Icosa Investments warns of tornado season threat to aggregate cat bonds

A number of aggregate catastrophe bonds have already seen their annual deductibles severely eroded by previous catastrophes and with this weekend’s severe weather activity in the United States providing a reminder of the tornado threat, cat bond fund manager Icosa Investments has cautioned investors to assess the risk of certain deals wisely.

As we reported this morning, the US experienced an impactful outbreak of severe and convective weather across the Midwest and Southern states over the weekend, which we said highlights the contribution the tornado and severe convective storm (SCS) peril can present to aggregate cat bonds and insurance-linked securities (ILS).

Swiss catastrophe bond fund manager Icosa Investments AG commented on the outbreak of severe storms, saying that with the accepted season for tornadoes typically in the spring months, the market can expect more of these types of events to occur.

“For cat bond investors, individual tornadoes are typically not a major concern, as insured losses from a single tornado event rarely exceed the low single-digit billions,” Icosa Investments explained.

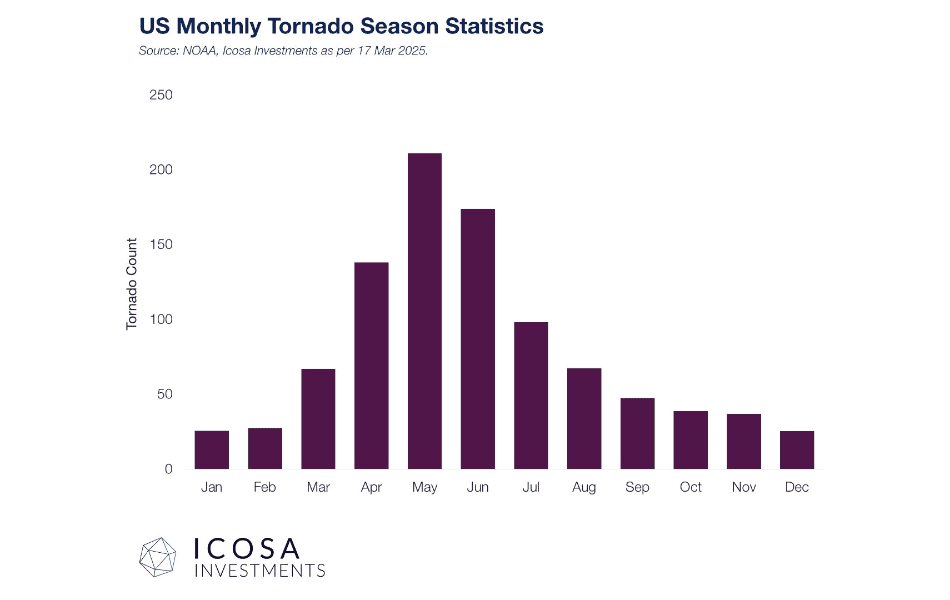

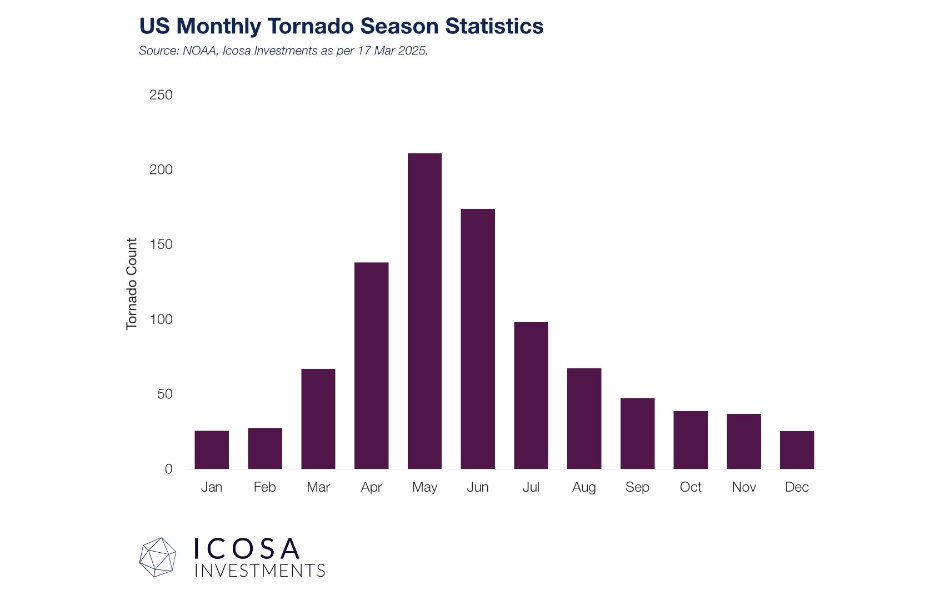

“However, the real risk lies in the accumulation of losses over time, particularly for aggregate cat bonds, which cover multiple events within a set risk period. As illustrated in the figure below, tornadoes are not isolated occurrences. They are frequent throughout Q2, making this a critical period for certain cat bond structures.”

Going on to state, “This year, tornado season will be closely watched by investors holding aggregate indemnity transactions, many of which have already experienced erosion in their annual deductible due to losses from Hurricanes Helene and Milton as well as California wildfires.

“Several transactions are now particularly exposed, as prior events have significantly reduced—(or maybe even completely depleted) the available buffer meant to absorb tornado losses. With the Q2 resets sometimes still months away, these bonds remain vulnerable to additional adverse events.”

Florian Steiger, CEO of Icosa Investments, further explained that, “Tornado season typically isn’t a major concern for cat bond investors, but 2025 could be different. Several aggregate indemnity cat bonds have already exhausted a significant part (or more) of their annual deductibles due to last year’s hurricanes and the LA wildfires. As a result, they now face heightened exposure to the upcoming Q2 tornado season.

“If 2025 brings tornado activity similar to last year, we might see multiple cat bond defaults in the coming weeks.”

The attachment erosion of annual deductibles for aggregate cat bonds has been eroded significantly in some cases by the recent wildfires, meaning a number are marked-down heavily in cat bond secondary pricing sheets at this time.

Typically it would take a significant severe convective storm (SCS) or tornado outbreak to cause any meaningful further erosion, but with some of the aggregate cat bonds having risk periods that end at the mid-year and the tornado season peak nearing, it may be wise to adopt some caution.

Tornado season is always a threat given severe thunderstorm risk is a covered peril for many aggregate cat bonds, but this year over the next few months this threat is heightened given the high levels of annual deductible erosion experienced.

Commenting on secondary pricing of aggregate cat bonds, Icosa Investments said, “While broker prices already reflect some of this risk, we believe that certain aggregate indemnity cat bonds are potentially priced too high, creating a skewed risk-return profile with excess downside risk. Investors should carefully assess these exposures, particularly in light of recent market developments.”