Inspiring Female Leaders in Insurance in Asia-Pacific | Elite Women

Jump to winners | Jump to methodology

Champions of change

Insurance Business’ Elite Women 2025 are recognised for their outstanding achievements and industry contributions over the past 12 months. The IB team selected 71 deserving winners after a rigorous assessment that considered the nominees’ leadership impact, influence, innovation and commitment to drive progress and societal wellbeing.

However, the challenges faced by women in the industry are clear and underline the achievements of 2025’s Elite Women even more.

For example, Australia’s Workplace Gender Equality Agency’s data for Financial and Insurance Services shows that men make up the minority of the total workforce but are the majority in the upper and upper-middle pay quartiles.

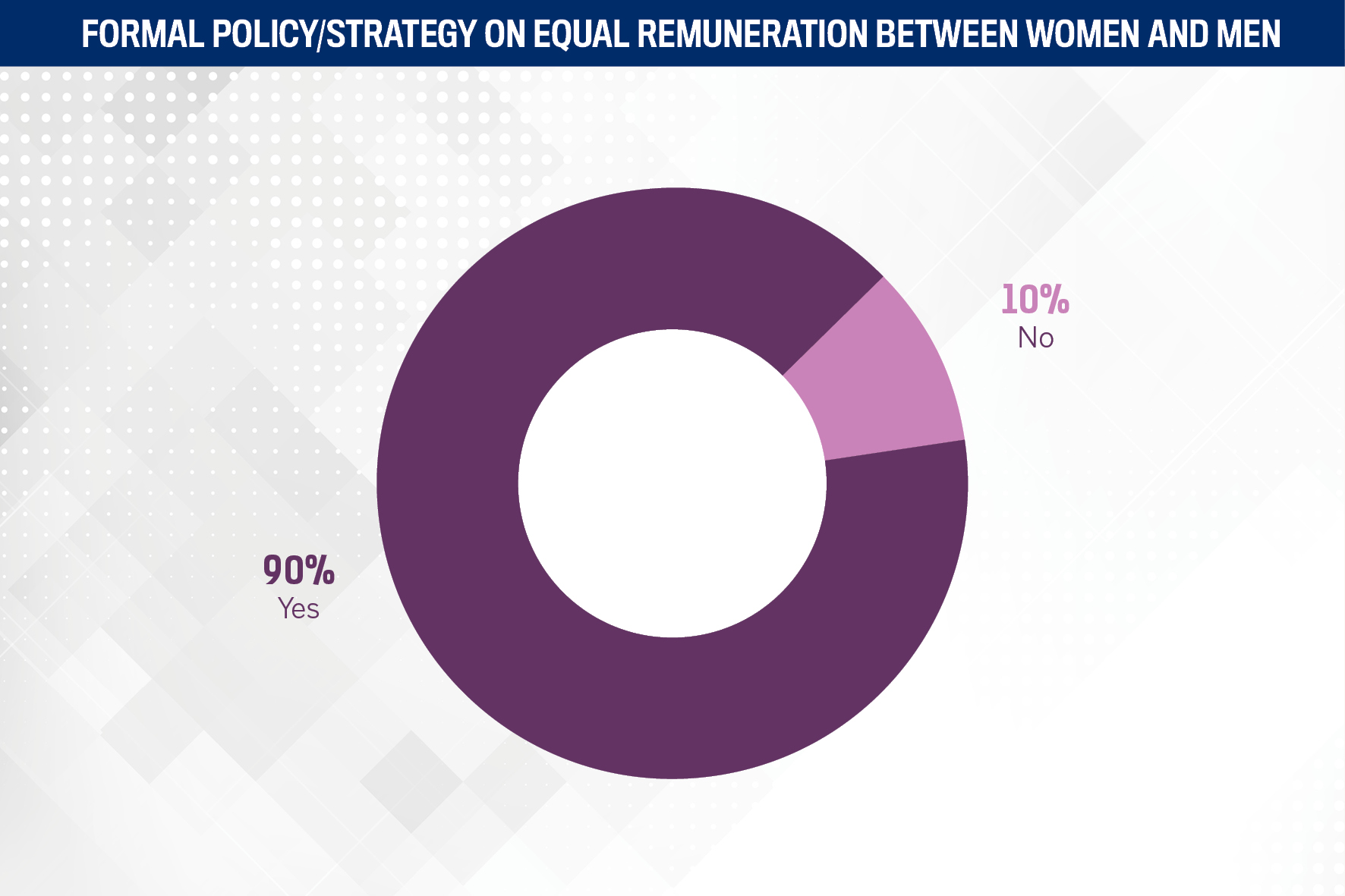

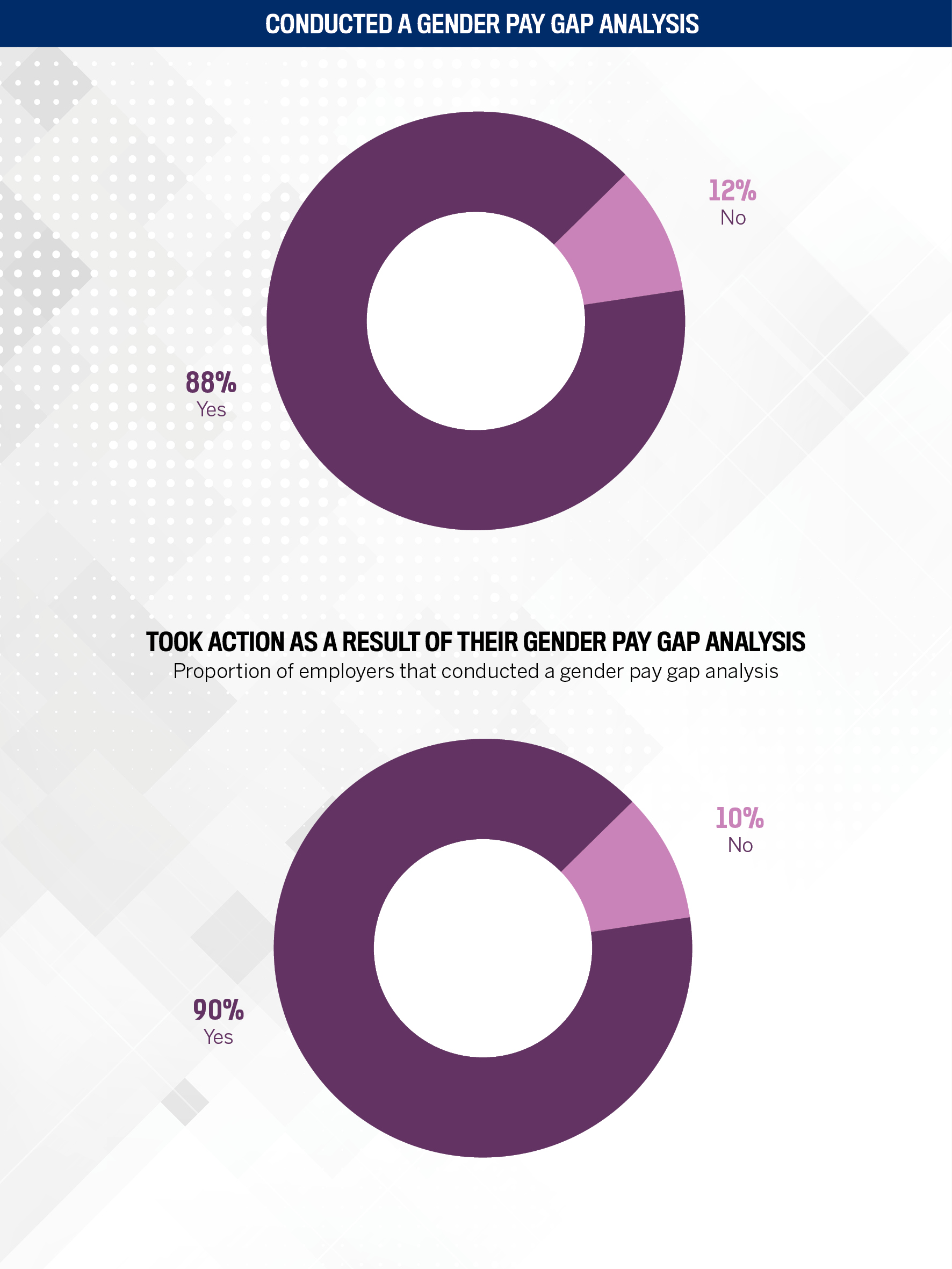

While further insight reveals that while most organisations in financial and insurance services have a policy on equal renumeration, there are 10% who don’t, 12% have never conducted a gender pay analysis and 10% of employers took no action based on their gender pay analysis.

Similarly in New Zealand, the gender pay gap in the financial and insurance services sector was 29.3% as of June 2024 according to Ministry for Women data, reflecting significant disparities in pay between men and women, particularly considering the national gender pay gap was 8.2%.

The Financial Services Council NZ stated, “The gap isn’t merely a number; it reflects systemic barriers, unconscious bias and inequities in the workplace.”

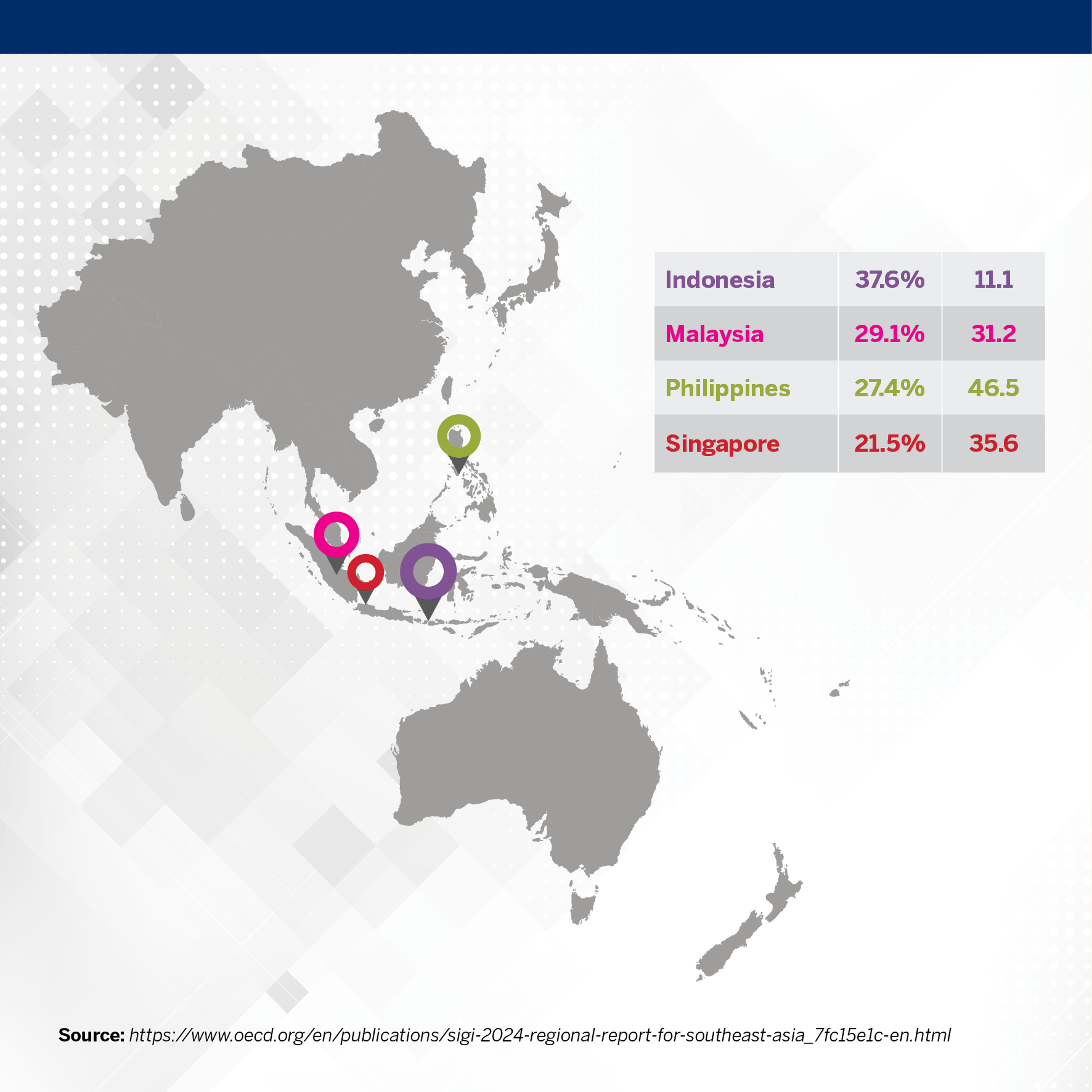

The OCED’s 2024 report for Social Institutions and Gender Index (SIGI) for Southeast Asia asked respondents across the region a series of questions, including:

share of the population that agrees or strongly agrees that “if a woman earns more than her husband, it is a problem”

share of the population that agrees or strongly agrees that “when a mother works for pay, the children will suffer”

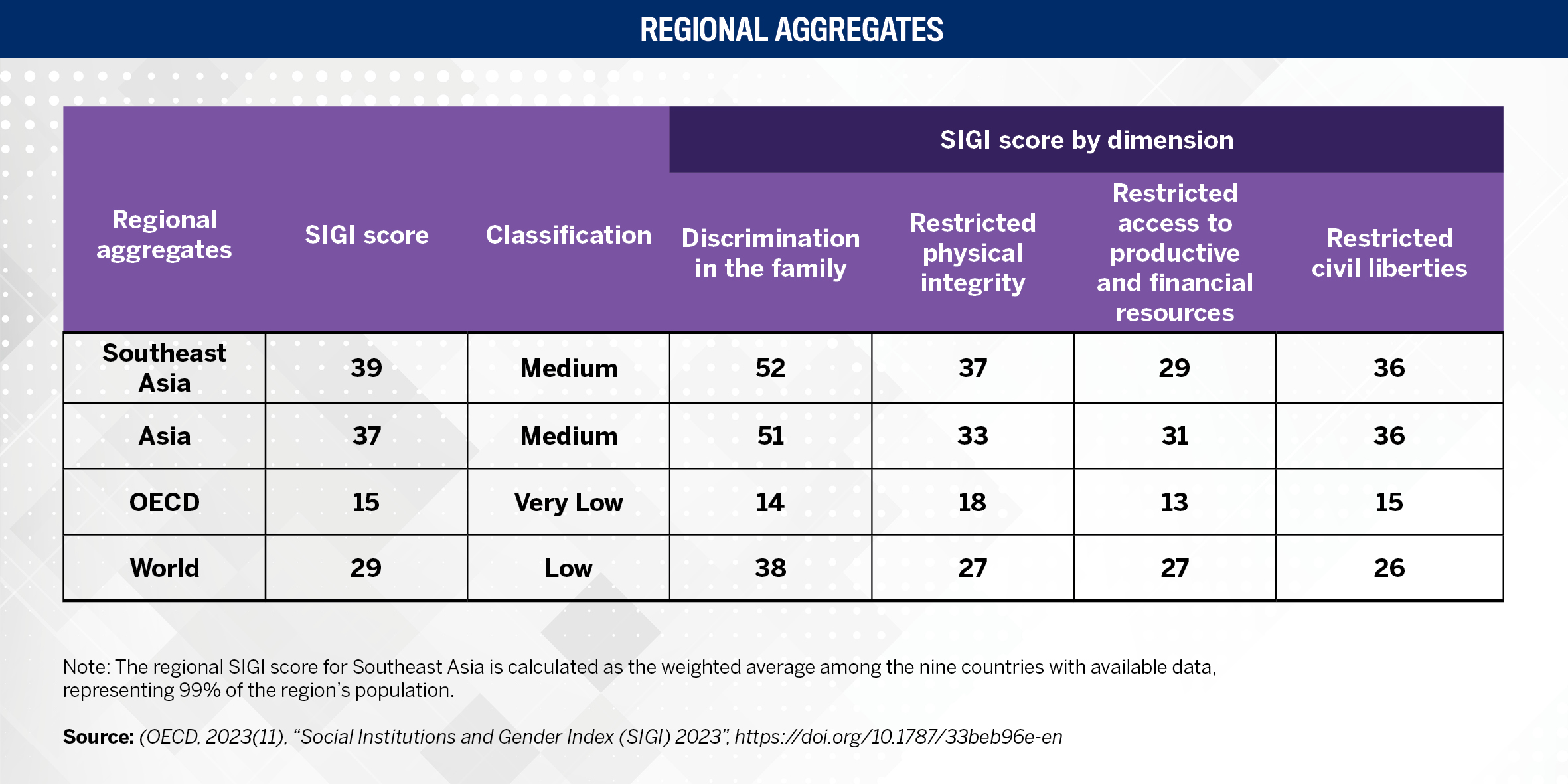

The SIGI is a composite index measuring discriminatory social institutions, and its data also showed that Asia performs worse in comparison to the OECD and the world, again hindering women’s ability to pursue a career.

Determination and belief behind success

Five consistent factors define 2025’s Elite Women as female industry leaders across the Asia-Pacific region, demonstrating a blend of strength, leadership and the ability to create meaningful change:

ability to overcome challenges, stay calm under pressure and persist through setbacks

commitment to guiding, supporting and uplifting colleagues, especially women and emerging leaders

acting with honesty, transparency and accountability in all professional interactions

ability to connect with people on a deep level, build trust and foster teamwork

seeing the bigger picture, making informed decisions and driving industry progress

These attributes are illustrated by industry respondents’ comments to IB about what makes a woman of influence in the region’s insurance sector in 2025:

“A force to be reckoned with. She carefully picks her battles, stands up for herself and the women in her circle and is an example to other women for what can be accomplished”

“Drives positive change, empowers others and leads with integrity, vision and determination”

“Uses their position and expertise to lift the bar for everyone”

“Champions change and innovation, daring to question the status quo and push for progress even when it’s uncomfortable”

“Strong self-confidence and belief, empowering her to take risks and pursue goals fearlessly. With dedication and resilience, she perseveres through challenges, staying committed to her ambitions”

IB’s own data reaffirms that while progress has been made in equal pay and gender representation, these statistics show that equality in leadership is a work in progress. Women continue to face structural barriers to advancement, and meaningful change demands industry-wide commitment to breaking down systemic challenges.

Bold vision drives Asia-Pacific’s most inspiring female leaders

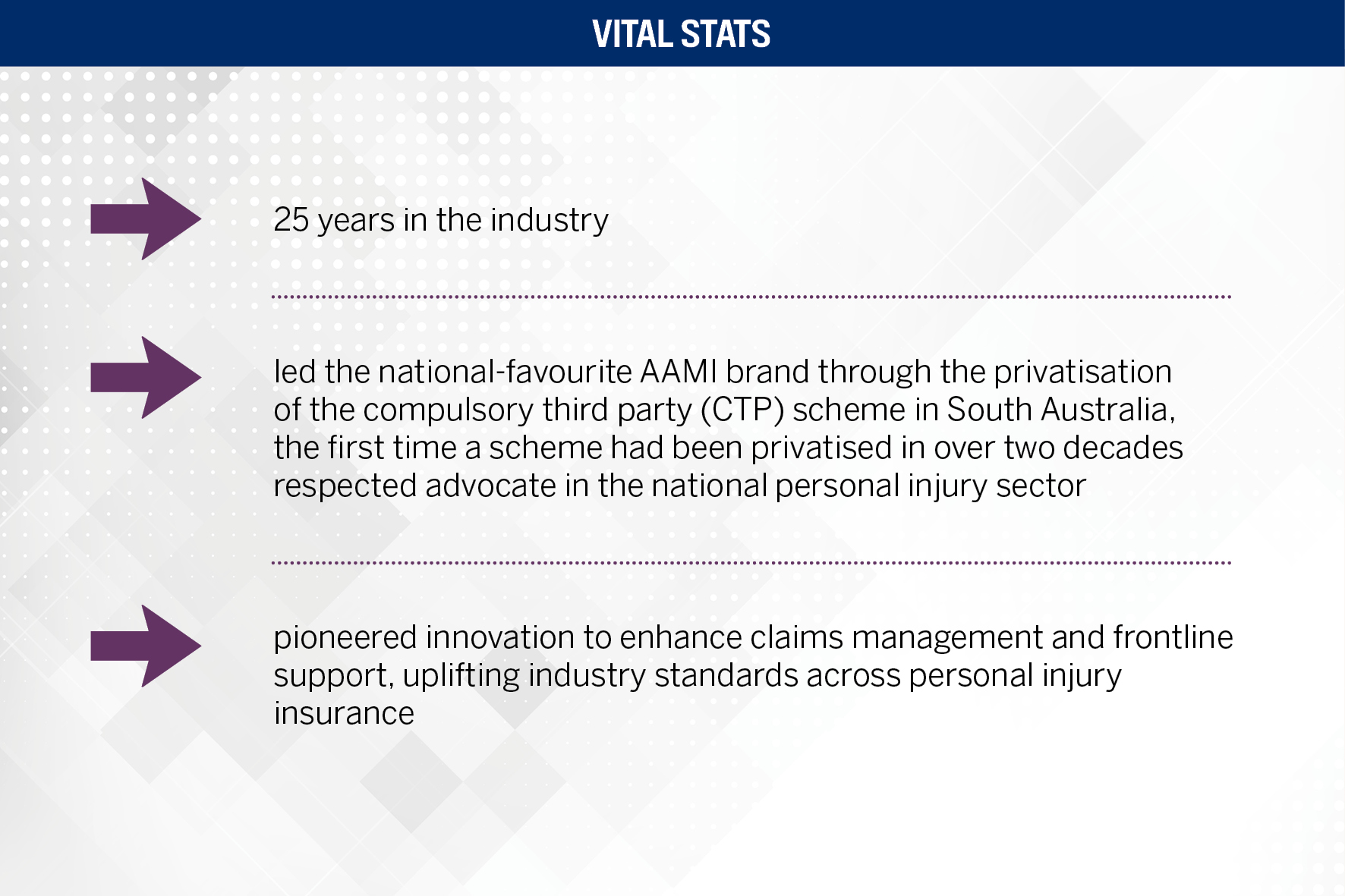

The executive general manager has seen firsthand that success isn’t just about strategy and execution; it’s about people. Tsolis is an ardent believer that strong businesses are built on strong people, and the greatest impact comes from unlocking their potential.

“What I find most rewarding is investing in talent, developing high-performing teams and creating environments where people can thrive,” she says. “Whether mentoring emerging leaders, driving improvements in business performance or championing better customer outcomes, my passion lies in empowering those around me.”

Her career journey began in 1998 with the Promina Group, where she developed a deep appreciation for strategic business management and its impact on long-term success.

Through her early experiences, she gained valuable insights into how effective decision-making, operational efficiency and customer-centric strategies contribute to sustainable growth. This foundation shaped her approach to leadership, fostering a keen ability to navigate complex business environments while driving continuous improvement and innovation.

Tsolis advocated for customer-centric improvements across the personal injury business, prioritising service excellence and claims efficiency, earning recognition at the Australian Service Excellence Awards, presented by the Customer Service Institute of Australia in 2022:

With her success in South Australia, she took what she had learned in CTP insurance and used it as the basis to influence significant change strategically across the broader personal injury business.

“Never underestimate emotional intelligence. Women lead best by embracing their unique strengths, not conforming to tradition”

Allicia TsolisSuncorp

She prioritised a people-first strategy, embedding diversity, learning and development and a strong employee value proposition at the core of her business. By fostering a workplace that values growth and empowers individuals, she ensured that customer service remained central to everything.

Her commitment to excellence was reflected in her dedication to delivering a best-in-class claims experience, supporting both the community and the personal injury industry with empathy, efficiency and innovation.

More recently, Tsolis has advocated for driving operational efficiency and excellence using AI, reinforcing the brand’s position as an industry leader.

Insurance is an industry where knowledge, execution and leadership matter, so Tsolis has prioritised sharpening her abilities, building a strong network and remaining fearless in her ambition.

She says, “Breaking barriers isn’t about simply navigating the status quo; it’s about redefining it. I am focused on driving thought leadership and influencing and advocating for positive outcomes. I continue to build on my success and the teams around me by encouraging diverse thinking in the workplace.”

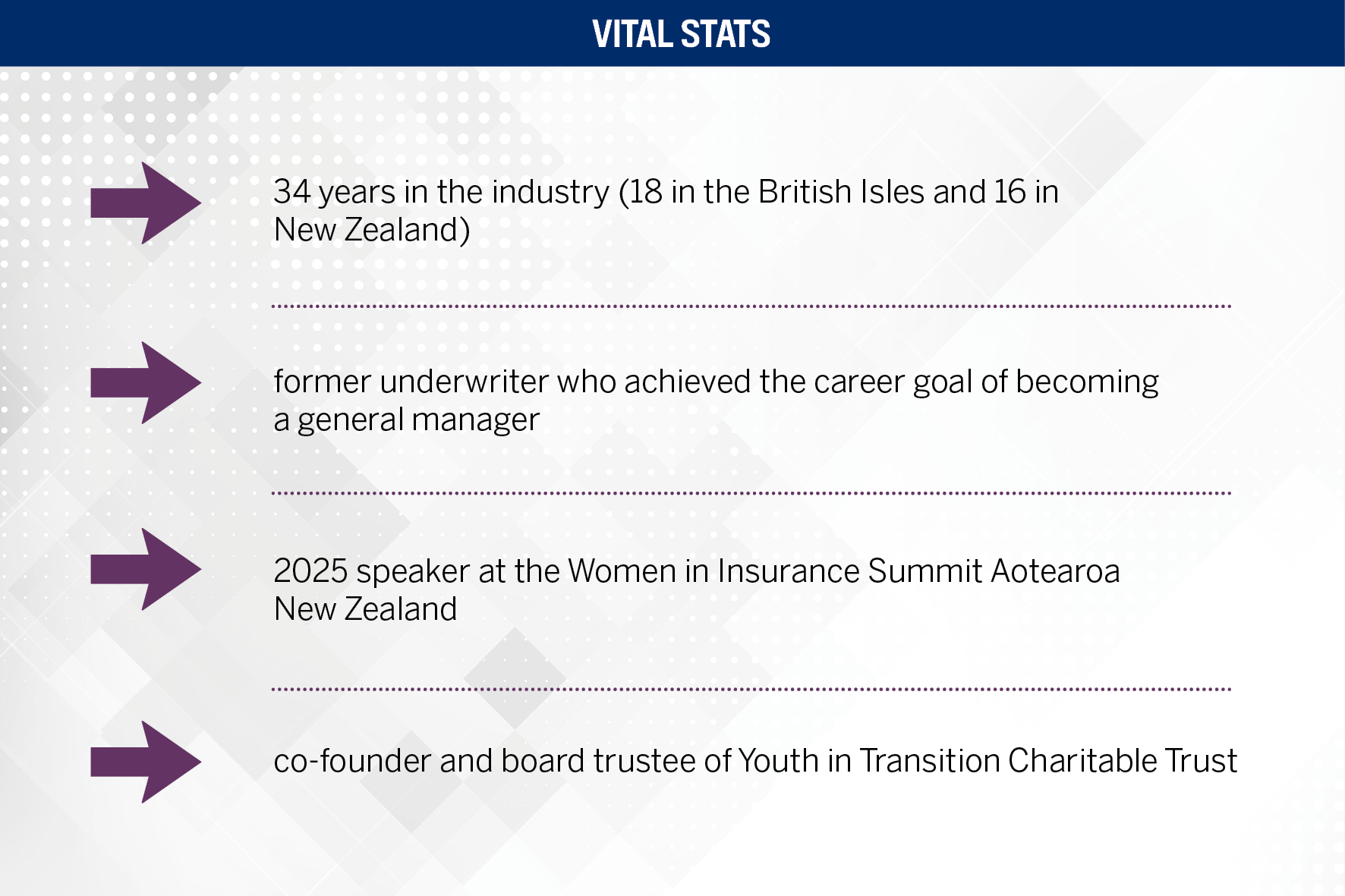

As a self-described competitive person, the general manager of partnerships and facilities receives an adrenaline rush when achieving her goals and targets.

After settling in Auckland in 2002 following almost two decades in the British Isles, Windsor knew she had to upskill quickly to learn the country’s insurance regulations and nuances, such as the difference in employers’ liability.

Within less than two years of joining the industry, she was invited to join a key national partner relationship management team comprised of well-connected, experienced professionals at her former employer, Lumley Insurance.

“I’m proud to have been welcomed into that team because I’d been working hard on getting to know people and trying to master some of the relationship skills I learned from the team leaders,” Windsor says.

The former underwriter at an insurer and later national manager at Rothbury secured her current role with the brokerage in late 2021 after competing against some experienced professionals. The achievement filled her with pride as one of her goals was to move up the ranks to a general manager role, where she has excelled at driving new business growth in specialist schemes and facilities.

“If you don’t know something, admit it. Have integrity, and rather than making something up, say you’ll find out and follow up. That earns far more respect than pretending to know the answer”

Brigitte WindsorRothbury Insurance Brokers

Windsor says, “The people are the most rewarding part of this industry. They are incredibly supportive, helpful and encouraging, and I like to ask a lot of questions. They are always open to answering them.”

That same openness fuels her enthusiasm for the industry’s fast pace and need for continuous learning. Her passion for communication has also translated into a love of public speaking, a skill she had developed through training.

As a dedicated champion of educating companies and associations about insurance’s important role in supporting communities, she remains focused on helping clients secure their financial future and rebuild after disasters.

As a financial adviser/business owner, McCartney helps clients pay off their mortgages faster while ensuring financial security. She believes that borrowing money requires protecting one’s ability to pay and has integrated insurance as a crucial part of the process.

Early in her career with a lender, she found it dismaying when advisers treated insurance as a checkbox, offering clients limited coverage options with minimal discussion. After opening her business, she pursued the holistic side of insurance, which sparked a passion for deeper learning and a commitment to educating herself and clients.

Over the past 20 years, McCartney has dedicated her career to providing high-quality, personalised advice that ensures clients have the correct cover for themselves and their families, safeguarding their financial future from unexpected events.

“When it comes to insurance, I’ve always been about the claims,” she says. “I don’t just educate my clients about their coverage; I also manage all of their claims. That’s been key to my development and trust in the industry.”

“We need to see our own value. It’s crucial that women don’t see themselves as less competent. If we don’t recognise our worth, we risk falling behind”

Emm McCartneyNZHL Canterbury Metro

McCartney describes reaching $9 million in claims paid to her clients as a “massive milestone” and the biggest highlight of her career.

She says, “I know that money has fundamentally changed people’s lives. Without that, I don’t even want to imagine what life would be like for them. I get goosebumps thinking about it.”

With a clientele of roughly 1,000 and growing, McCartney willingly springs into action when her phone rings on the weekend, knowing the news will likely not be good.

“It’s the worst time in someone’s life, but I know I’ve looked after them,” she says. “When that payment is made, when they sign the last form and the money goes into their account, I know I’ve done right by them.”

Building an advice business and career can be a challenging journey, but as her nominator noted to IB, she has navigated this superbly, embracing regulatory change and adapting her business as new processes and technologies demand it.

McCartney says, “Standing together and supporting each other makes us stronger. Some women enter this industry and feel intimidated by their surroundings. That’s why we need to educate ourselves, become experts and never doubt our abilities.”

After nearly three decades in the industry, the general manager of workers’ compensation finds nothing more rewarding than reconnecting with former professionals she has mentored, helping them confidently advance through the ranks.

Throughout her career in the workers’ compensation industry, including 16 years of management experience at QBE Insurance, Sutton has built a vast network of like-minded professionals within the personal injury sector.

“Seeing people grow and flourish in the industry just warms my heart,” Sutton says. “They still come back to check in with me, and whenever we catch up, they have a big grin on their face. Whenever we talk about those early days or any part of the journey I was involved in, they always smile and express their appreciation.”

As her leadership style matured, developing and empowering others has become second nature.

“When challenges arise, don’t carry the burden alone. Brainstorming and bouncing ideas off others makes any problem more manageable. Having a trusted circle you can debrief with is invaluable”

Tracy SuttonWarren Saunders Insurance Brokers

She says, “You can’t be successful alone. As you progress in leadership, the more responsibility you take on, the more you rely on the people around you. It’s not about having all the answers yourself; it’s about having the right team in place, empowering them and ensuring you’re all working towards the same goal.”

Sutton believes that titles don’t define people, and it can be easy to feel intimidated by seniority.

“If you treat people with respect and professionalism, you’ll be able to have meaningful conversations with anyone, whether they’re a CEO, director or entry-level employee,” she says.

Across her seven years with Warren Saunders Insurance Brokers, she has driven several modernisation projects and initiatives, including:

implementing a new claims management solution to improve performance and satisfaction

overhauling workflow management and processes that had been in place for over a decade, delivering more efficient and reliable outcomes within 12 months

Lessons for the next generation

Succeeding in a traditionally male-dominated industry comes with challenges, from proving your expertise more than your peers along with navigating unconscious bias to ensure your voice is heard.

Rather than seeing these as barriers, Tsolis approached them as opportunities to lead with impact. Three key strategies have been instrumental in her journey:

Owning your expertise: “In environments where credibility isn’t always assumed, you have to make it undeniable. I’ve focused on mastering my craft, driving strategic outcomes and ensuring that my voice is backed by insight and execution. When you consistently deliver results, recognition and influence follow”

Shaping the conversation: “It’s not enough to have a seat at the table; you have to shape the discussions that drive change. I’ve been deliberate about positioning myself as a strategic thinker, challenging outdated perspectives and ensuring that business decisions reflect commercial success and long-term industry evolution”

Lifting as you climb: “To thrive in this industry, you must break barriers and open doors for others. I’ve prioritised mentoring and sponsoring emerging talent, advocating for diverse leadership and fostering a culture where people feel empowered to lead authentically”

To stand out and succeed, Windsor has honed these approaches:

Knowledge and education: “I had to be prepared. I needed to understand the products, the industry and how business was done”

Respect: “I had to prove that I knew my subject matter. You have to demonstrate that you are professional, qualified, experienced and capable of adding value. I also learned when to listen and when to speak, giving people the respect they deserve by genuinely listening to them”

Two key priorities stand out for McCartney:

Continuous learning: “I went to the Million Dollar Round Table (MDRT) global conference in Dubai in 2024, attended by professionals from Asia. I was shocked at how many young women were there. In New Zealand, the insurance industry is still dominated by men, but I saw that shift happening”

Education: “Education is everything. Numbers never lie, and the more I educate myself, the stronger my claims knowledge. That’s what defines me in this industry”

Heart: “I believe women have a natural advantage in this industry because we lead with heart and emotion. Men have that, too, but not in the same way”

Collaboration and relationship-building have been the foundation of Sutton’s success:

Collaboration: “Problems, issues or roadblocks are always more manageable when you bounce ideas around with others”

Building strong relationships: “When you walk into a room full of industry heavyweights, having familiar faces, people who will smile at you, back you up or serve as allies makes a huge difference. That confidence comes from investing in relationships, fostering a solid professional network and treating people with genuine respect. You never know when those connections will come back around to support you”

Abigail Edney

Global Head of Insurance

Computershare

Aimee Henderson

Operations Manager (AUS)

Grace Insurance

Alisa Martins

Chief Operations Officer, Underwriting Operations

Pen Underwriting – Australia

Ann-Marie Coleman

Senior Associate

DLA Piper

Caroline Laband

Partner

Wotton Kearney

Charlotte Watts

Head of Energy and Mining, Asia

WTW

Claire Gomo

Practice Group Leader – Insurance

Hunt & Hunt Lawyers

Cynthia Yap

Managing Director

Dynamic Insurance Services

Drew Schnehage

Chief Executive Officer

Innovation Group Australia

Emily Davies

Head of Corporate Affairs and Sustainability

Tower Insurance

Emily-Rose Srbinovska

Senior Account Manager

AEI Canberra

Emma Doney

Associate Director, Queensland Manager and Executive Loss Adjuster

YDR Chartered Loss Adjusters

Eva Jones

Operations Manager and Insurance Specialist

Strata Insurance Solutions

Gemma Lipovski

Head of Data and Projects

NTI

Heather Coutts

Senior Account Executive – Authorised Representative

Capstone Insurance Brokers

Jacqui Milson

Head of Howden Care

Howden Insurance Brokers Australia

Jayde Mulholland

Co-Chief Executive Officer

Qikio

Jen Bettridge

Clear Leader and Director

Clear Insurance

Jessica Jenkins

Business Development Manager

Coalition

Josefina Salvador

President and Chief Executive Officer

Liberty Insurance Corporation

Julie Morgan

Head of Claims

AXA XL

Kate Greaves

Director

Goldsworthy General Insurance Services

Katherine Hill

Manager – Insurance Risk and Resilience

RACQ

Katie Stephenson

Head of Corporate, Commercial Queensland

Marsh

Kim McEwan

Head of Casualty – Australia

AXA XL

Kim Yeoh

Chief Financial Officer, Asia

Sun Life

Kym Maynard

Financial Adviser

Haven Financial Advisers

Lianne Waru

New Zealand Manager

NM Insurance

Lindsey Reagan

Adviser Technical Support Manager

Haven Financial Advisers

Lisa Carter

Chief Executive Officer, Founder and Managing Director

Clear Insurance

Lisa Mainelli

Group General Counsel

Ambrose Construct Group

Meg Long

Chief Operating Officer

McLardy McShane Group

Melanie Sutton

Executive Manager – Business Delivery

IAG

Melissa Davis

Head of Broking and Account Director

Scott Winton

Melyssa Soo

Financial Services Associate Director

AIA

Michelle Boyd

Delivery Lead and Chief Compliance Officer

Folio.insure

Mikaela Watts

Operations Manager

B.I.L.

Misha Henaghan

Partner

Wotton Kearney

Nancye Maloni

Underwriting Manager

AA Insurance

Natasha Gale

Chief Executive Officer and Director

ARAG Services Australia

Nicky Stokes

Team Leader, Finpro Corporate

Marsh

Patricia Priest

General Manager, Commercial Insurance

QBE Insurance

Pauline Davies

Co-Founder and Director

InsuredHQ

Penne Murphy

Executive Account Manager

Interlink Insurance Brokers

Petra Lucioli

Group Claims Manager and Director

Delta Insurance

Poppy Foxton

Corporate and Commercial NSW Leader

Marsh

René Hattingh

Head of Technical Delivery

Howden New Zealand

Sammie Chan

Asian Client Services Leader

Marsh NZ

Sarogini Millott

Chief Underwriting Officer

Community Underwriting Agency

Sharyn Reichstein

Chief Risk Officer

Tower Insurance

Sheena Love

Group General Counsel

FWD Insurance

Tainui McGregor

First Party and Claims Operations Manager

Arch Insurance

Tanushree Arora-Sopori

Executive Manager and Broker – Broking Operations

Fortuna Advisory Group

Tessa Chirnside

Co-Founder and Chief Operating Officer

Rhodian Group

Veronica Grigg

Chief Executive Officer, Asia

Sedgwick

Vibha Coburn

Group Chief Executive Officer and Chief Executive Officer

Manulife Holdings Berhad and Manulife Insurance Berhad

Wendy Foweraker

Executive General Manager, Broking Operations

Community Broker Network

Wendy McFarlane

Domestic Broker

Rothbury Insurance Brokers

Yen Junirah Jamil

Head, Business Development

Finology

Yen Yen Koh

General Manager, Singapore

bolttech