Insured catastrophe losses reach $118bn in 2023, with 69% protection gap: Aon

Global catastrophe losses falling to sources of insurance and reinsurance capital reached $118 billion in 2023, according to the latest estimate to emerge from broker Aon.

Aon’s insurance industry loss estimate for 2023 catastrophes compares to a slightly higher $123 billion estimate from Gallagher Re.

In December, Swiss Re had estimated overall insured natural catastrophe losses at $100 billion.

Meanwhile, in January, reinsurance firm Munich Re said that global natural disasters and severe weather are estimated to have caused the insurance and reinsurance industry losses of US $95 billion in 2023.

Once again, the broker figures are far ahead of the reinsurance firms, as in our experience they tend to include more losses from smaller severe weather catastrophes.

According to insurance and reinsurance broker Aon, global economic losses from natural catastrophes reached $380 billion in 2023.

Which leaves a significant protection gap of 69% to the $118 billion of catastrophe losses that Aon estimates were covered by insurance.

The economic loss figure was 22 percent above the 21st Century average, Aon said, explaining that this was driven by significant earthquakes and relentless severe convective storms (SCS).

Insured catastrophe losses for 2023 were 31% above the 21st Century average and rose above $100 billion for the fourth year in a row, Aon explained.

The protection gap, at 69%, was wider than the prior year, with the earthquakes in Turkey one significant driver of this.

Aon said that the protection gap “highlights the urgency to expand insurance coverage.”

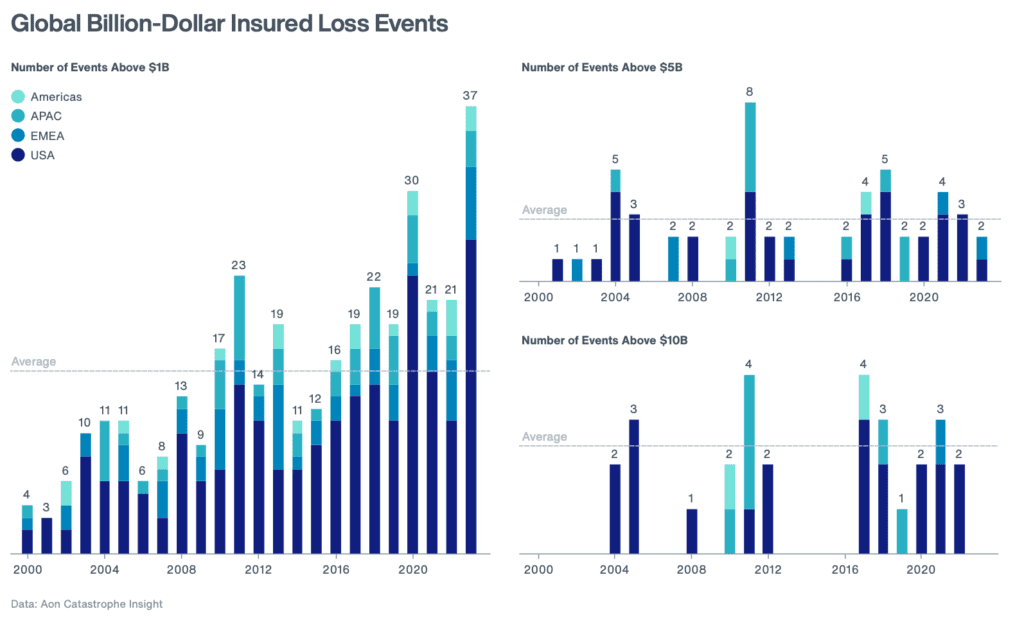

One very notable figure from Aon’s catastrophe report, is the fact that 2023 saw a record number of events causing $1 billion or more in insured losses, reaching 37, beating the previous record of 30 set in 2020.

The relentless severe convective storm (SCS) activity in the United States was a key driver of this new record, but as the graphic above shows, larger insured events were less prevalent in 2023 than in some recent years.

“Amidst increasing volatility and complexity, there is a significant opportunity for organizations to become more resilient to the climate and catastrophe risks highlighted in our report,” explained Greg Case, CEO of Aon. “By working across the private and public sector we are accelerating innovation, protecting underserved communities and better addressing the economic impacts of extreme weather to create more sustainable outcomes for businesses and communities around the world.”

Andy Marcell, CEO of Risk Capital and CEO of Reinsurance at Aon, also said, “The findings of the report highlight the need for organizations – from insurers to highly impacted sectors such as construction, agriculture and real estate – to utilize forward-looking diagnostics to help analyze climate trends and mitigate the risk, as well as protecting their own workforces. Risk managers can take advantage of increasingly sophisticated tools and leverage analytics to unlock capital and make better decisions. Equally, the insurance industry plays a critical role in improving the financial resilience of communities within their portfolios and taking the opportunity to bridge the protection gap with new and relevant products.”

“The report highlights how communities can be vulnerable to disasters in different ways. For example, earthquakes in 2023 highlighted underinsurance and the importance of regulation and enforcement of building codes,” commented Michal Lörinc, head of Catastrophe Insight at Aon. “In addition, deadly floods – notably in Libya and India – reinforce the necessity for proper maintenance of infrastructure while the Hawaii fires demonstrated the critical need for reliable warning systems and forecasting.”