InsurTech Revolution or Evolution?

The last few months of enforced locked down and remote working have forced many companies to invest in technology to continue trading in a challenging and in many ways an uncertain market.

History tells us that there are always winners and losers when the economic environment is thrown into disarray by certain situations and the Covid -19 crisis is no different. Some companies have reacted quickly and positively whilst others have been caught out by the speed of change in the market. For others who have traded remotely and invested in technology the impact has been minimal and in some instances they’ve increased sales and productivity.

I recently read an interesting book

Create the future – tactics for disruptive thinking – Jeremy Gutsche (NewYork Times best seller)

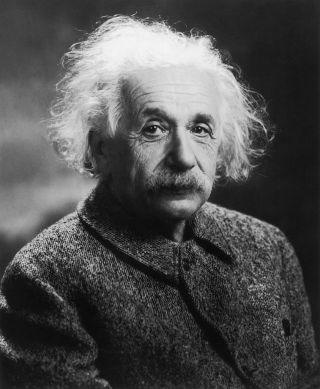

He quotes Einstein’s proposed rules of work:

‘Out of clutter, find simplicity’

‘From discord find harmony’

‘In the middle of difficulty lies opportunity’

Although the principles are dated, they are as relevant today as ever.

Jeremy Gutsche goes on to talk about companies failing to recognise the pace of change within their own industry, which can lead to disruption and for big companies this pattern of disruption can be used to create strategies for survival and for small companies this should influence your plan of attack.

These ideas and points can be related to any sector however the more I progressed through the book the more I thought about the Insurance market. The market is dominated by Global multibillion turnover companies many who have transacted in the same way for years. However in recent years we have seen a number of new entrants (Insurtechs) enter the market challenging and disrupting the way insurance products are sold and transacted including the whole process through to the settlement of a claim.

So what Is Insurtech?

According to Investopedia:

Insurtech refers to the use of technology innovations designed to squeeze out savings and efficiency from the current insurance industry model. Insurtech is a combination of the words “insurance” and “technology,” inspired by the term fintech.

The belief driving insurtech companies and investments by venture capitalists in the space is that the insurance industry is ripe for innovation and disruption. Insurtech is exploring avenues that large insurance firms have less incentive to exploit, such as offering ultra-customized policies, social insurance, and using new streams of data from Internet-enabled devices to dynamically price premiums according to observed behavior.

According to a recent Willis Towers Watson InsurTech briefing –

Total new worldwide funding commitments to the InsurTech sector in 2019 were US$6.37 billion, 33.9% of the historical total, following a record-breaking $1.99 billion of investment in 75 projects during Q4 2019,

Although Covid-19 is impacting the amount of new and potential deals in the market there is still plenty of appetite and activity in the market.

Bought by Many – £78..4m

Lemonade – $1.6b valuation

Now history tells us that not all new entrants are successful, however the way we think, trade, and transact are changing at a rapid pace and a number of InsurTechs have firmly established themselves as significant players in the market.

In today’s world, simpler, quicker, flexible contracts and transactions seem to be the order of the day combined with an increased focus on customer satisfaction and digitalisation.

Last year I interviewed several CEO’s and Claims Directors from leading Insurers and MGA’s regarding several topical issues and challenges facing the Insurance market.

One point they were all in agreement with was technology and particularly emerging technologies were going to play a significant part in the future automation of Insurance transactions and the claims process.

Waseem Malik –Executive Managing Director of Claims – AXA Insurance UK

‘Somewhere down the line, I think automation will play a big role.. And for me, it’s not about robots replacing people, it’s about how can we use it in a clever way, to free up our people to do the value-add stuff’

Colin Thompson, Founder & Group Chief Executive Officer, Nexus Underwriting Management Ltd

‘We recognise the need to lead and innovate with technology. Across the Group, we have developed pioneering platforms that facilitate efficient online quoting for the specialist products, further increasing the speed and volume of business that can be processed and underwritten.

So what does the future hold?

How will the traditional London Lloyd’s market adapt to the increasing demands of digitalisation?

From a recruitment point of view how many of the skills relied upon in the Insurance market today will become obsolete in the not too distance future?

What would happen if the likes of Google or Amazon invested heavily and committed to entering the Insurance market? (look how Uber transformed a market)

Time will tell the answers to these and other questions, however one thing that is guaranteed, InsurTechs are here to stay!

Right International is a market leading recruitment firm who specialise in sourcing the top talent across the InsurTech and wider insurance market.

If you are looking to add to your team now or in the near future or are looking for your next career move, I would welcome the opportunity to help – please contact me.

Keep healthy and safe.

All the best,

Gary Pike

Founder & MD

Right International Insurance Headhunters

At Right International our specialty is sourcing the top achievers for the Insurance and InsurTech Market. Get in touch.

Please feel free to share:

![]()

![]()