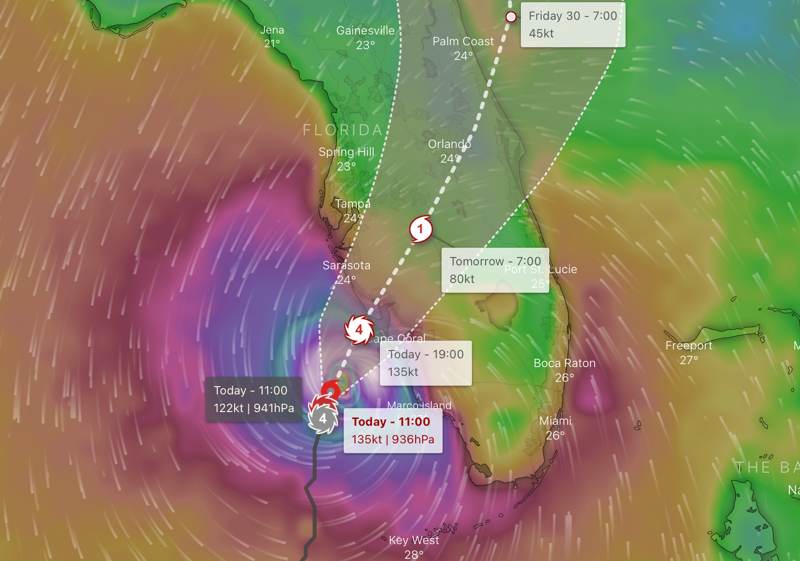

Hurricane Ian puts over $5bn of named storm cat bonds at risk

Major hurricane Ian puts a significant chunk of the global catastrophe bond market at-risk of potential losses, given there are in excess of $5 billion of US named storm specific, or well documented multi-peril cat bonds from nationwide sponsors, with Florida as a named covered state.

That’s not to mention the US multi-peril catastrophe bonds, of which there are over $6.5 billion outstanding at this time, many of which provide their sponsors with named storm reinsurance or retrocession, with Florida typically included.

On top of this, the international multi-peril catastrophe bond outstanding bracket of the market is currently over $8.8 billion in size, Artemis’ data shows.

It’s much harder to easily work out how much exposure to Florida hurricanes there is in the multi-peril buckets, but it seems safe to assume a reasonable percentage is.

In the past, it’s been said that as much as 60% to 70% of the entire catastrophe bond market’s risk capital outstanding has exposure to US named storms and hurricanes, but when you narrow that down to Florida wind only it drops a lot.

Back in 2013, risk modeller Verisk calculated that 64% of its catastrophe bond database had some Florida wind exposure.

But, with over $5 billion of US named storm and clearly marked multi-peril bonds with Florida wind or named storm surge and flood exposure, as well as a reasonable share of the US multi-peril cat bond and international multi-peril cat bond brackets, it seems safe to assume there is a significant amount of cat bond risk capital with some level of exposure to a significant Florida hurricane event like Ian.

Whether the catastrophe bond market will face any losses is harder to say at this time, but there will certainly be deductible erosion and some significant price movements in the secondary market as uncertainty is set to reign for a time after landfall.

We should expect the Plenum UCITS cat bond fund indices to tumble at their next index calculation as well, while the ILS Advisors ILS fund index will also be set for a September fall it seems.

The fact hurricane Ian is striking Florida right at the end of the month is also set to make setting end of month net asset values quite the challenge for ILS and cat bond fund managers.

Most will choose to take a more significant mark-to-market hit sooner, in end of month NAV’s, we suspect, with the potential to recover some of that later perhaps.

Either way, there’s a lot of catastrophe bond and ILS risk capital exposed and with hurricane Ian now making landfall at near Category 5 with 155 mph winds and an 18 foot storm surge, it’s expected that losses will flow across the market, with cat bonds perhaps likely to take at least a small share.

Analyse all of Artemis’s catastrophe bond data using our range of charts and visualisations.