Hurricane Otis a “monumental” weather model miss: RMS

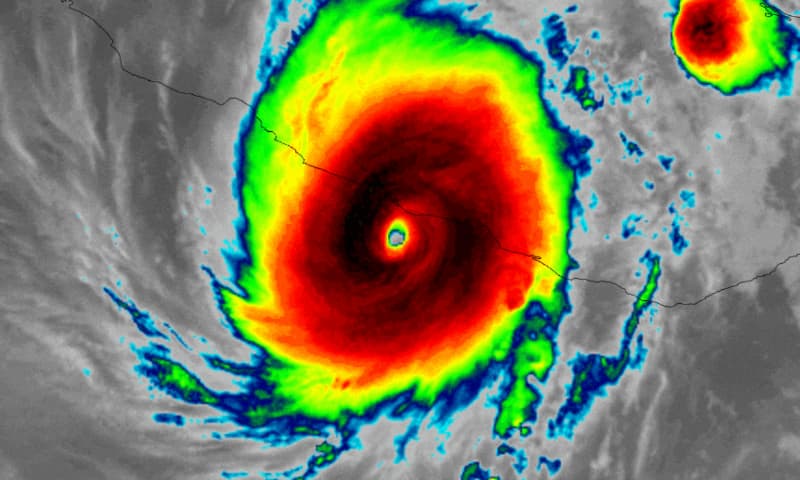

Hurricane Otis slammed into Mexico’s Pacific coast yesterday morning as a significant category 5 storm with sustained winds of 165 mph and has caused significant damage, but its rapid intensification was missed by all the major weather models, which RMS’ James Cosgrove calls a “monumental” miss.

Hurricane Otis is officially the strongest hurricane on record to make landfall on Mexico‘s Pacific coastline and also the first ever Category 5 major hurricane to make landfall from the Eastern North Pacific since records began, RMS Senior Modeler James Cosgrove explained.

As we were first to report yesterday, hurricane Otis is set to trigger a disaster insurance payout under the Mexican government’s IBRD / FONDEN 2020 catastrophe bond.

We also reported first that specialist ILS investment manager Plenum said that it anticipates the payout being 50% of the notional of the $125 million of Class D Fonden 2020 cat bond notes that are exposed to Pacific hurricanes.

RMS’ Cosgrove highlights an important point, in that hurricane Otis had not been anticipated to intensify at the rate seen and in fact none of the weather models were suggesting the rapid intensification that occurred.

The evening prior to hurricane Otis’ landfall, the storm was forecast to intensify, but then to weaken before it neared the Mexican coast.

In the end the wind speeds went from tropical storm to Cat 5 hurricane in 24 hours, while the minimum central pressure of hurricane Otis plummeted by over 50 mb in just 12 hours.

Cosgrove noted that, “The intensification rate of Otis is likely to be among the top ten all-time rates of intensification.”

In fact, the speed of intensification was at three times the criteria for rapid intensification, Cosgrove said.

Importantly, Cosgrove notes that as the weather models had not forecast the rapid intensification, or suggested such a significant storm would make landfall, it will have affected emergency preparations in the Acapulco region of Mexico that has been impacted by hurricane Otis.

“The remarkable and monumental ‘miss’ or ‘bust’ by all the weather models to identify the onset and magnitude of Otis’ intensification will have had serious implications for preparations and evacuations in Acapulco and the surrounding areas on Mexico’s west coast,” Cosgrove said.

Adding that, “While hurricane warnings were issued twenty-four hours before landfall, this was when the forecasts called for a Category 1 landfall. Only within twelve hours of landfall did the forecast landfall intensity increase to a Category 4 major hurricane.”

Early damage reports in the media and online show significant structural property impact to hotels, homes, government buildings and resorts in the region, with widespread damage in the landfall area and further afield more wind damage and rainfall related flooding and landslides from Otis.

Hurricane Otis has the potential to be a costly hurricane for Mexico, with ramifications for the local insurance industry and potentially some layers of reinsurance protection as well.

The fact forecasts were not predicting such an intensity of the storm, or the significant deepening of its central pressure, will also have meant that catastrophe bond holders were not as prepared for the loss they now face, as they perhaps could have been.

Cat bond fund managers and investors rely on the forecasts and the risk models to be able to inform their trading strategies, when a hurricane approaches land.

In this case, just 12 hours prior to landfall, it did not look like hurricane Otis was going to threaten the Fonden catastrophe bond, but we now see this cat bond as facing a loss and just awaiting a formal triggering determination from the calculation agent.

We’re told that the working version of the NHC best track data for hurricane Otis continues to show the landfall minimum central pressure at 923 mb, which is likely sufficient for the 50% loss of the $125 million of cat bond principal.

It’s possible the finalised best track data may be required for the final determination, after which calculation agent AIR will be able to deliver a report, which could take some time.

Hurricane Otis once again demonstrates that rapid intensification can see storms become far more severe in their impacts than had been thought just hours before, which has serious ramifications for the safety of those in the storms path.

It also has potential ramifications for holders of cat bonds and other ILS or reinsurance investments, as preparation through secondary trading, or hedging decisions, may not always be possible to undertake or make on a fully-informed basis.

Also read:

– Hurricane Otis likely to trigger Mexico catastrophe bond payout.

– High probability Mexico cat bond loss will be 50% ($62.5m) from Otis: Plenum.

You can read all about the $485 million IBRD / FONDEN 2020 catastrophe bond and every other cat bond transaction in the Artemis Deal Directory.