IAG-backed geospatial crop insurance solution launches

IAG-backed geospatial crop insurance solution launches | Insurance Business Australia

Environmental

IAG-backed geospatial crop insurance solution launches

Platform released as under-insurance continues to challenge agricultural sector

Environmental

By

Roxanne Libatique

Digital Agriculture Services (DAS), an Insurance Australia Group/IAG Firemark Ventures backed company, is launching a new geospatial crop insurance solution aimed at enhancing risk management for Australian farmers and insurers.

With climate-related threats increasingly impacting agriculture, this solution uses advanced technology to offer more precise and transparent insurance coverage, helping both insurers and producers mitigate financial risks.

Geospatial crop insurance solution

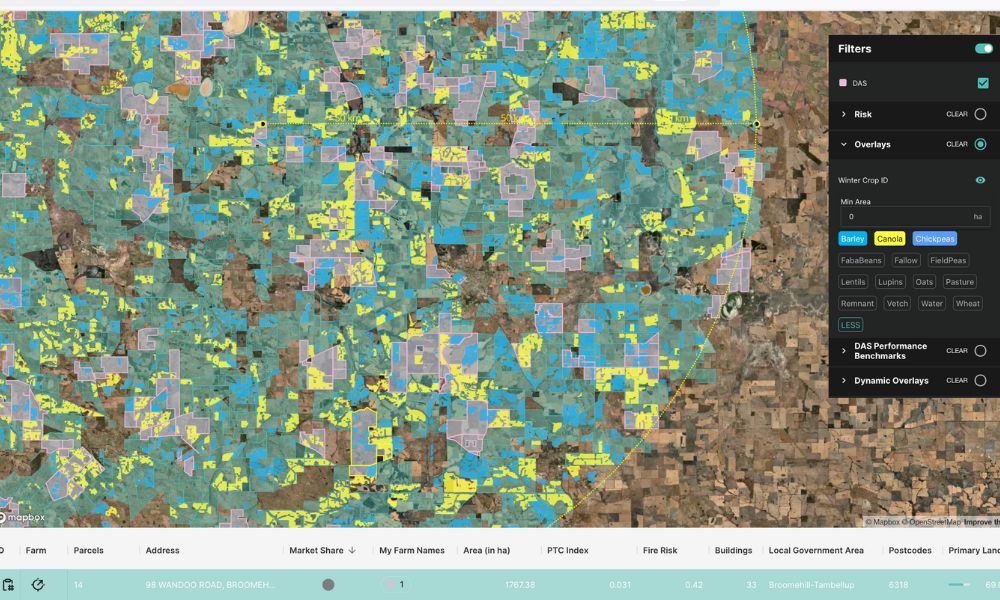

The DAS platform is designed for insurers, underwriters, brokers, and reinsurers, incorporating geospatial data and machine learning to provide detailed mapping and verification of insured properties, crop types, and yields.

It is part of a broader suite of geospatial tools that enable insurers to visualise insured properties and assess risk distribution across different regions.

DAS CEO Anthony Willmott noted that the platform aims to address persistent issues like premium leakage and under-insurance.

“It delivers dual benefits for insurers and the growers they protect by spatially locating insured paddocks and verifying their insurance status and details; then identifying crop type, estimated, and actual yields to provide almost full visibility on the property insured,” he said.

Agriculture sector faces under-insurance

The rollout comes as under-insurance continues to challenge the agricultural sector, with climate change driving higher premiums.

Willmott said the solution benefits insurers by reducing loss rations and offering farmers more competitive insurance options.

“This solution is a win-win for both insurers who want to decrease loss ratios and costs that lead to higher premiums, and producers who want competitive rates for insuring their land,” he said.

The DAS platform is flexible, supporting both traditional farm insurance and standalone crop coverage, which provides insurers with better tools to manage agricultural risks.

Australia is the first market for DAS’s new geospatial insurance platform, with plans to expand into other regions.

The plan sets new targets for reducing carbon emissions by 2030 and aligns with global efforts to mitigate the impacts of climate change, particularly in Australia and New Zealand.

The Climate Action Plan includes measures to reduce IAG’s scope 1 and 2 emissions in line with international climate targets, while also addressing scope 3 emissions throughout its supply chain, which covers customers, partners, and suppliers.

The launch of the plan coincides with a report by the Insurance Council of Australia (ICA), which highlights the rising economic toll of natural disasters. Over the past three decades, the financial impact of extreme weather has tripled, with Australian insurers now paying an average of $4.5 billion annually in claims for weather-related events, up from $2.1 billion in previous years. Floods have been identified as a key driver of these rising costs.

Insurance Australia Group (IAG) is backing Digital Agriculture Services (DAS) in launching a new geospatial crop insurance solution aimed at enhancing risk management for Australian farmers and insurers.

With climate-related threats increasingly impacting agriculture, this solution uses advanced technology to offer more precise and transparent insurance coverage, helping both insurers and producers mitigate financial risks.

Geospatial crop insurance solution

The DAS platform is designed for insurers, underwriters, brokers, and reinsurers, incorporating geospatial data and machine learning to provide detailed mapping and verification of insured properties, crop types, and yields.

It is part of a broader suite of geospatial tools that enable insurers to visualise insured properties and assess risk distribution across different regions.

DAS CEO Anthony Willmott noted that the platform aims to address persistent issues like premium leakage and under-insurance.

“It delivers dual benefits for insurers and the growers they protect by spatially locating insured paddocks and verifying their insurance status and details; then identifying crop type, estimated, and actual yields to provide almost full visibility on the property insured,” he said.

Agriculture sector faces under-insurance

The rollout comes as under-insurance continues to challenge the agricultural sector, with climate change driving higher premiums.

Willmott said the solution benefits insurers by reducing loss rations and offering farmers more competitive insurance options.

“This solution is a win-win for both insurers who want to decrease loss ratios and costs that lead to higher premiums, and producers who want competitive rates for insuring their land,” he said.

The DAS platform is flexible, supporting both traditional farm insurance and standalone crop coverage, which provides insurers with better tools to manage agricultural risks.

Australia is the first market for DAS’s new geospatial insurance platform, with plans to expand into other regions.

The plan sets new targets for reducing carbon emissions by 2030 and aligns with global efforts to mitigate the impacts of climate change, particularly in Australia and New Zealand.

The Climate Action Plan includes measures to reduce IAG’s scope 1 and 2 emissions in line with international climate targets, while also addressing scope 3 emissions throughout its supply chain, which covers customers, partners, and suppliers.

The launch of the plan coincides with a report by the Insurance Council of Australia (ICA), which highlights the rising economic toll of natural disasters. Over the past three decades, the financial impact of extreme weather has tripled, with Australian insurers now paying an average of $4.5 billion annually in claims for weather-related events, up from $2.1 billion in previous years. Floods have been identified as a key driver of these rising costs.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!