Hurricane Francine aggregate erosion to take some cat bonds nearer attachment: Twelve

Hurricane Francine’s losses after its landfall in Louisiana are not anticipated to cause any losses to per-occurrence catastrophe bonds, but the losses may be sufficient to cause further attrition for aggregate cat bonds, resulting in a further erosion of the deductibles that sit beneath their attachment points, according to Twelve Capital.

Specialist insurance-linked securities (ILS) and reinsurance investment manager Twelve Capital explained that as of the time of writing its update on hurricane Francine on Friday, the early estimates for insurance market were low.

As we reported, at the end of last week those early estimates of insurance industry losses for hurricane Francine were coalescing around the $1 billion mark to a maximum $3 billion.

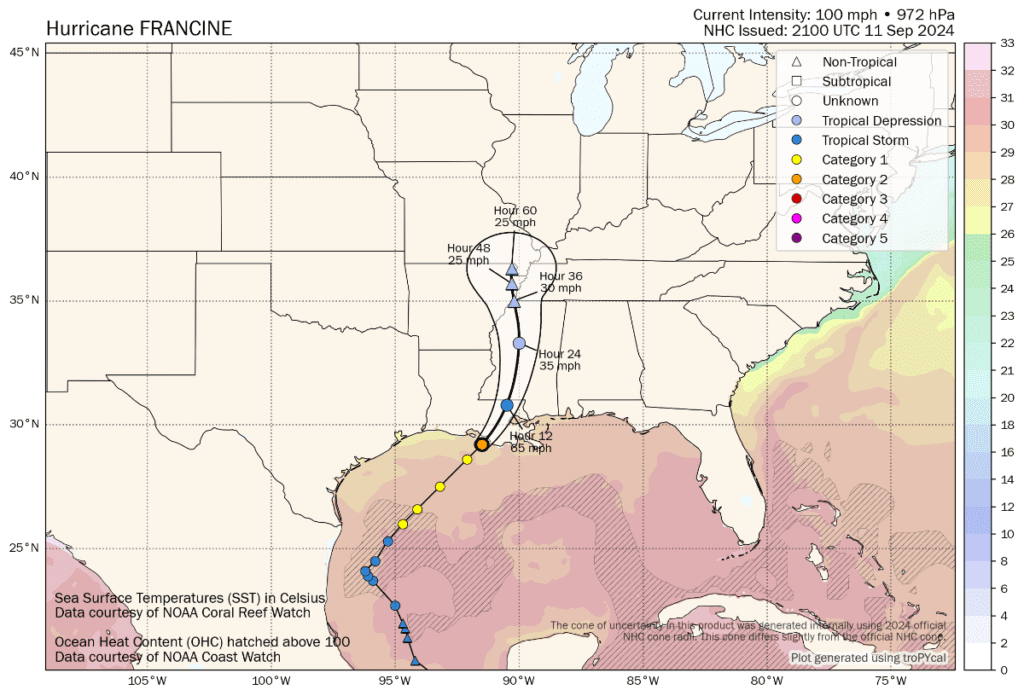

The storm made landfall on the Louisiana coastline as a Category 2 storm with 100 mph sustained winds.

We had also reported that analysts from RBC Capital Markets said Francine’s losses were expected to be manageable for property and casualty insurers, while minimal impacts were expected for the reinsurance market.

While hurricane Francine came ashore in a relatively sparsely populated area and the storm was of relatively low severity at just Cat 2, Twelve Capital did caution that building codes in Louisiana have only recently been updated.

“We flag that building codes in Louisiana were updated only in 2023, compared to 2002 for Florida, where a higher portion of buildings are built according to stronger modern standards. Enforcing of budling codes also remains uneven. State infrastructure, and particularly bridges, are in poorer conditions than the national average,” the investment manager explained.

Moving on to discuss the impacts and potential losses from hurricane Francine, Twelve Capital noted that, “Most insured losses from Hurricane Francine are anticipated to fall within primary insurers’ retentions under their reinsurance coverages.”

On catastrophe bonds specifically, the investment manager said, “We do not expect Francine will result in any loss to per-occurrence Cat Bonds.

“However, there will be continued aggregate erosion to some bonds, with some getting closer to their attachment point.”

In addition, Twelve Capital also highlighted FEMA’s FloodSmart Re catastrophe bonds, given the heavy rainfall related flooding and also storm surge impacts of hurricane Francine.

“We are monitoring the Federal Emergency Management Agency sponsored notes with combined outstanding notional of USD 1.3bn providing protection for the National Flood Insurance Program. At the time of writing we do not expect any losses to these notes, however surface water flooding around the New Orleans metropolitan area will be monitored,” Twelve Capital explained.