Hurricane Beryl forecast moves nearer Jamaica. Cat bond on watch, offers fall

The latest update from the National Hurricane Center on major hurricane Beryl has seen a notable shift in the forecast track that would take the storm closer to Jamaica with 120 mph or greater winds, a scenario that puts Jamaica’s World Bank catastrophe bond firmly on-watch and we’re told offers in the secondary market have tumbled as a result.

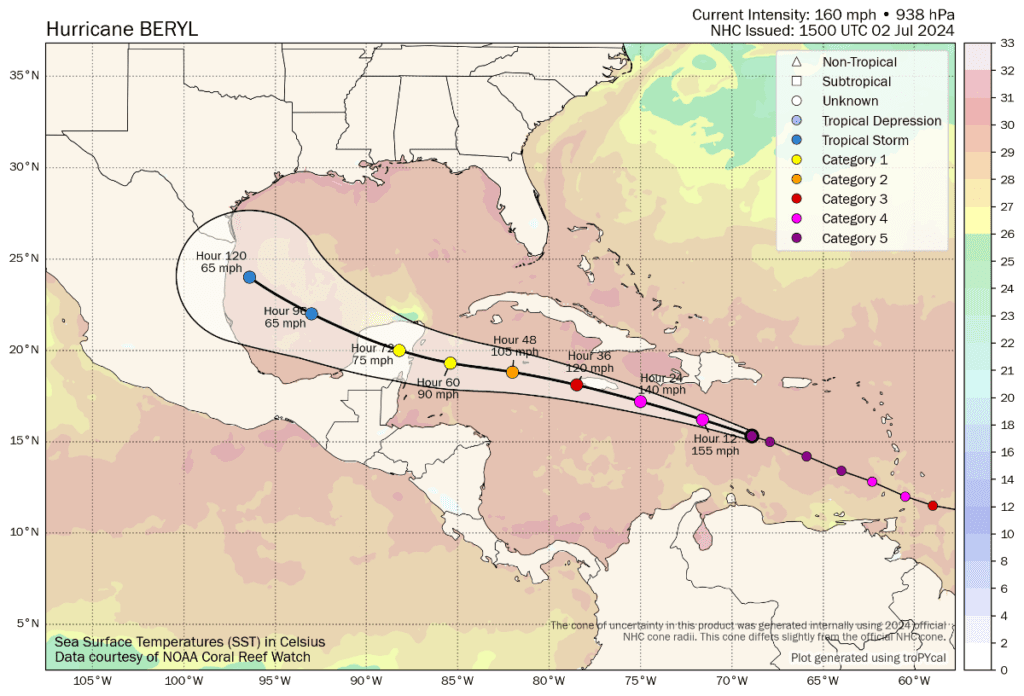

As of the 15:00 UTC update from the NHC, major hurricane Beryl is still said to have 160 mph sustained winds, so slightly weaker but with no significant change in terms of its potential to be damaging.

Minimum central pressure is slightly higher at 938mb, but again not significant indication of weakening yet.

The NHC update said, “Weakening is forecast later today, but Beryl is still expected to be near major hurricane

intensity as it moves into the central Caribbean and passes near Jamaica on Wednesday and the Cayman Islands on Thursday. Additional weakening is expected thereafter, though Beryl is forecast to remain a hurricane in the northwestern Caribbean.”

Hurricane Beryl’s core remains relatively tight, with hurricane-force winds still said to extend outwards up to 40 miles from the center. But the storm is growing, with now tropical storm force winds extending outwards up to 175 miles.

Notably though, the latest update from the NHC has updated the forecast path for major hurricane Beryl and this update takes the storm much closer to Jamaica, potentially a glancing or direct hit.

The latest forecast data suggests hurricane Beryl could still be a strong 120 mph storm at the time it nears Jamaica, putting the $150 million IBRD CAR Jamaica 2024 catastrophe bond transaction more firmly on-watch as the track has also moved closer to the island.

The map below is from Tomer Burg’s excellent resources (click it for the very latest version).

If you look at the tracking map above, which is the latest at this time (15:00 UTC, Tuesday), the forecast path for hurricane Beryl has moved closer to Jamaica.

It now suggests the storm could brush the coast with winds around 120 mph, or even make a landfall, which could be sufficient to be a triggering event for the catastrophe bond, given how wind speeds tend to translate to central pressure.

As we’d noted before, the minimum central pressure will need to be at 969mb or lower for any triggering to occur, although that would require that pressure to be read in one of the central boxes of the parametric trigger structure, over a region like Kingston, Jamaica.

A pressure of 950mb could be sufficient to trigger the cat bond in one of the parametric boxes a bit further out from the capital region, we understand.

The catastrophe bond minimum payout is for 30% of the $150 million of principle, after which it pays out on a sliding scale up to the 100% of principle mark.

When it comes to translating wind speeds to pressure of hurricanes it is not an exact science, but when it comes to the Saffir Simpson scale, there are estimates that a hurricane of Category 3 strength (wind speeds of 111-130mph) would have a central pressure in the region of 945mb to 964mb.

A Category 2 hurricane (wind speeds of 96-110mph) is estimated to have a central pressure in the region of 965mb to 979mb.

Which would suggest that if hurricane Beryl does impact Jamaica, or at least cross into the parametric boxes, it could have a central pressure low enough to cause a triggering event. How much is impossible to estimate, given the parametric trigger is constructed from multiple small boxes across Jamaica and close to its shores, but based on the latest forecast path outlook hurricane Beryl does pose a real threat to this cat bond at this time.

Interestingly, we’ve spoken with some sources in the catastrophe bond market to find out whether there has been any action in the secondary market focused on Jamaica’s catastrophe bond today.

We were told that earlier today, just a few hours ago, offers were being made at around the 97 mark, which sources said was unrealistic even based on the earlier forecast path.

But, since this latest update, we’re now told offers have tumbled into the range of 50 to 60 cents on the dollar.

Our sources still said this cat bond is unlikely to trade at those levels, given the new forecast path that has been published.

In fact, we understand that in order to find any buyers, those offers may need to halve or more. However, at this stage and with the forecast outlook worsened for Jamaica, finding buyers may not be easy, we’d imagine.

Finally, adding to the uncertainty, broker BMS Re’s latest update from its Senior Meteorologist Andrew Siffert suggests that there is an area of stronger wind shear just before Jamaica. That could help to weaken hurricane Beryl faster and further before it reaches the island.

As a result, it appears this could be a situation (if the track does not shift back away from Jamaica) where the catastrophe bond market needs to watch closely right up to Beryl nearing Jamaica, to get a better idea of the potential for this to be a cat bond triggering event.

It’s worth adding here that, should Jamaica be hit more directly by hurricane Beryl the impacts could be significant and a dangerous situation emerge for the island nation.

In that eventuality, should the cat bond be triggered, it would provide Jamaica a valuable source of disaster financing for its recovery from storm impacts, demonstrating the importance of insurance and the value of parametric triggers, as well as capital markets structural and funding diversification.

Also read: Jamaica Minister of Finance highlights risk transfer as hurricane Beryl approaches.

Track the 2024 Atlantic tropical storm and hurricane season on our dedicated page and we’ll update you as new information emerges.