IAG buys more cat reinsurance than expected at renewal, updates on storms

Australian primary insurance group IAG has renewed its main catastrophe reinsurance tower up to $10.5 billion for calendar year 2024, with the firm’s CFO citing the more stable reinsurance market as allowing the company to purchase more reinsurance than had been anticipated.

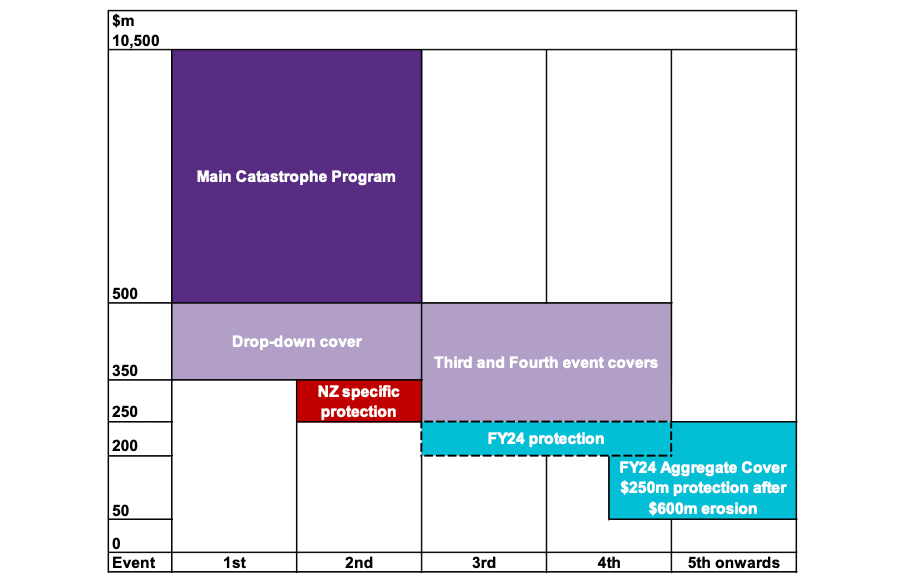

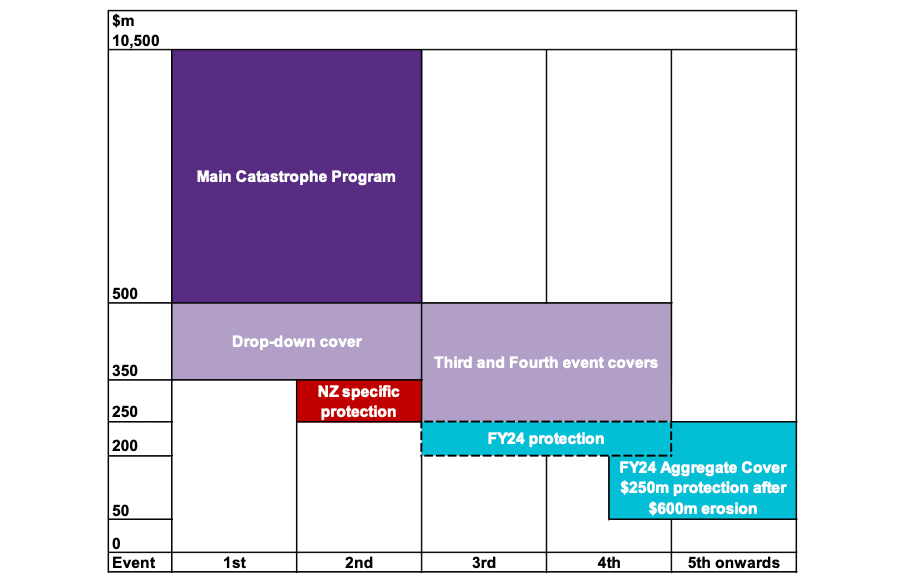

The main occurrence catastrophe reinsurance tower now attaches at the same $500 million of losses as a year ago and now extends to the $10.5 billion level at the top-end, which is a $500 million increase for the coming year.

You can see the IAG 2023 reinsurance tower in our article from a year ago.

The main catastrophe cover that runs up to $10.5 billion provides IAG with protection for two events this year. The reinsurance tower works in conjunction with IAG’s 37.5% whole account quota share arrangement that remains in force.

IAG also secured an additional drop-down cover of $150 million, to reduce its retention for the first two events to $236 million, (67.5% of $350 million after the quota share), with an additional premium due if the drop-down cover is used on a first event.

There is an additional drop-down cover for New Zealand specific second events of $100 million excess of $250 million and third and fourth event covers of $250 million excess of $250 million.

For the rest of IAG’s fiscal year, that runs to the mid-year, the insurer also has pre-quota share third and fourth event reinsurance protection of $150 million for losses greater than $200 million, and aggregate reinsurance of $250 million, excess of $600 million, with qualifying events capped at $200 million excess of $50 million per event, as previously announced last July.

Taking all of its reinsurance protections for 2024 into consideration, IAG has a maximum event retention of $236 million as at January 1st 2024.

IAG Chief Financial Officer William McDonnell highlighted the improved renewal conditions, “Global reinsurance markets have stabilised during 2023, allowing IAG to purchase greater reinsurance protection than we originally expected.

“The cost of the overall program is broadly consistent with our expectation and our guidance of a FY24 reported insurance margin of 13.5% to 15.5%.”

IAG also provided an update on the severe storm related losses that have hit Australia through December and into the start of this year.

As we reported yesterday, an insurance catastrophe declaration has been declared running into the New Year, for storms, rainfall and flooding across eastern parts of Australia, with over 38,000 insurance claims lodged since December 23rd.

IAG has received around 17,000 claims so far from weather events that impacted Australia in December, including around 500 claims from ex-Tropical Cyclone Jasper and around 9,000 claims from severe storms that occurred around Christmas Day, the insurer said today.

CEO Nick Hawkins said, “The weather events that impacted communities across the holiday period were devastating and our thoughts are with those who lost loved ones during this difficult time. Our property assessors and partner builders are on the ground in affected areas supporting customers with emergency assessments and make-safe repairs. The safety of communities and our customers is our top priority.”

IAG highlighted its reinsurance protection for last year, saying it had a maximum event retention in December 2023 of $169 million and at this stage, the insurer said its natural perils costs are tracking below its natural perils allowance.