Hurricane Ida loss creep wipes out another Louisiana Citizens cat bond

Additional loss creep from 2021’s hurricane Ida has now eroded another layer of Louisiana Citizens’ catastrophe bond backed reinsurance protection, with the $50 million Class B notes of the residual market insurers’ Pelican IV Re Ltd. (Series 2021-1) cat bond set to pay out all of their principal in a reinsurance recovery.

Hurricane Ida hit Louisiana Citizens portfolio of property insurance risks particularly hard, with the insurer already having made full recoveries from the reinsurance protection provided by its $60 million, single tranche and per-occurrence Catahoula Re Pte. Ltd. (Series 2020-1) catastrophe bond, and the $75 million per-occurrence tranche of the Pelican IV Re 2021 deal as well.

But that Pelican IV Re cat bond also had another layer of coverage, a higher aggregate tranche that sat at the top of Louisiana Citizens reinsurance tower.

Artemis can now report that Louisiana Citizens losses from hurricane Ida have continued to creep and they have now blown through the top of that tower, so eroding the $50 million tranche of Pelican IV Re annual aggregate notes as well.

Sources told us that a notice of the reduced interest event amount shows a total loss for both tranches of Pelican Re cat bond notes.

At the same time, we’ve seen two cat bond secondary market pricing sheets that now have the Pelican IV Re Class B notes marked down for bids of zero.

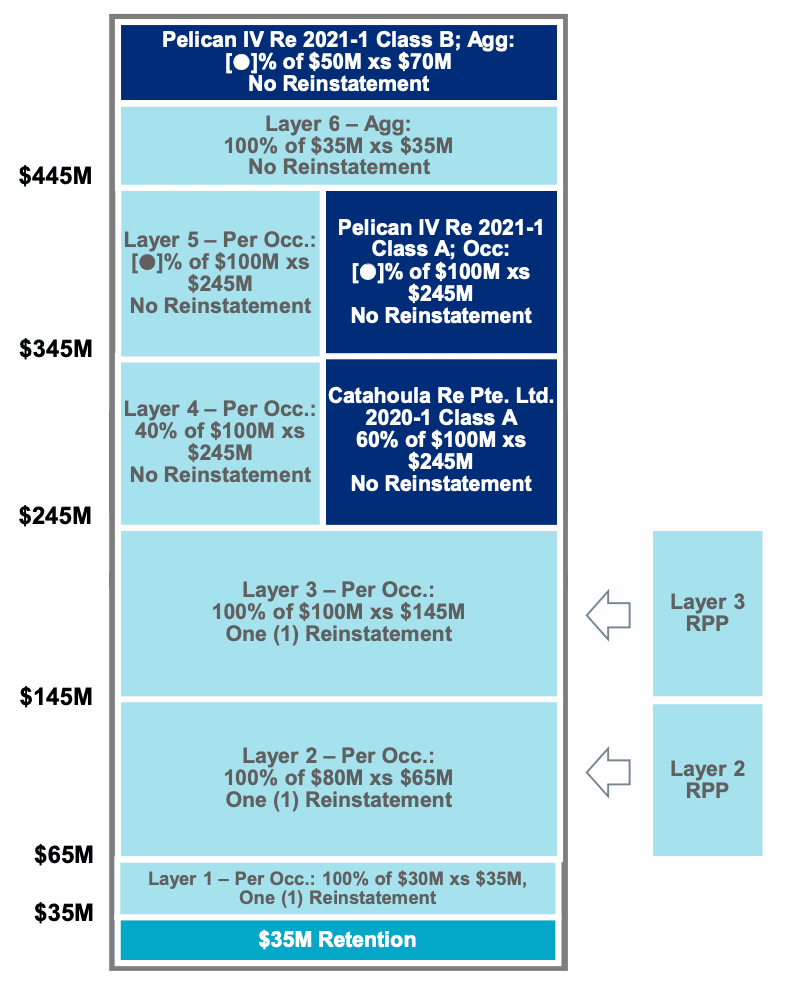

You can see the Louisiana Citizens reinsurance tower as it stood at the time of hurricane Ida in 2021 to the right.

It shows that the first catastrophe bond to respond and provide cover was the Catahoula Re Pte. 2020 transaction, that attached at $245 million of losses on a per-occurrence basis.

Directly above that, the Pelican IV Re 2021 Class A catastrophe bond notes attached at $345 million of losses, again on a per-occurrence basis.

Both these two classes of cat bond notes were understood to have been triggered and become a total loss, with full reinsurance recoveries expected, as long ago as November 2021.

It’s taken a lot longer for the Pelican IV Re 2021 Class B notes to attach, with the notes subject to a reduced interest event notice as of August 8th 2022.

While these are a class of cat bond notes that provide Louisiana Citizens with aggregate reinsurance, it seems likely that the loss is purely due to the insurers hurricane Ida losses creeping higher and eating right the way through the layer of cover.

These Class B Pelican IV Re cat bond notes were marked in secondary pricing sheets a month ago for bids as high as 85 or 90 cents on the dollar as recently as a month ago.

But in the latest pricing sheets to come out on Friday, they are now market at zero, implying a total loss of the $50 million of principal for investors holding the cat bond notes and a full reinsurance recovery for Louisiana Citizens.

This news suggests Louisiana Citizens Property Insurance Corporation blew through its entire reinsurance provisions on the back of hurricane Ida losses, reflecting the severity of the storm and its severe impacts on homeowners in the state.

You can view details of many catastrophe bond defaults and losses in our Directory.

——————————————————————— Tickets are selling fast for Artemis London 2022, our first ILS conference in London. Sept 6th, 2022.

Tickets are selling fast for Artemis London 2022, our first ILS conference in London. Sept 6th, 2022.

Register soon to ensure you can attend.

Secure your place at the event here!

—————————————