Insured H1 2024 catastrophe losses at least $61bn, 25% above average: Gallagher Re

Insured losses from natural catastrophe events around the globe are estimated to be “at least” $61 billion, which is 25% above the decadal average and reinsurance broker Gallagher Re notes that yet again US severe convective storm (SCS) events have driven the majority.

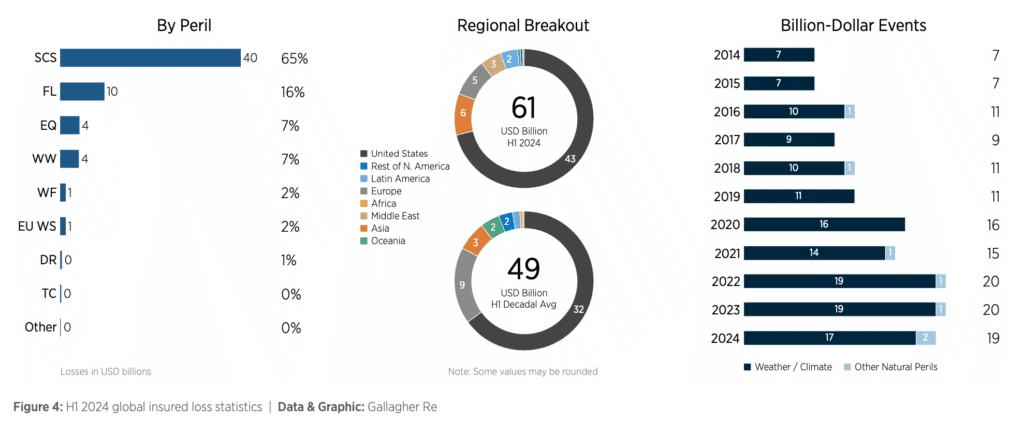

Of the $61 billion or more in global insured catastrophe losses, Gallagher Re estimates that 61% are attributed to US severe thunderstorms and SCS outbreaks.

The broker says that this amounts to “a minimum $37 billion” of the insurance industry loss from catastrophe events in the first-half coming from US SCS events.

As a result, Gallagher Re notes that the first-half of 2024 will be the second most costly US SCS H1 loss toll on-record, only falling behind the previous year’s $47 billion.

Driving home just how impactful severe convective storm (SCS) losses in the United States have become, that means the 18-month run-rate (full-year 2023 and first-half 2024) for insured SCS losses in the US is now above $100 billion.

Gallagher Re Chief Science Officer Steve Bowen explained, “There was no shortage of meaningful storylines for natural catastrophes to start 2024, but the record-setting cost of US thunderstorm activity remains an incredibly important story to tell.

“Surpassing $100 billion in insured losses within an 18-month span confirms that SCS should no longer be treated as a non-peak peril for the industry.

“This staggering sum gives emphasis to the critical importance of promoting proactive mitigation investment in this increased environment for destructive thunderstorms — before the next major disaster occurs.”

Globally, SCS was also a factor, with more losses from the peril around the world in H1. Overall, the SCS peril is estimated to have driven some 65% of global insured nat cat losses in the first-half.

Weather and climate related events drove 93% of the global H1 insured loss total, which is slightly down on the average of 95% but Gallagher Re noted that loss development could result in this being equalled or even beaten in time.

Over the first-half, Gallagher Re said there were 19 billion dollar insured loss events, just slightly below the 20 recorded in 2022 and 2023.

You can see some statistics on first-half 2024 insured catastrophe losses in the infographic below, taken from Gallagher Re’s new report:

While the first-half insured nat cat loss total of above $61 billion is down on the prior year, only due to the higher level of US SCS losses, the economic total for the globe has come in lower that average in H1 2024.

Gallagher Re explained that total H1 economic losses from natural catastrophe events around the globe were estimated at $128 billion, slightly down on the decadal average of $133 billion.

Looking ahead, Gallagher Re’s Steve Bowen said, “As we shift to the rest of the year, the transition to La Niña will not only influence Atlantic hurricanes but also bring more extreme weather volatility to various regions of the world and with it, difficult challenges to many communities around the globe.

“It’s important to note, the fundamental premise of insurance is to help people in their time of need, and the reinsurance industry is well positioned and capitalized to deliver on that need.”