ILS fund return dispersion high again in Feb, on CA wildfire & Helene flood losses: ILS Advisers

The ILS Advisers Fund Index has reported a +0.17% return for February 2025, but the company has highlighted a second consecutive month where there was a broad dispersion between ILS fund returns and performance, as effects from losses due to the California wildfires continued to flow through the market.

In addition to the wildfire related negative performance hits felt by certain catastrophe bond funds and private ILS funds in February, ILS Advisers also notes that updated loss information related to the flooding from hurricane Helene also dented some positions in the month.

ILS Advisers noted that only approximately 753% of the ILS fund constituents within its Index have reported their data for February 2025 so far.

Discussing catastrophe activity in February and its effect on the catastrophe bond and broader ILS market, ILS Advisers said, “February was a quiet month with no new natural catastrophe events. However, updated loss information from the Los Angeles wildfires and the inland flooding caused by Hurricane Helene has led to further declines in fire- and flood-exposed ILS positions.”

We had reported back in February that the NFIP’s estimate of flood insurance losses from hurricane Helene had risen during the month, which had an effect on some of the FloodSmart Re cat bond deals with price movements and extensions of maturity evident a few weeks later.

“Additionally, a series of multi-peril annual aggregate structures remain under pressure as we enter the peak of severe thunderstorm season in March, April, and May across the central United States.”

After a significantly negative January for the ILS Advisers Fund Index, after full reporting came in and drove a -1.99% month for the benchmark, with February’s positive 0.17% return the year-to-date figure for 2025 after February now stands at -1.82%.

That’s likely to move once the remaining ILS funds have reported their data to include in the Index for February, which like last month could have a meaningful effect given the wildfire impacts seen.

Recall that, when 75% of ILS fund constituents had reported, the ILS Advisers Fund Index was initially negative by -0.38% for January 2025.

But, as we later reported, once the last few ILS funds data was incorporated, the January 2025 return fell to -1.99%, revealing a very significant near 20% performance gap between the best and worst performing strategies.

For February 2025, ILS Advisers reports that pure cat bond funds as a group averaged a 0.35% gain for the month, but funds incorporating private ILS strategies, such as collateralised reinsurance and retrocession, were down -0.20% on average.

With 27 ILS funds out of the 37 constituents having reported results for February so far, 19 had reported positive returns for the month, while 8 had reported negative.

ILS Advisers highlighted that “dispersion in performance remained high in February” with the best-performing ILS fund delivering a +1.64% return for the month and the worst a -2.17% result.

Which results in a performance gap of 3.81% for the month of February 2025 so far, but as other ILS funds report there is a chance this could widen.

ILS Advisers said, “Extended reporting times are common following major insured events, as valuation processes depend on the receipt of accurate data from insurance companies.”

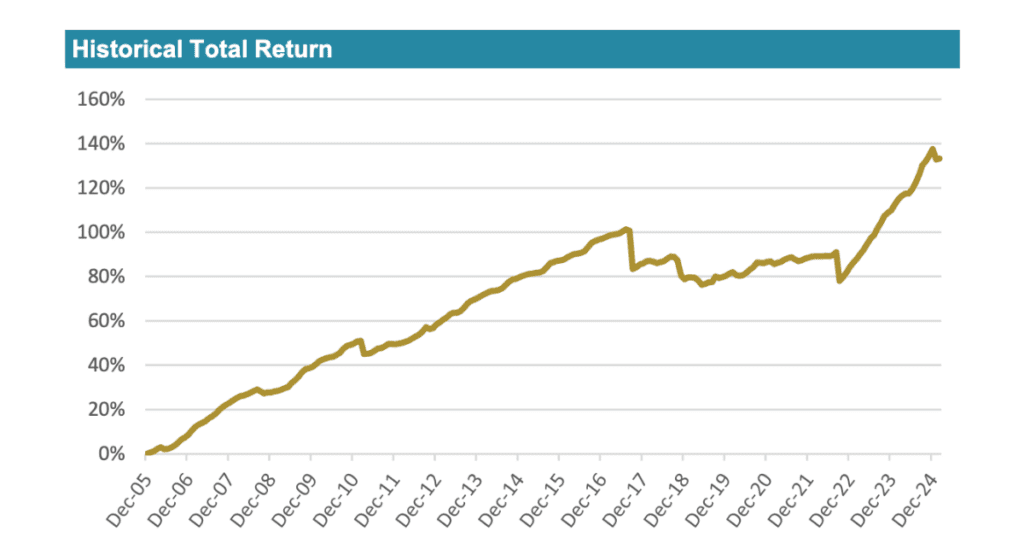

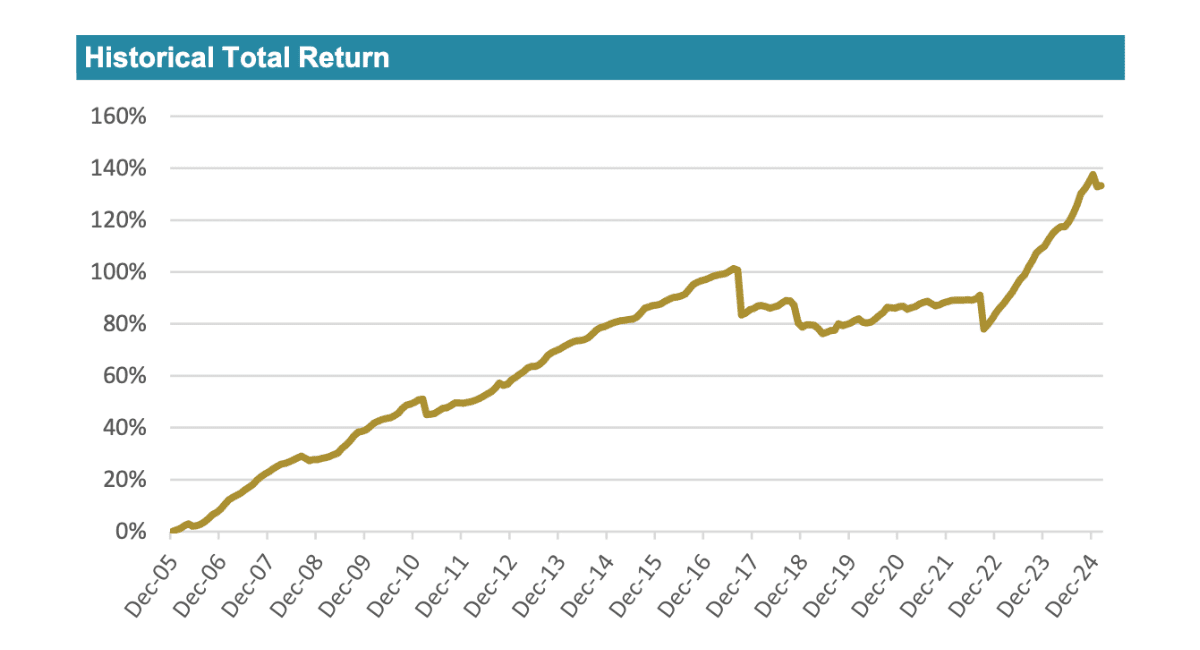

You can track the ILS Advisers Fund Index here on Artemis. It comprises an equally weighted index of 37 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.