Insurance industry must prepare for demise of non-competes, despite legal challenges to FTC rule

Insurance industry must prepare for demise of non-competes, despite legal challenges to FTC rule | Insurance Business America

Insurance News

Insurance industry must prepare for demise of non-competes, despite legal challenges to FTC rule

And how to safeguard your non-solicitation contract clauses

Insurance News

By

Mark Schoeff Jr.

It didn’t take long for the U.S. Chamber of Commerce to try to block a sweeping regulation that prohibits the use of employment clauses that prevent workers from leaving and taking jobs with competing firms.

The large business trade association filed a lawsuit on Wednesday – the day after the Federal Trade Commission approved a final rule that would eliminate the use of non-compete agreements for almost every U.S. employee.

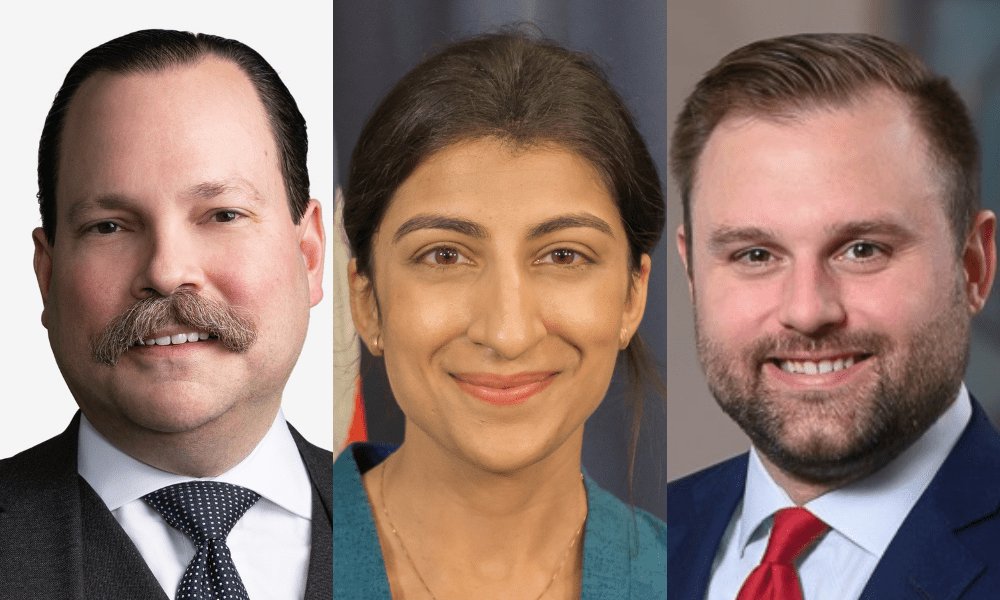

But insurers and insurance brokerages should not be lulled to sleep by the Chamber’s and other legal challenges that are certain to emerge, said Matt Prewitt (pictured above, left), a partner at ArentFox Schiff. They need to start preparing for the profound changes in business practices that the rule will usher in.

“They may take their eye off the ball and think ‘problem solved’” by the legal action to scuttle the regulation, Prewitt said. “That’s probably the worst thing they can do in this climate.”

Prewitt points to the split FTC vote, 3-2, on the 570-page final rule. The three Democratic commissioners were in favor, saying it’s needed to protect workers and promote competition. The Republican commissioners asserted the FTC exceeded its authority in issuing the rule.

But there was no praise for non-competes at the FTC open meeting on Tuesday.

“Nobody gave a full-throated, aggressive defense of non-compete agreements,” Prewitt said. “Employers need to recognize the FTC’s action, even though it may exceed constitutional authority, is part of a broader trend against the enforcement of non-compete agreements.”

FTC touts freedom to pursue a new job

The FTC said approximately 30 million U.S. workers are subject to non-compete agreements. The final rule would:

Make unenforceable existing non-competes for most employees.

Ban non-competes for senior executives, or those making more than about $151,000, after the effective date of the rule, which is 120 days from when it’s published in the Federal Register.

Allow existing non-competes for senior executives to remain in effect.

The FTC said non-compete reform would result in an annual $524 increase in earnings for the average worker and spur the creation of 8,500 new businesses each year.

“The FTC’s final rule to ban non-competes will ensure Americans have the freedom to pursue a new job, start a new business or bring a new idea to market,” FTC Chair Lina Khan (pictured above, center) said in a statement.

Businesses have turned to non-compete clauses in employment contracts as a way to protect trade secrets and other proprietary information. The FTC rule will close off that option.

“There’s more skepticism about non-compete agreements,” said Kevin Paule (pictured above, right), an attorney with Hill Ward Henderson. “In the long-term, businesses should think about whether there are other ways they can protect their assets.”

Rule doesn’t ban, but could affect non-solicitation clauses

The FTC suggested that the goal of protecting proprietary business information can be met through trade-secret laws and non-disclosure agreements.

The FTC rule does not ban non-solicitation agreements, where employees are free to work at a competing firm but restricted in taking customers or clients with them.

“The thing that I really need to protect is the book of business, and the non-solicit is a lot more important” than a non-compete, said Rich Eknoian (pictured immediately above), CEO of World Insurance Associates. “If you told me that people could leave and then start taking their clients, then I’d say, well, that’s a real value killer. But people being able to leave and work somewhere else, honestly, that doesn’t sound terrible to me.”

Even though the FTC rule doesn’t ban non-solicitation agreements, Eknoian and others may still have to review the scope of their non-solicits. The FTC rule says that employment agreements that are so broad that they effectively become non-competes are prohibited.

Influencing team movements

Whether a non-solicit is a de facto non-compete depends on its parameters, Prewitt said.

“You’ve got to make sure when you’re drafting your non-solicit covenant…that there’s a clear path for an employee to understand what is the right way to exit,” Prewitt said.

The fact that the FTC rule doesn’t explicitly address non-solicits could have an effect on teams of brokers leaving one firm for another.

“An employer may continue to prevent a former employee from soliciting or ‘poaching’ former employees,” Paule said. “Employees and teams will be allowed to move, but there may be litigation regarding the basis for the movement and whether improper solicitation occurred.”

Allowing non-competes in business sales

In one of the biggest changes the FTC made to the final rule, it will allow non-competes to be used in the context of the sale of a business. The original proposal in January 2023 said that a seller had to own at least 25% of a business to be subject to a non-compete. The final rule removes that threshold.

“The fact that they took that out is certainly positive for sales transactions,” said Jim Witz (pictured immediately above), a shareholder at Littler Mendelson. “It would have made sales more difficult if companies were not able to protect their investment in the company they’re purchasing through a non-compete.”

That was a bright spot in the final rule for businesses. But Witz also cautions that they can’t count on the whole thing being eliminated even though legal challenges have created much uncertainty around the regulation.

“Employers have to prepare as if the rule is going to survive – at least pending a possible injunction staying enforcement,” Witz said.

Potential ‘game-changer’ requires new strategy

The FTC rule is “potentially game-changing” for businesses because they have relied on non-competes for decades to protect their propriety information, Prewitt said. Now they must think of ways to make employees want to stay, such as compensation incentives.

“They need a broader strategy beyond non-compete agreements,” Prewitt said. “That strategy needs to include trade secret protection policies, confidentiality agreements and employee-retention [practices] that are more carrot and less stick.”

Eknoian said he’s ready for a world without non-competes.

“I love the status quo, we’re doing really well, but if change comes about, you only have one choice, and that’s to figure it out and be better in the new environment than anyone else,’ he said. “We’re gonna roll up our sleeves and figure it out.”

Jen Frost contributed to this story.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!