IAG reveals rising property claims amid climate change inaction

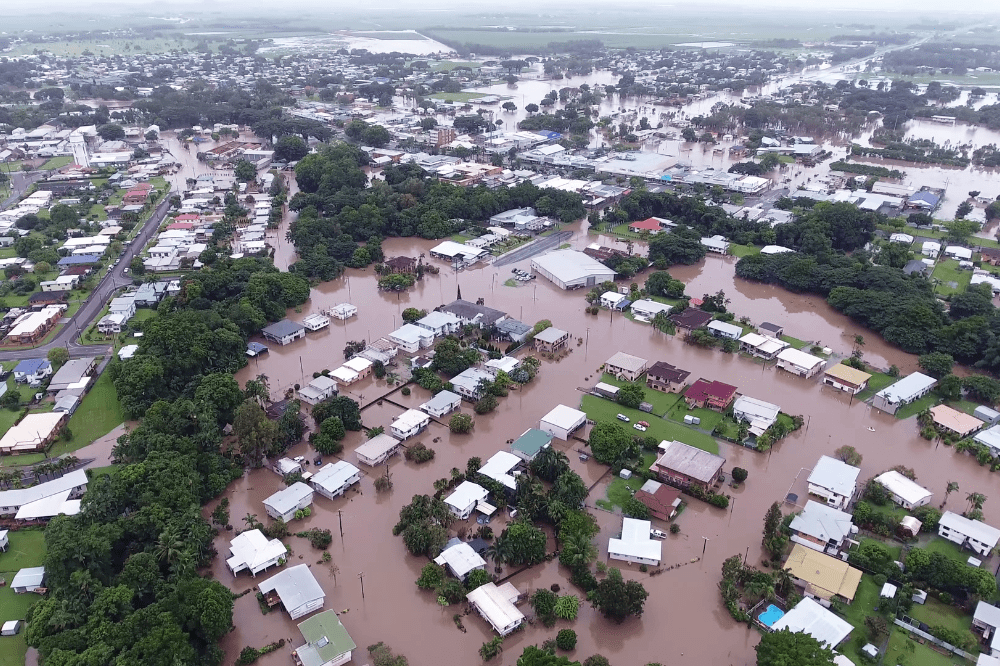

The insurance group, which does business in New Zealand under the AMI, State and NZI brands, said the data shows New Zealanders are concerned about and increasingly impacted by climate change. However, too little is being done at an individual, community or government level to help mitigate climate change’s effects.

“In August, we called for three practical, collaborative steps to be taken, which will lead to a real reduction in the flood risk faced by some of New Zealand’s most exposed communities,” said Amanda Whiting, IAG New Zealand CEO. “And while we have since had some good conversations with the government, we are still waiting on any actual decisions or commitments to the steps contained in that plan. In the meantime, New Zealanders continue to be affected by the devastating impacts of climate change on their properties and livelihoods.

“As New Zealand’s largest general insurer we are committed to being here to help people recover from wild weather events,” she said. “But insurance can only ever be one component of the solution. We need to work collectively and urgently to better protect people and property in our most at-risk communities.”

IAG conducted a nationwide survey which found that 82% of people believe wild weather is increasing in frequency and severity, and 42% feel ill-prepared to respond to a storm.

Dr Bruce Buckley, chief meteorologist for AMI, State and NZI, said New Zealand’s climate has changed irrevocably, and that the country is now susceptible to the compounding effects of rising sea levels, warming seas, and damaging tropical weather systems.

“Sea level rise will accelerate and is unstoppable,” Buckley said. “And, while New Zealand’s physical location means we have always been susceptible to tropical systems, the effects of warmer sea temperatures around New Zealand plus the current and future La Niña-like climate forcing patterns means they are likely to occur more frequently than ever before.”

IAG’s tracker also provided an update for extreme weather and flooding that affected Nelson Tasman, Marlborough, and other parts of the country in August. The insurer has received 1,716 claims and is currently paying out approximately $20 million to customers.

“We are continuing to support customers affected by the August storm,” said Wayne Tippet, executive general manager for claims, IAG NZ.