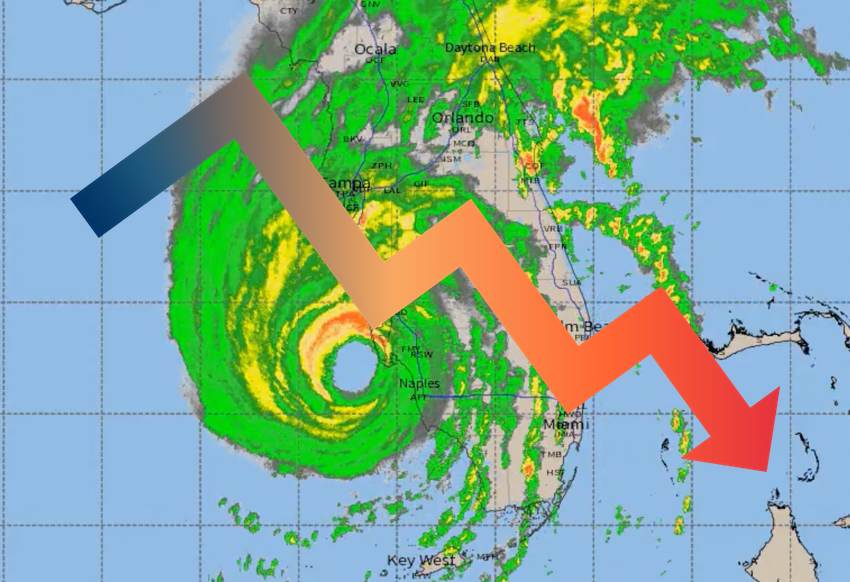

Hurricane Ian to cause Florida indemnity & FloodSmart cat bond losses: Twelve

Hurricane Ian’s impact is likely to cause losses to some Florida focused indemnity catastrophe bonds, as well as to some of the NFIP’s FloodSmart Re cat bond series, according to investment manager Twelve Capital.

In an update published on Thursday, Twelve Capital, the Zurich-headquartered insurance-linked securities (ILS) and reinsurance linked fund manager, forecast losses for the catastrophe bond market.

The ILS fund manager said that it believes cat bond losses are likely, but how widespread they are will depend on the eventual quantum of the insurance and reinsurance market-wide loss from the hurricane.

Twelve Capital said, “The initial industry loss estimates for this event are in the range of USD 30bn to USD 80bn, but this will only become clearer over the coming days and weeks as damage reports start coming in.”

Highlighting the further uncertainty related to the eventual industry loss given a second landfall is forecast for hurricane Ian.

Twelve Capital added, “Given that this is still an active storm there is uncertainty around what may happen next, while current predictions have Ian weakening into a tropical storm and heading north, there is the possibility that it will stay a category 1-2 storm as it travels near Orlando, Florida or potentially to restrengthen in the Atlantic and make a second landfall in the Carolinas.”

The investment manager moved onto the impacts it expects the catastrophe bond market to face as a result of hurricane Ian’s Florida damage.

“In terms of impact, this is likely to cause losses to Florida indemnity catastrophe bonds, as well as the Floodsmart bonds issued by the NFIP,” Twelve Capital explained.

There are numerous Florida indemnity cat bonds exposed, some from carriers domiciled in the state, others from nationwide carriers, as we’d explained before here.

The lowest down FloodSmart Re cat bonds would attach at somewhere between $5 billion and $5.5 billion of losses to the NFIP from a named storm event, such as hurricane Ian.

Meanwhile, the NFIP’s private reinsurance layer attaches at $4 billion, so that would begin to payout first, meaning if Twelve Capital is right and the FloodSmart Re program is set for losses, then so too is the NFIP’s traditional reinsurance tower.

On the FloodSmart Re cat bond series, which provide reinsurance to FEMA’s National Flood Insurance Program (NFIP), one had already traded at a discount price, as we reported earlier this week.

But Twelve Capital also noted the potential for a more wide spread cat bond market loss, should the eventual indusrty loss from hurricane Ian move higher in the range.

“Index-linked catastrophe bonds will be much more dependent on the overall loss – there could be very limited impact should the event stay below USD 50bn, some impact between USD 50bn and USD 75bn, and should the loss increase beyond this there will be a larger number of index-linked bonds at risk,” the investment manager said.

It will be some time before any clarity over the fate of index-trigger cat bonds, so those based on reported industry losses, is available as official estimates take time to be delivered.

As a result, this uncertainty is what could driver a particularly wide-spread marking down of cat bond secondary pricing sheets at the end of today, as we explained in this article yesterday.

Also read:

– Hurricane Ian Florida insured wind & surge losses $28bn – $47bn: CoreLogic.

– Hurricane Ian economic loss in Florida around $65bn: RMSI.

– Hurricane Ian: A historic hit for Florida, no matter the quantum of loss.

– Hurricane Ian to impact cat bond funds. Plenum says hit to be “limited”.

– Hurricane Ian to add reinsurance rate momentum, disrupt Florida market: KBW.

– A particularly broad cat bond mark-down this Friday?

– Cat modeller data hinted at hurricane Ian’s $50bn+ industry loss potential.

– Hurricane Ian: Rapid weakening may see losses nearer $32.5b, says KBW.