ILS capital growth sluggish, fresh capital replacing lost or exited: AM Best

Insurance-linked securities (ILS) capital overall is only growing back slowly, with some fresh capital raising largely just replacing that which had been lost due to catastrophe events or investor redemptions and exits, rating agency AM Best explained in a new report.

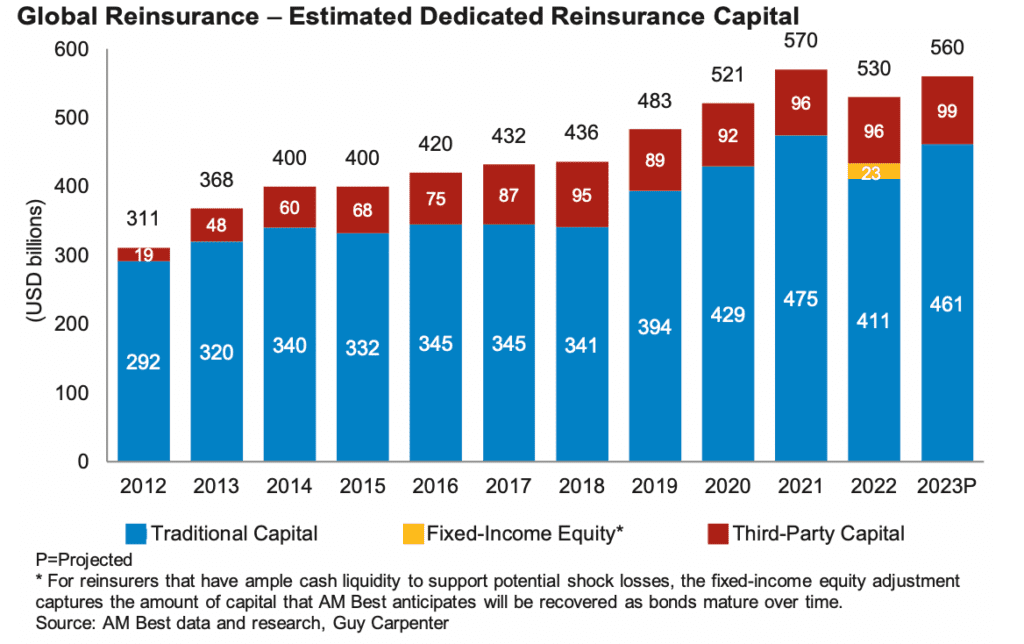

As we reported recently, AM Best and reinsurance broker Guy Carpenter are forecasting third-party capital in reinsurance, so alternative capital or insurance-linked securities (ILS) capacity, will grow by just over 3% in full-year 2023, to reach approximately $99 billion by year-end.

While that is not significant growth by any means, it’s encouraging to note that AM Best’s commentary suggests there is likely more deployable ILS capital now available, with trapped capital steadily unwinding and being replenished from fresh inflows.

The rating agency said that third-party capital “recycles and stagnates” in 2023, still remaining relatively flat since 2018, in terms of the top-line figure reported.

Citing “loss fatigue, model uncertainty, and opportunity costs for potential new market participants” all as deterrents to raising new capital in ILS markets over the last few years, there have been green shoots of growth thanks to the improvements in reinsurance market pricing and terms.

“Tightening terms and conditions have allowed some ILS funds to attract investors and at least replace much of the lost capital,” AM Best explained.

Also citing some, “notable capital raises from established participants.”

The conflicting factors of the recent historical performance of ILS investment strategies, versus the more beneficial improvements in terms and conditions, as well as pricing, mean the recovery is still slow.

Leading the rating agency to say, “Expected returns for 2023 have improved meaningfully, although new capital has essentially only replaced the capital that exited the ILS market.”