ILS Advisers Fund Index down -0.38% on wildfire impacts in Jan 2025

The ILS Advisers Fund Index has reported a -0.38% return for January 2025 on the back of the recent California wildfire losses. With 75% of ILS fund managers having reported returns for the period so far, the Index could fall further as additional data points from private ILS strategies are included.

ILS Advisers noted that the insurance-linked securities (ILS) funds tracked by the Index were impacted by the wildfires to various degrees.

Explaining some of the context behind the impacts felt by ILS funds, ILS Advisers said, “Although wildfire is often classified as a “secondary” peril, the scale of this event is expected to affect the ILS market.

“Multi-peril annual aggregate structures, which account for cumulative losses from various natural disasters over a year, may come under additional strain. Typically covering the period from June to May, these structures have already been significantly impacted by earlier catastrophes, including Hurricanes Helene and Milton. The latest wildfire losses will further deplete these aggregates, leaving them more vulnerable to springtime severe weather events such as thunderstorms and tornadoes.

“In the liquid catastrophe bond segment, several California wildfire-specific cat bonds matured in late 2024 and were not renewed, reducing overall exposure to this peril. However, several multi-peril cat bonds experienced price corrections of 20–75%, contributing to a 1.9% decline in the cat bond market in January.

“The impact has been felt not only in multi-peril annual aggregate structures but also in lower-attaching per-occurrence covers.”

ILS Advisers highlighted that catastrophe bonds funds were, in general, less affected.

“Pure cat bond funds as a group posted a 0.08% gain for the month, while funds incorporating private ILS strategies lost -1.40% on average,” the company said.

Out of the ILS fund strategies tracked by the ILS Advisers Fund Index and to have reported so far, 12 funds delivered positive returns for the month of January 2025, while 15 were negative.

ILS Advisers said that only approximately 75% of the ILS funds within its Index have reported data for January 2025 so far, with the remainder all being private ILS strategies, that typically allocate to collateralized reinsurance and retrocession opportunities and so valuations can take longer to establish.

As a result, the Index return for January 2025 may deteriorate further as these final strategies report their data.

The range in performance terms was particularly wide in January 2025, with the best performing ILS fund delivering a +0.87% return, but the lowest performance reported so far was at -3.71% for the month.

The effects of the California wildfires are evident in the Index performance for January and given the complexity and scale of the catastrophe loss event it is possible some funds continue to feel certain portfolio effects into their February performance as well.

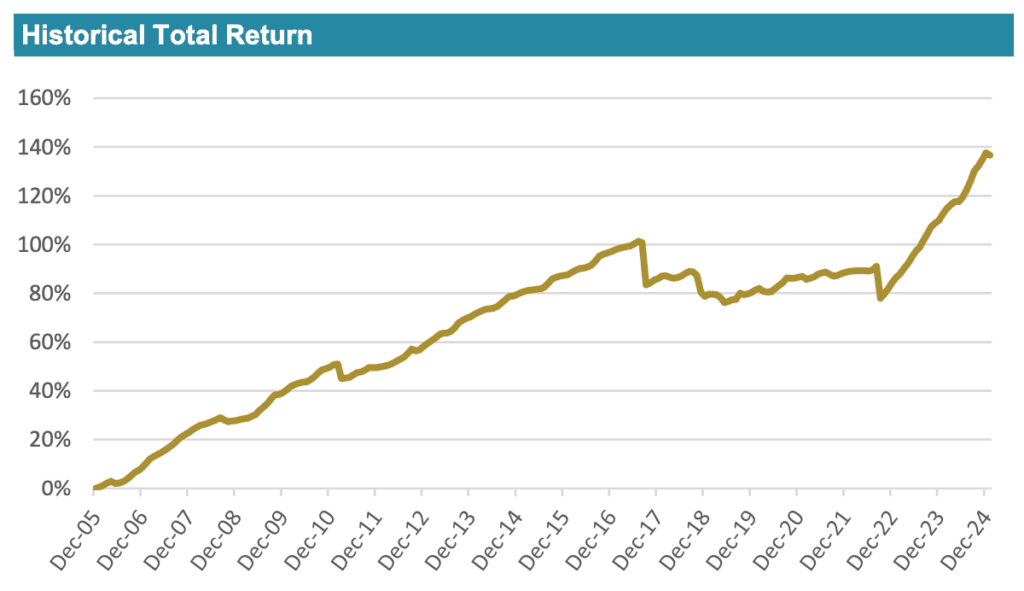

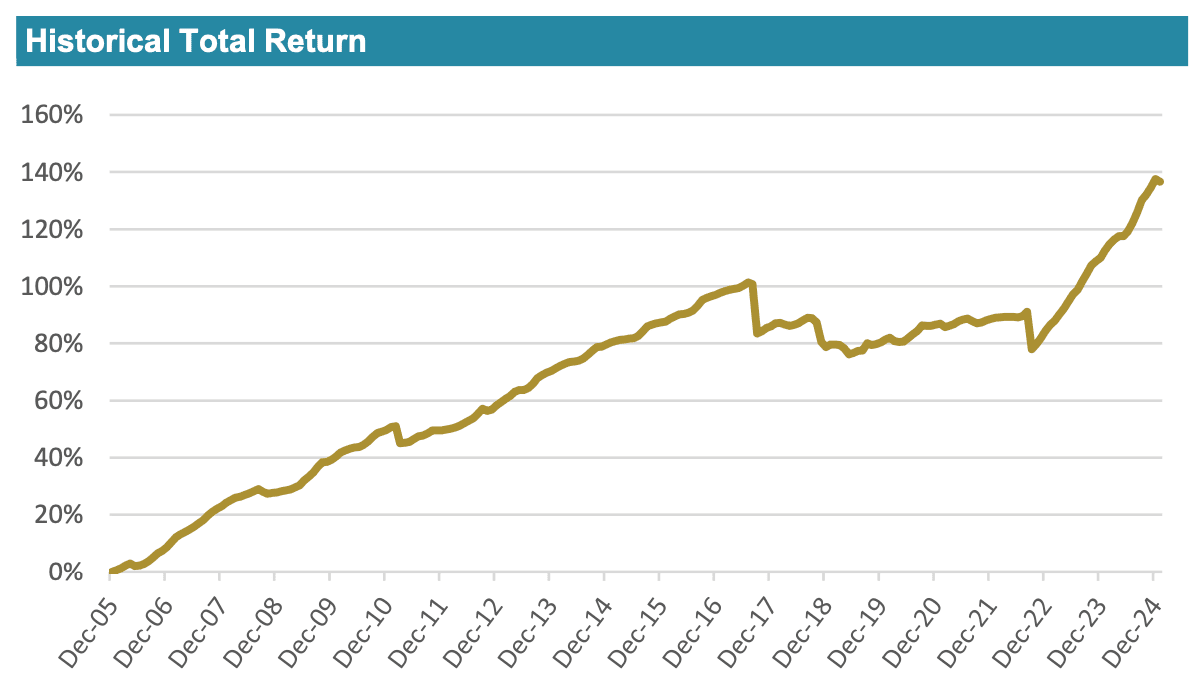

You can track the ILS Advisers Fund Index here on Artemis. It comprises an equally weighted index of 37 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.