ILS funds are best performing hedge funds of 2023: Preqin

At a time when assets under management (AUM) have been climbing across alternative investment strategies and investors are carefully assessing their allocations and attracted to diversifying assets, the insurance-linked securities (ILS) niche has come out as top performer of the hedge fund world, Preqin has said.

The macro backdrop, which now sees investors actively seeking out relatively uncorrelated strategies and having money to put into alternatives at this time is important, as the performance of the ILS asset class over the last year is set to drive increasing interest, we believe.

Preqin, a provider of hedge fund and alternative investment data and analytics, reports on hedge fund categories performance to September 30th and provides an outlook for alternative investment flows as well.

CEO Christoph Knaack explained that, “Total assets under management (AUM) across the alternative asset classes tracked by Preqin continue to climb at a healthy rate; according to our latest forecast we expect it to be more than 8% annualized up to 2028.”

Which is strong forecast growth, albeit slower than the double-digit growth seen in alternative asset flows over years from 2016 to 2022.

But, even with flows slowing, the fact the ILS market is delivering such solid performance right now, at a time of high global volatility and market fluctuation, which is driving investors to look at alternatives again, should ultimately help the asset class win its fair share.

ILS, like many hedge fund strategies, has demonstrated some stability in times of volatility this year, which is precisely what allocators look for in an alternative.

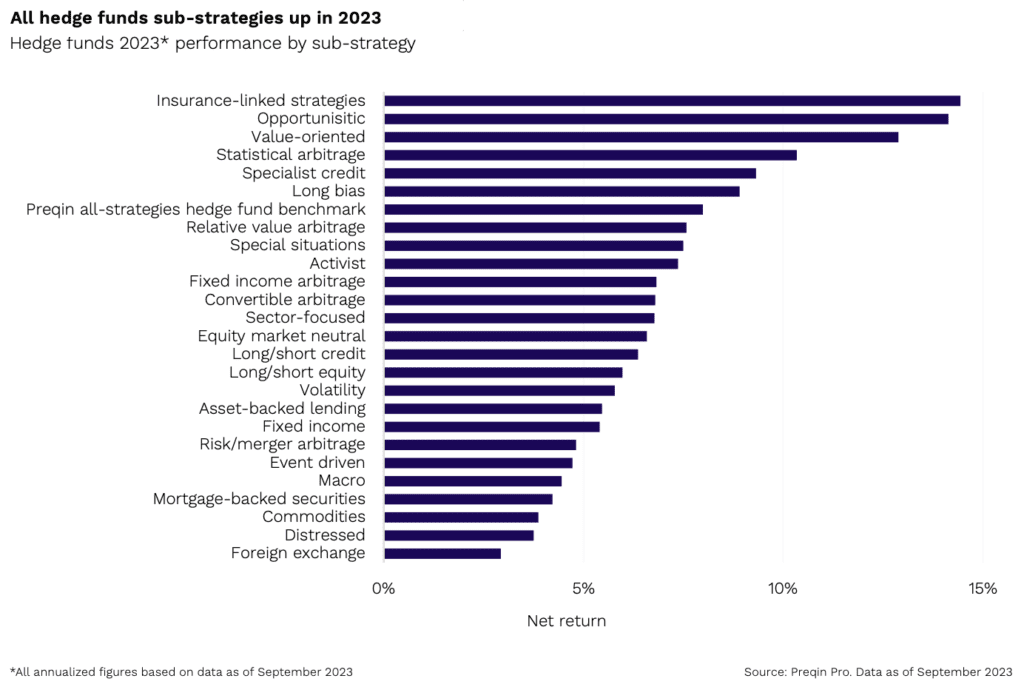

In fact, of all the hedge fund sub-strategies tracked by Preqin, insurance-linked securities (ILS) led the way this year.

“Among hedge fund sub-strategies, Insurance-linked securities (ILS) strategies performed best, with an annualized return for 2023 of 14.4%. The niche strategy, which focuses primarily on non-financial risks such as natural disaster risk, showed little to no correlation to global markets during the year, as well as

the longer term,” the alternative investments data provider explained.

Preqin categorises ILS as a “niche” within alternatives and notes that it is one area that has “received large inflows in the past near- decade.”

In fact, the niche hedge fund strategy segment is now $86 billion in total, by Preqin’s measure, which only includes active funds, so not other ILS strategies such as collateralized reinsurance structures.

“Cash flows into niche strategies have been consistently positive since the start of 2021, making them unique as most hedge fund strategies have struggled to retain or attract client capital,” Preqin explained.

The firm also noted that as markets around the globe have seen outflows, it is often the niche strategies that see capital flowing in.

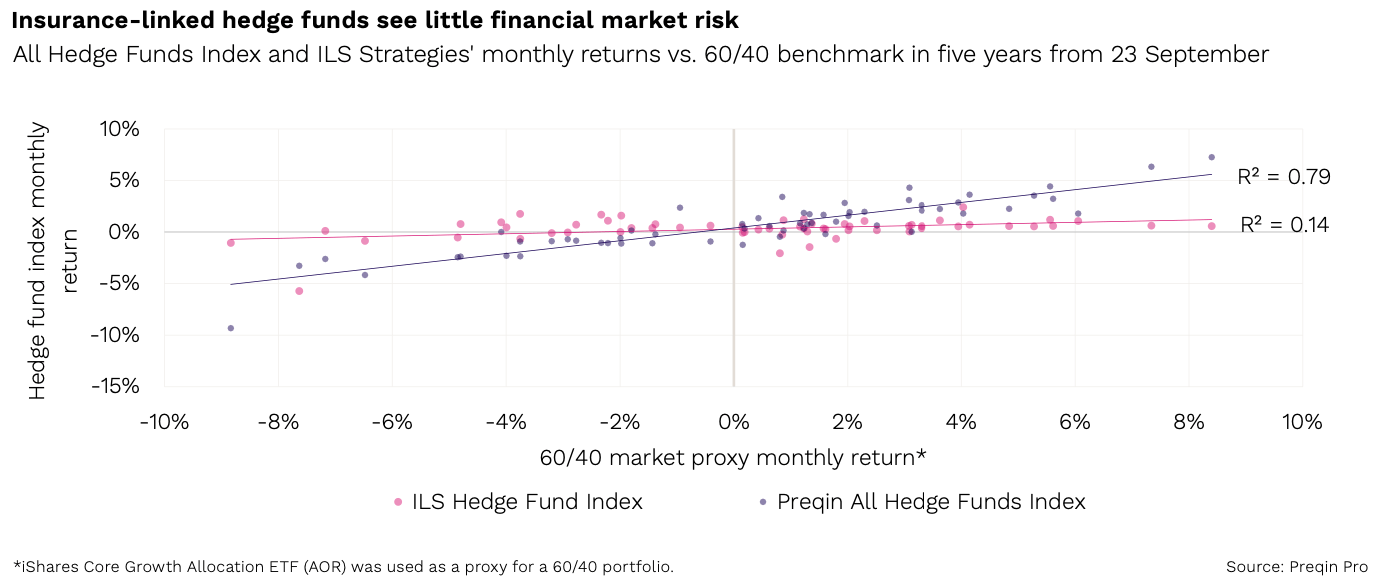

Overall, ILS investment strategies have shown far less correlation to global markets, even than other niche hedge funds, Preqin says.

“In the past five years, ILS strategies showed a R2 statistic of 0.14, almost entirely uncorrelated to the 60/40 market portfolio, compared with 0.79 for the All Hedge Funds Index,” Preqin said.

They further said, “The current demand for niche strategies has been driven by short-term factors that have created ideal circumstances for them to be used to diversify the risks of traditional financial assets.”