Insured catastrophe losses $93bn to end of September: Gallagher Re

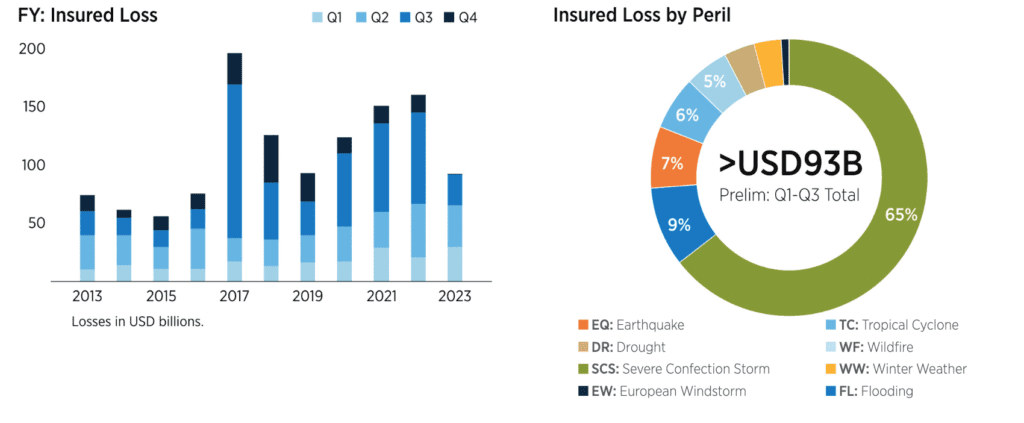

Natural catastrophe losses covered by public and private insurance or reinsurance have already reached US $93 billion by the end of September, putting 2023 on-track to be another year with over US $100 billion of insured catastrophe losses, Gallagher Re has said.

The reinsurance broker cites “record-setting weather/climate events and extreme temperatures,” which it says have elevated natural catastrophe losses around the globe.

For the period of January to September 2023, Gallagher Re estimates economic losses to have reached US $290 billion and insured losses US $93B, putting 2023 on track to become the sixth year since 2017 to exceed US $100 billion in annual insured losses.

Of those, $86 billion are from the impacts of weather and climate related catastrophe events.

Gallagher Re’s new natural catastrophe report shows that the United States accounted for 74% of all global insured losses through September.

That included 23 out of 29 one-billion-dollar natural disaster insured loss events that have occurred during the first nine months of 2023.

The dominant peril for insured natural catastrophe and weather losses remains severe convective storm (SCS), and Gallagher Re now puts SCS insured losses at more than US $60 billion year-to-date.

The United States is again the source of the majority, with some US $54 billion or more in SCS insured losses in the country this year, a figure the reinsurance broker says is “staggering”.

Steve Bowen, Chief Science Officer, Gallagher Re said, “We’ve reached the point where annual insured losses topping USD100 billion should be assumed as a new normal, and 2023 is on track to again surpass this total. The ongoing effects from a strengthening El Niño have been supercharged by the ongoing influence from climate change. 2023 has been a year marked by a plethora of new natural catastrophe records, financial losses for various perils, or highly anomalous weather and climate phenomena.”

Telling again is the size of the protection gap, especially in the United States.

Here, 68% of the economic losses were not insured, which Gallagher Re explains, “Highlights how much opportunity exists to better prepare global citizens for natural catastrophe risk. While this is most urgent in countries with emerging and developing economies, there are large gaps which exist in even the most mature insurance markets with individual perils.”

Bowen added, “The insurance industry has an important role to play in the climate change conversation but a collaborative approach with other public and private sector entities must be achieved. It remains paramount to promote further investment to protect the most vulnerable nations facing accelerated climate or natural peril risk, including more insurance frameworks to lower the wide protection gap and the construction of infrastructure capable of withstanding the climate impacts of today and tomorrow.”