Insurance marketplace: Everything your clients need to know

Insurance Business aims to shed light on this matter by answering the most common questions people have about the health insurance marketplace. This is part of our client education series. Health insurance professionals can share this article with their clients to help guide them in finding the coverage that best suits their healthcare needs.

The health insurance marketplace – also referred to as the marketplace or health insurance exchange – is a good place to start for many low-income Americans searching for affordable healthcare coverage. In most states, the marketplace is administered by the federal government through Healthcare.gov, while some states operate their own exchanges. Apart from the websites, people can shop around for and enroll in a health plan that suits their needs and budget through call centers and in-person services.

Every health insurance policy in the marketplace offers the same essential benefits, which were set by the ACA. In general, Americans can use the insurance marketplace for the following:

Comparing plans for coverage and affordability

Enrolling in a low-cost health plan

Getting answers to any questions or clarifications they may have about healthcare insurance

Finding out if they qualify for Medicaid, tax credits, or lower premiums

Parents can also enroll their kids in the Children’s Health Insurance Program (CHIP) through the marketplace, while small enterprises can access the Small Business Health Options Program (SHOP) to provide health insurance for their employees.

To be eligible to secure coverage through the health insurance marketplace, one must meet these minimum requirements:

Must reside in the US

Must be a US citizen

Must not be in prison

Healthcare.gov also notes that those who have already accessed Medicare are disqualified from enrolling in a health or dental plan from the marketplace.

Individuals can sign up for a health insurance plan during an open enrollment period, which typically runs from November 1 through January 15. But even if this period has ended, a person may still be able to secure coverage if they have experienced a qualifying life event. These events include:

Getting married

Having a baby

Losing their previous health insurance

Coverage typically begins between two and six weeks after enrollment.

Through these health insurance marketplaces, Americans can choose from a range of coverage types designed to meet different healthcare needs.

“Some types of plans restrict your provider choices or encourage you to get care from the plan’s network of doctors, hospitals, pharmacies, and other medical service providers,” according to HealthCare.gov. “Others pay a greater share of costs for providers outside the plan’s network.”

These are the four types of plans that people can access through the marketplace:

1. Health Maintenance Organization (HMO)

This type of health insurance plan often limits coverage to care from doctors who work for or are contracted with the HMO. Policies generally do not cover out-of-network care except in an emergency. Plans may likewise require that a policyholder live or work in its service area to be eligible for coverage. HMOs typically provide integrated care and focus on prevention and wellness.

2. Exclusive Provider Organization (EPO)

This is a managed care plan where services are covered only if the doctors, specialists, or hospitals are in the plan’s network – except in cases of emergency. This means that if a policyholder opts for an out-of-network provider, they will have to cover the full cost of treatment themselves.

3. Point of Service (POS)

In this kind of plan, policyholders pay less if they access doctors, hospitals, and other healthcare providers belonging to the plan’s network. POS coverage also requires the insured to get a referral from their primary care doctor for them to see a specialist.

4. Preferred Provider Organization (PPO)

This health plan allows policyholders to pay less for healthcare if they choose to get treatment from providers in the plan’s network. However, they can also access doctors, hospitals, and providers outside of the network without a referral for an additional cost.

Similarly, health plans in the insurance marketplace are also offered in four categories, also referred to as the “metal tiers,” which indicate how the costs are split between the insurer and the policyholder. These categories also do not have an impact on the quality of care a person receives.

The table below sums up how the costs are split in these metal tiers:

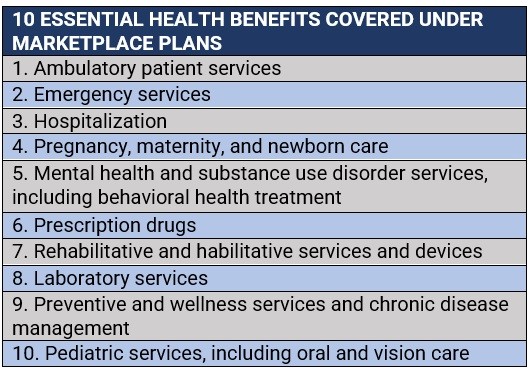

One of the changes Obamacare has implemented in the US healthcare system is the standardization of insurance plan benefits. Prior to this, the benefits offered by insurance companies varied significantly between policies. Currently, US health insurance plans in the marketplace are required to cover a list of 10 “essential health benefits” or EHBs listed in the table below.

Health insurance marketplace plans are also required to offer birth control and breastfeeding coverage. Dental and eye care coverage for adults, meanwhile, are not considered essential benefits but are available as optional add-ons, along with medical management programs.

The ACA, however, does not mandate that large company-sponsored health insurance plans to cover any of the EHBs above. The thinking was that the insurance marketplace would apply competitive pressure prompting employer health plan providers to offer these ACA-compliant benefits.

Healthcare.gov, the government’s health insurance exchange website, can be accessed in states where the marketplace is run by the federal government or jointly administered through state-federal partnership. Those with fully state-operated marketplaces have their own websites that residents can visit.

According to the consumer information website Healthinsurance.org, there are four types of marketplaces based on how these are administered. These are:

1. Federally run marketplaces

These are where the states fully rely on the federal government for their marketplaces and use the HealthCare.gov website and customer service call center. There are currently 24 states with federally administered health insurance exchanges. These are:

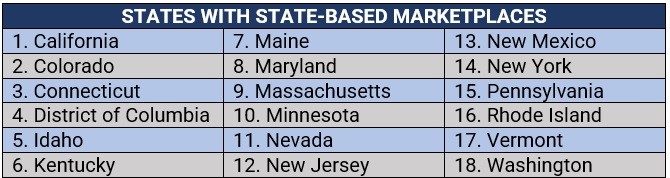

2. State-based marketplaces (SBMs)

These are where the states oversee the marketplaces and operate their own websites and call centers. Residents from these 18 states can access SBMs:

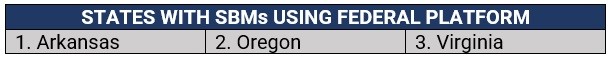

3. State-based marketplaces that use the federal platform (SBM-FP)

These are where the states administer their own marketplaces but rely on HealthCare.gov for enrollment. These states are:

Virginia, however, has already enacted a law creating a state-run marketplace that will be active by the fall of 2023.

4. State-federal partnership marketplaces

Operation is similar to that of a federally run marketplace but involves more state participation in oversight and management. These states also use HealthCare.gov for enrollment.

The open enrollment period, which typically runs from November 1 to January 15, is the only time consumers can enroll in a health insurance marketplace plan. During this period, health insurance customers can apply for a health plan online, by phone, through paper application, or with the help of a trained professional.

Some individuals may qualify for special enrollment periods, allowing them to apply for an insurance marketplace plan outside of the open enrollment, as long as they have experienced a certain life event, including marriage, having a newborn, or losing health coverage.

People, however, can access Medicaid or CHIP outside the enrollment period.

Unemployed Americans can still access affordable health plans through the marketplace, with their household size and income determining what coverage they are eligible for. However, because of their employment status, it may be hard to get an estimate of their annual income. According to Healthcare.gov, jobless individuals can base their income calculation on the following:

Unemployment compensation received from the state

Total income of the household

Additional types of income, including interest income, capital gains, and alimony

Most withdrawals from traditional individual retirement accounts (IRAs) and 401ks

For the last, the health exchange website advised individuals to check their IRS Form 8606 instructions for information on non-deductible contributions and IRS Publication 590-B for information on Roth accounts.

It also reminded policyholders to immediately update their income information with the insurance marketplace if there are income changes during the year to ensure that they get the right amount of savings.

Damian found health coverage for $0 a month with financial help.

See if you qualify for a low- or no-cost plan by exploring your plan options now. Enroll by January 15th!https://t.co/a3l91Qbp70 #GetCovered #MarketplaceOE pic.twitter.com/2kKUelQVKe

— HealthCare.gov (@HealthCareGov) December 16, 2022

Can you access a health insurance marketplace plan if you have a pre-existing condition?

Under the ACA, health insurers in the exchange are not allowed to exclude anybody from coverage because of a chronic or disabling illness or injury, or recent treatment received for a medical condition. This means a person’s pre-existing condition cannot be a basis for eligibility. All health plans must also cover treatment for pre-existing conditions from the day coverage starts.

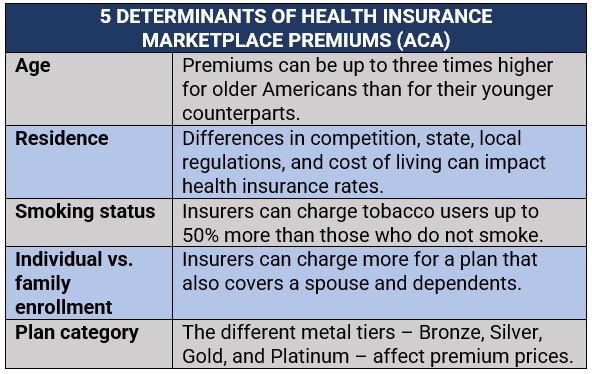

Insurance providers are likewise prohibited from using medical history and gender when calculating premiums. Obamacare has set five factors that health insurers can consider when determining premiums. These are summed up in the table below:

Self-employed Americans can access the same coverage as standard health insurance marketplace plans. These include:

Doctors’ fees

Inpatient and outpatient hospital care

Prescription drugs

Pregnancy and childbirth

Mental health services

Specific services may also vary, depending on the state where a self-employed individual is based. You can check out the top health insurance providers for self-employed Americans in our latest rankings.

Do you have questions about the health insurance marketplace that were left unanswered? Do you want to share tips and advice to those who may be searching for affordable health coverage? Type your thoughts in the comment box below.