How workers comp is calculated in the USA

How workers comp is calculated in the USA | Insurance Business America

Guides

How workers comp is calculated in the USA

Several factors come into play in how workers comp is calculated

When calculating workers’ compensation rates, several variables come into play, resulting in premiums that often vary significantly from policy to policy and insurer to insurer.

To give employers and employees a clearer picture of what goes on behind the scenes, Insurance Business delves deeper into these factors and explains how workers comp is calculated across the country. Insurance professionals can also share this guide with their clients who may be wondering how insurance companies determine the premiums they pay. Read on and uncover the math behind workers’ compensation costs in this article.

Workers’ compensation rates are calculated using this simple formula:

As you may have noticed, there are three main variables that influence how workers comp is calculated. These are:

Your company’s annual payroll

Job classification code and class code rate

Experience modification rate (EMR)

We will discuss these factors in more detail in the sections below.

1. Payroll

Workers’ compensation insurance providers often calculate premiums based on your company’s projected payroll. Here, you must take into consideration all types of employees, including those who work full-time, part-time, seasonal, and temporary. Generally, the larger your payroll, the higher the costs you pay for workers’ comp coverage.

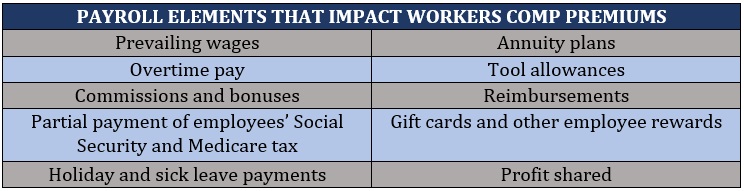

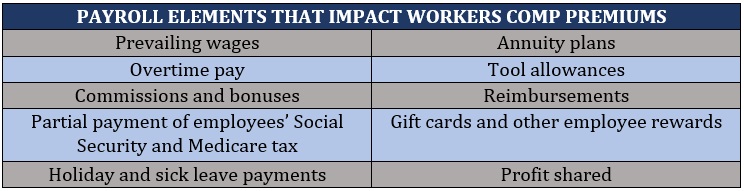

Insurers factor in several aspects of your payroll when calculating premiums. Some of these are listed in the table below.

Not everything paid to your employee, however, has an impact on how workers comp is calculated. These include the following:

Once you have gotten an estimate of your annual payroll, you can divide the figure by 100. Another important thing to take note of is after every fiscal year, your insurer reassesses your payroll expenses and either refunds excess premiums or charges you more.

2. Job classification code

Job classification code, or simply class code, is a four-digit number that indicates the type of work a job entails and the risks associated with that job. Depending on the state, class codes are either set by the National Council on Compensation Insurance (NCCI) or the state’s workers’ compensation bureau.

Class codes have a corresponding class code rate, which in technical terms, is the amount per $100 in salaries that should be paid in workers’ compensation insurance premiums for each employee.

The NCCI provides an online tool where you can look up the different job codes in each state, along with the corresponding workers comp rates on its website. But you need a user ID and password to access it. This website, however, offers the same features without the need for log-in credentials.

There are currently 35 states and the District of Columbia that uses the NCCI’s job classification systems. Eleven states have their own ratings systems, while four states – North Dakota, Ohio, Wyoming, and Washington – are considered “monopolistic states.” These states do not recognize workers’ compensation coverage if they were taken out from another state. This detailed map from the NCCI shows to which group each state belongs.

3. Experience modification rates

Workers compensation insurance providers also factor in a company’s claims history when determining premiums. This is done through what the industry calls experience modification rating (EMR). EMR, also referred to as experience mod, typically ranges between 0.75 and 1.25, with 1.0 being the industry average.

Insurers use EMRs to compare a business’ claims history against the industry average to predict its likelihood of filing claims in the future. An experience mod above the industry average of 1.0 is called a debit mod, meaning a business’ losses are greater than the average, pushing its premiums up. An EMR of less than 1.0, also known as credit mod, meanwhile, means the losses are below average, which can make a company eligible for reduced premiums.

New businesses, because they don’t have any claims history yet, start out with an EMR of 1.0 in the first few years. The premiums they pay for workers comp insurance may increase or decrease depending on the frequency and severity of their claims over the years.

JARGON BUSTER

Experience modification rating

Experience modification rating (EMR) is a metric used by workers’ compensation insurance providers to assess the past cost claims and the future probability of additional claims of a company.

Class codes, EMR. Insurance can be a complex topic that’s full of jargon. If you want to make sense of all these industry buzzwords, you can check out this glossary of common insurance terms that we have prepared.

Let’s say you have a small plumbing business with an annual payroll of about $120,000. Under NCCI’s job classification, plumbers have a class code of 5183, with a corresponding class code rate of $1.68. And since your hypothetical business is relatively new – let’s say it has been operating less than three years and hasn’t made any claims yet – we’ll assign an EMR of 1.0.

So, using the formula above, calculating your workers’ compensation insurance premiums will look like this:

Your estimated annual premium is $2,016. This figure, however, is just a ballpark estimate as each state has varying rules when it comes to workers compensation. This means the amount you need to pay may be significantly higher or lower depending on where your employee is performing the job and not necessarily where your business is based.

If you want to know the laws governing workers compensation in your state, you can click on the corresponding link in the table below.

But still, the best way to determine how much you need to pay for workers’ compensation insurance is to consult an experienced insurance professional like the five-star winners of our Top Workers’ Compensation Insurance Companies awards.

Our latest batch of awardees have been handpicked by their peers and vetted by our panel of industry experts as trusted and reliable market leaders. By partnering with these award-winning workers comp insurance providers, you can be sure that you are getting the right protection that suits your business.

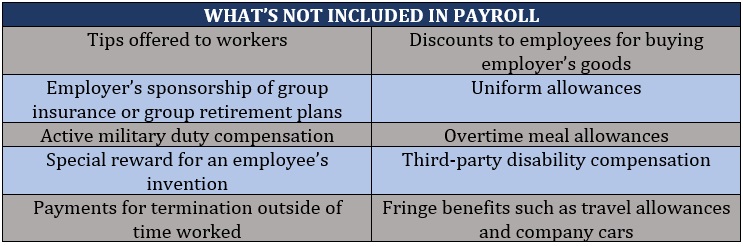

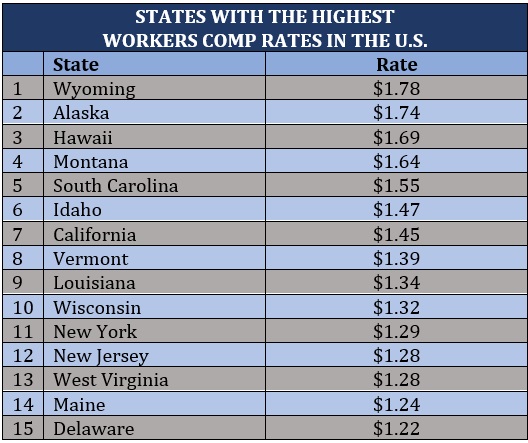

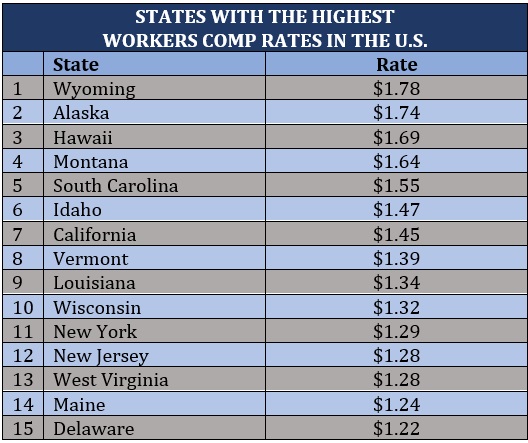

The National Academy of Social Insurance (NASI) recently released its latest workers compensation report, which included the workers comp rates in each state. The tables below show the top 15 states with the highest and lowest rates, according to the report.

You may have noticed that the figures above are a bit low, even for the states with the highest rates. The reason is that workers comp rates, also called premium index rates, are expressed as a dollar amount that companies pay for coverage per $100 in payroll, similar to how job class code rates work. Workers compensation rates are also used by insurers to determine insurance premiums.

According to the Insurance Information Institute (Triple-I), workers compensation insurance generally has two main parts, which also play a role in how workers comp is calculated. These are:

Part one – Workers’ compensation: This is where the insurance company agrees to pay any state-required amount of compensation. Coverage is not capped, meaning the insurer will pay whatever amount the business is obligated to because of a work-related accident.

Part two – Employers’ liability: This protects against lawsuits filed by an employee for a job-related illness or injury that is not subject to state statutory benefits. This type of policy comes with a monetary limit.

Almost all states require businesses to purchase workers’ compensation insurance, depending on the industry in which the business operates and the number of its employees. The only exception is Texas, which only requires private employers providing contract work to the government to purchase coverage for staff working on the project.

Workers’ compensation insurance is a type of business insurance policy that covers the cost of medical care and a portion of lost wages of employees who get injured or sick in a job-related incident. It also protects a business from the financial liability of paying for these expenses out of pocket.

Different insurance providers offer different levels of protection, but generally workers compensation insurance policies pay out for the following:

Hospital and medical bills: These include the costs of medical treatment for the sick or injured staff, such as doctor visits, surgeries, and medication. Medical expenses related to COVID-19 may also be covered, depending on the state and industry.

Lost wages: Policies pay out a portion of the employee’s salaries if they require time off due to a work-related illness or injury. This ensures that they have a source of income while recovering.

Ongoing care: This includes treatment expenses resulting from extended medical care, such as occupational and physical therapy, and other rehabilitation costs.

Disability benefits: Employees who become disabled due to a job-related accident qualify for full or partial disability benefits.

Death benefits: This covers funeral and burial expenses and provides financial benefits for the beneficiaries if an employee dies because of a workplace accident.

If you want to keep abreast of the latest developments in the workers’ compensation insurance space, visit and bookmark our Workers Comp section, where you can find breaking news and industry updates.

Do you agree with how workers comp is calculated? Do you think workers compensation insurance is an essential coverage? Feel free to share your thoughts below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!