Hurricane Otis to drive multi-billion-dollar insurance market loss: Gallagher Re

Reinsurance broker Gallagher Re has said that hurricane Otis will be one of the costliest natural catastrophe events in Mexico’s history, with a multi-billion-dollar insurance market loss anticipated because of the devastating impacts of the storm.

Damage to residential and commercial property in the Acapulco region is significant, with numerous high-value hotels and resorts severely impacted and potentially total losses in some cases.

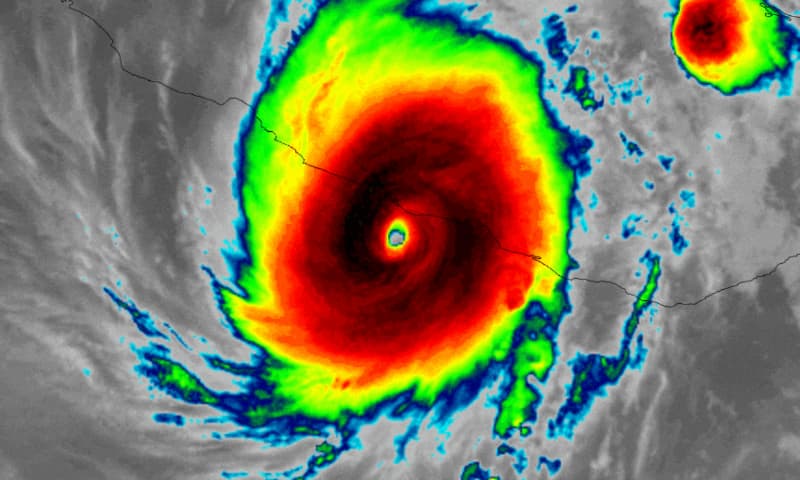

There were at least 39 fatalities after the hurricane made landfall as a Category 5 storm with 165 mph winds.

As we reported early Wednesday morning last week, based on the reported pressure from the NHC, it appears hurricane Otis will trigger the $125 million Pacific hurricane tranche of the Mexican government’s IBRD / FONDEN 2020 catastrophe bond, causing a loss of principal to investors that hold them.

We also reported that CoreLogic said the “insurable” loss from hurricane Otis’ category 5 winds onslaught in the Acapulco and surrounding region of Mexico is in the range of $10 billion to as much as $15 billion.

While risk modeller Moody’s RMS noted that hurricane Otis’ rapid intensification was missed by all the major weather models.

The World Bank catastrophe bond is anticipated to pay-out for the hurricane, with the market anticipating a 50% loss to the Class D notes, which would be $62.5 million of notional that would be paid to the Mexican government’s Treasury to assist with recovery and reconstruction after the disaster.

But the damage caused by hurricane Otis goes much further, with Gallagher Re saying the economic loss is expected to be above $10 billion, while the insurance market loss will be in the billions of dollars.

At that level, there could be more reinsurance support from the traditional market to assist Mexican insurers in paying claims.

In addition, we understand the government’s catastrophe insurance arrangements, that sit alongside the catastrophe bond to provide disaster risk financing, are also expected to pay-out, at least partially.

Hurricane Otis was the strongest landfilling storm and the first Category 5 landfall, along Mexico’s Pacific Coast

in the official record, Gallagher Re notes.

On the loss expectations, the reinsurance broker said, “The expectation is that insured losses will be considerable into the billions of dollars (USD) and become one of the most expensive events (if not highest) on record for the Mexican insurance market.

“Given the scale of damage to several high-end commercial properties, this will be a notable driver of the insured payouts.”

The most costly Mexican hurricane landfall was Wilma in 2005, that is estimated to have caused an $11.3 billion economic loss. Hurricane Otis could be more expensive, once the extensive damage is assessed and the effects of interruption related costs to businesses and commerce are added.

Also read:

– Hurricane Otis likely to trigger Mexico catastrophe bond payout.

– High probability Mexico cat bond loss will be 50% ($62.5m) from Otis: Plenum.

– Hurricane Otis a “monumental” weather model miss: RMS

– Hurricane Otis “insurable” loss estimated $10bn to $15bn by CoreLogic.

– Some uncertainty, but probable Otis will trigger 50% Mexico cat bond loss: Twelve Capital.