Insurance adjuster courses: where to take in-person training

Insurance adjuster courses: where to take in-person training | Insurance Business America

Guides

Insurance adjuster courses: where to take in-person training

There are plenty of options if you want to take an insurance adjuster course in person. Here are our picks for the top training providers

Adjusters play a key role in the insurance process. They are responsible for assessing and investigating claims to find out if an insurer should pay for the damage and by how much. That’s why extensive training is required if you want to be one.

If you want to pursue a career as an insurance adjuster, there’s no shortage of training providers to choose from. Depending on your learning style, taking in-person classes may be better than self-directed online courses.

To help you with your search, we’ll list the 10 best places to take an in-person insurance adjuster course. We’ll discuss the different classes available, how long the courses last, and how much they cost. Read on and take your pick from our list of insurance adjuster training providers.

If you retain information better through face-to-face collaboration, the best way to take an insurance adjuster course is by joining an in-person class. To come up with the list, Insurance Business reviewed dozens of providers to find out the ones offering classroom training. Most of these providers also offer online courses. The list is arranged alphabetically.

1. AAA Training Unlimited

AAA Training Unlimited offers Texas all lines and property and casualty (P&C) adjuster pre-licensing courses both online and in person. If you choose face-to-face training, you will need to attend at least 90% of the 30 hours of classes before you can take the completion exam.

If you’re attending the live three-day adjuster class, you will need to complete the required 10 hours of pre-study. The course fee is $325.

You can also take the Xactimate software training, which is equivalent to 16 credit hours of continuing education. The course runs for two days in Irving, Texas and isn’t available online. It costs $325 but if purchased with a pre-licensing insurance adjuster course, the price is $575.

Insurance adjuster course – what is Xactimate

2. AB Training Center

Agent Broker Training Center offers mostly online classes, but in-person insurance adjuster courses are available in some states. It provides pre-licensing courses for those wanting to be an all lines, P&C, or workers’ compensation adjuster. The courses are available in all 34 licensing states. We will talk about these states in a later section.

Course fees for in-person classes are not readily available on AB Training Center’s website. It’s best for you to contact the company directly to get more information on their insurance adjuster course.

3. Claims Adjuster Academy

Claims Adjuster Academy offers pre-licensing, Xactimate, and continuing education courses both online and in person. For online classes, the fees range from $69 to $295 for single courses, while bundles cost $450. Live classroom training costs $395 and covers a range of topics.

You can access the calendar for in-person classes on the company’s website, but you will need to register. Subscription is free. Claims Adjuster Academy has already catered to more than 4,500 students.

4. Claims Adjuster Training Institute

The Claims Adjuster Training Institute (CATI) has training facilities in Irving and Dallas, Texas where it holds in-person classes. It boasts a comprehensive lineup of insurance adjuster courses, from pre-licensing to continuing education.

The courses are diverse, that’s why it’s hard to get an average pricing. CATI’s Texas all-lines pre-licensing course, for example, costs $399. The Xactimate skill lab is priced at $499. You can view the full schedule of classes on the events calendar page on the institute’s website.

CATI also holds partnerships with several hotel chains in the area. If you live far away, you can get lodging and shuttle discounts courtesy of the institute.

5. Insurance Adjuster Now

Insurance Adjuster Now (IAN) offers a range of courses that will train you to handle various claims. These include large losses from hurricanes, hail, fire, and other disasters. The group consists of trainers with decades of claims handling experience.

Many of IAN’s courses are hands-on and held face-to-face. One of its popular offerings is the bootcamp training. This four-day insurance adjuster course prepares students for catastrophe deployment. The topics covered include customer service, scoping techniques, and mock inspections. The course is open for licensed adjusters with Xactimate training. The course fee is $550.

6. Mile High Adjusters

Mile High Adjusters provides in-person training in Texas and New Jersey. You can take the company’s two-week insurance adjuster course to help you get a Texas all-lines adjuster license. The course consists of:

4 days of pre-licensing classes, which ends with you taking the Texas insurance license exam

1 day of scoping

3 days of Xactimate training

5 days of boot camp

You can also take these courses separately. These are priced at $599, $197, $499, and $595, respectively. The two-week course costs $1,590.

Mile High Adjusters also offers a three-day file review course for file reviewers, desk adjusters, and examiners who may or may not write estimates. The course fee is $395.

7. MOCAT Adjusters

MOCAT offers a full range of courses for those who want to become an insurance adjuster. Its hands-on adjuster training course consists of four parts:

Practical policy: comprehensive training to earn you a Texas adjuster license

Claims management: discusses organization and scheduling

Scoping damage: covers identification, investigation, and documentation

Estimatics: Xactimate training

Enrollees have access to:

weekly coaching calls

MOCAT IA firm connections

the Claimstacker portal for one year

MOCAT Certification

The classes are held in Nixa, Missouri. The course fee is $2,995.

8. The Adjuster Guy

The Adjuster Guy (TAG) provides online and in-person training for the Texas all-lines adjuster license. It offers the Licensing Basics and LicensingPlus in-person training for $699 and $1,299, respectively. The classes are held in the Dallas-Fort Worth and Stephenville, Texas areas. They are conducted by independent adjusters with decades of industry experience.

Both courses run for 40 hours and ends with the taking of the state licensure exam. The main difference is that LicensingPlus includes a three-day hands-on training and membership to the TAG private community.

9. The Adjuster School

The Adjuster School (TAS) offers an in-person insurance adjuster course leading to a Texas all-lines license. It consists of a pre-licensing course at $349 and Xactimate certification preparation at $400. The claims adjuster mastery evaluation is conducted online and costs $150. The classes are held in Irving for the Dallas area and Katy for the Houston area.

Registrations are on a first-come-first-served basis and can be done through TAS’ website. Walk-in enrollees are not allowed.

10. Veteran Adjusting School

The Veteran Adjusting School (VAS) offers a six-week vocational training program preparing students to become professional insurance adjusters. The course consists of 230 hours of hands-on classroom and field training on its campus in Sedona, Arizona.

The tuition fees are not readily available on the school’s website. It does mention, however, that the fees include tools such as:

tape measure

putty knife

laser measure

siding tool

clipboard with grid

multitool

chalk

compass

gauges

Students also get a laptop with a yearlong subscription to Xactimate.

VAS also provides job placement assistance and support in the first few deployments.

Why get a Texas all-lines adjuster license?

Texas has reciprocal agreements with almost all licensing states. This means you don’t need to take these states licensure exams to practice there. Texas also allows adjusters of non-licensing states to declare Texas as their residence.

An all-lines adjuster license gives you the authority to handle all types of claims. These can include home, auto, workers’ compensation, and man-made and natural disasters.

Insurance adjusters, also known as claims adjusters, assess and investigate claims to determine how much an insurance company should pay, if they should pay at all. The Bureau of Labor Statistics (BLS) lists the following as the main duties and responsibilities of an insurance adjuster:

evaluates and investigates insurance claims

determines if the policy covers the loss

ensures that claims are not fraudulent

contacts relevant parties to get additional details for questionable claims

talks with legal counsel about claims, if needed

negotiates settlements

authorizes payments

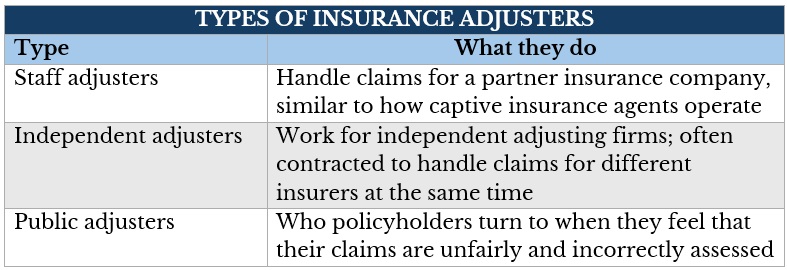

There are three general types of insurance adjusters:

If you want to become an insurance adjuster, you need to meet these requirements:

Basic eligibility criteria

You must be at least 18 years old and pass a criminal background check. You must also have a valid driver’s license and maintain a good driving record.

Pre-licensing education

You must complete 40 hours of pre-licensing coursework to prepare for the state licensure exam. This covers a range of subjects, including insurance products, regulations, laws, and ethics. You can take an insurance adjuster course either online or in a classroom.

Licensure exam

You must get at least 70% of your answers right to pass the state adjuster licensure exam. The test consists of 150 items and lasts from two to three hours.

Claims adjuster license application

After passing the test, you can apply for a license at your state’s insurance regulation department. You will be asked to provide proof of pre-licensing education and pay a fee. The fee varies by state. Applications are typically processed within a business day, after which you can get your adjuster license.

Continuing education

You must complete 24 hours of continuing education every two years to keep your license. CE courses cover a range of topics, including industry trends and new regulations. These can be taken online or in-person.

Each state also has different licensing criteria for claims adjusters. We have compiled the requirements for each licensing state below.

If your state is not listed above, then it’s one of the non-licensing states. You don’t have to get a license to practice as an insurance adjuster in these states. You may want to consider getting one if you intend to handle claims in other states.

Not all states require claims adjusters to get a license, but most do. Many independent adjusting firms in non-licensing states also prefer licensed candidates. This is because the job involves being assigned to different locations across the US.

Getting an insurance adjuster license can take a few to several weeks. You will also be required to finish a pre-licensing course, pass the licensure exam, and complete a background check.

Once you pass the test, you will need to formally submit your license application and pay the corresponding fees. You will also need to complete certain hours of continuing education to keep your license.

What do you think of our picks for the top insurance adjuster course providers? Is it better to take the courses in person or online? Let us know in the comments.

Keep up with the latest news and events

Join our mailing list, it’s free!