replacement cost value (RCV): pays for how much it would take to replace the stolen or damaged equipment at today’s cost

Heavy equipment policies often provide coverage for machinery that’s less than five years old. Some insurers offer policies that pay for the repair and replacement cost of older units, but only on an actual cash value basis. What this means is that eventually, your machinery will age out of the replacement value option.

3. The equipment must be worth less than $10,000

Heavy equipment insurance typically has a coverage limit of $10,000. This is the maximum value the policy will pay for the whole term. If you own high-value, top-of-the-line machinery, there’s a big chance that it’s not covered. Some insurers offer coverage for very expensive equipment, but this is often available at a steep price.

As tools and equipment insurance isn’t legally required, heavy equipment coverage is also not mandatory. Your clients, however, may require you to take out coverage as a condition of your contract.

You can purchase tools and equipment insurance as a standalone policy or as a rider to your commercial property or business owner’s policy (BOP). You can learn more about how the policy works in our comprehensive guide to tool insurance.

Most heavy equipment insurance policies are written on an all-risks basis. This means that coverage can include events that aren’t specifically listed in your policy document. Generally, heavy equipment coverage includes these incidents:

Natural disasters

Heavy equipment insurance covers loss or damage caused by natural calamities. These include hurricanes, tornadoes, wildfires, and lightning. Floods and earthquakes, however, aren’t automatically covered. If you’re operating your business or working on a project in an area prone to these events, you can purchase coverage through riders.

Theft

Policies cover theft that happens on the job site. They also cover incidents occurring while your equipment is being transported or stored in a facility.

Vandalism

If your machinery is damaged due to acts of vandalism, heavy equipment machinery will pay for the repair costs. This is regardless of whether the incident occurs in the job site or while the unit is being transported.

Unintentional damage

Heavy equipment insurance covers instances where one of your employees accidentally damages or breaks equipment while doing their jobs. It may also pay for the cost to repair damage caused by unforeseen incidents such as storage issues.

Heavy equipment insurance doesn’t cover every incident that can cause damage. Some of the most common exclusions from your policy are:

General wear and tear

Policies don’t cover loss or damage caused by natural deterioration. These instances include rusting, corrosion, and mechanical or electrical breakdown.

Intentional damage

Heavy equipment insurance will not pay for damage deliberately caused by your employees. If the units are misused or damaged because of negligence, your policy also won’t cover the repair or replacement costs.

Electrical and mechanical breakdown

Heavy equipment coverage doesn’t often include electrical or mechanical breakdown. Some insurers, however, offer extended coverage in the form of riders at an extra cost. A separate equipment breakdown insurance policy can also help cover the damage.

Stationary equipment

As mentioned, heavy equipment insurance only covers machinery that can be moved from one worksite to another. Stationary equipment such as boilers, HVAC systems, generators, computer systems, and other infrastructure-related machinery aren’t covered. An equipment breakdown policy may also help cover these.

Commercial vehicles

The vehicles your business uses to transport staff and other people aren’t considered heavy machinery and are thus excluded from coverage. These include cars, trucks, and vans. If you want coverage for these, you need to get commercial auto insurance.

Because businesses use different equipment and come with varying needs and exposure, it’s hard to provide a one-size-fits-all price point for heavy equipment insurance. To find out how much your premiums will cost, you must consider these factors:

how much your equipment is worth

how old the equipment is

how you maintain your equipment

where you store equipment

where your business operates

your business’ past claims

coverage limits of your policy

For Canada version only:

If you need expert legal advice on which types of equipment are required for your business, you can consult one of Lexpert’s leading asset equipment finance/leasing lawyers. These legal professionals can guide you through your jurisdiction’s regulations on equipment use and help your business with compliance.

Any business that relies on specialized machinery to keep their operations running can benefit from heavy equipment insurance. This type of policy prevents costly delays if an essential machinery is damaged or lost. Here are some types of businesses that may need to take out heavy equipment coverage:

construction businesses

mining operations, including oil and gas

agricultural enterprises, including farmers

heating, ventilation, and air conditioning (HVAC) technicians

landscaping businesses

professional installation services

contractors

manufacturing operations

retail businesses

Most insurance policies have a maximum coverage limit of $10,000. Some insurers, however, let you raise the amount to cover for more expensive equipment.

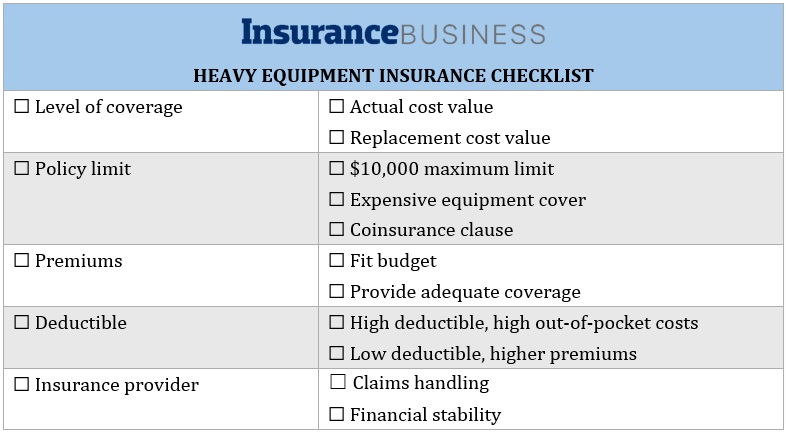

To find the right heavy equipment insurance policy, you must first understand your business’ unique needs and circumstances. Here are some of the factors you need to consider when choosing coverage.

Level of protection

Insurers often let you choose between actual cash value or replacement value coverage. While the ACV policies cost less, they may not provide the level of protection that you need. If your business operates high-value equipment that has depreciated significantly in the past few years, for example, you can benefit from purchasing an RCV policy.

Policy limit

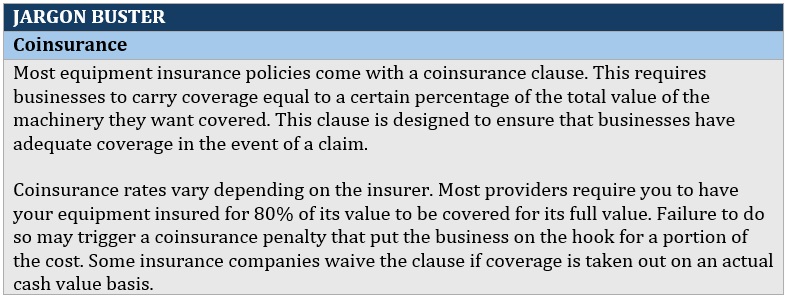

The maximum limit of your policy should be enough to cover the total value of heavy machinery. One factor to consider here are coinsurance rates. So, be sure to make an accurate assessment of the value of your equipment.

Premiums

As with every type of insurance policy, cheaper doesn’t necessarily mean better when it comes to coverage. A less expensive policy may fit your budget at first. In the long run, however, it can cost you more, especially if the policy isn’t enough to cover the damage.

Deductible

Choosing a higher deductible lowers your premiums because you’re essentially putting less risk on your insurer. But it’s important to carry an amount that you can afford to pay if an unexpected incident occurs.

Insurance company

Check out how well an insurer handles claims through online feedback and reviews. You can also ask clients or other businesses for recommendations. It also helps to check out the insurance company’s financial rating through the websites of various ratings agencies and industry bodies. A firm’s financial rating reflects its ability to pay claims.

Here’s a quick checklist of what to consider when choosing a heavy equipment insurance policy.

Getting the right coverage is just one of the steps that you need to take to keep your business protected. Your heavy equipment insurance policy must also be paired with sound risk management strategies. This involves being well-informed of the latest industry trends. You can achieve this by regularly visiting and bookmarking our Construction & Engineering Insurance News section , where you can find breaking news and the latest industry updates.

Do you think heavy equipment insurance is worth investing in? What other risk management strategies can you use to protect your machinery? Share your thoughts below.

Keep up with the latest news and events

Join our mailing list, it’s free!