How to start an insurance agency in Texas

How to start an insurance agency in Texas | Insurance Business America

Guides

How to start an insurance agency in Texas

Launching an insurance business in one of the US’ biggest markets requires careful planning. This guide on how to start an insurance agency in Texas can help

The insurance market in Texas is one of the largest in the country. It also contributes heavily to the state’s economy. These are just a few of the several reasons why launching an insurance business in the Lone Star State can be an appealing venture.

In this article, we will give you a step-by-step walkthrough on how to start an insurance agency in Texas. This guide will provide a rundown of the different requirements. We will also give you some practical tips on how to keep your business profitable.

If you’re planning on running your own insurance sales business in the state, this article can help. Read on and find out if launching an insurance agency in Texas suits you.

What makes running an insurance company an attractive venture is the strong growth potential that comes with it. Establishing your own insurance business in one of the most fiercely competitive markets, however, requires careful planning and preparation.

Here are the steps on how to start an insurance agency in Texas:

1. Strengthen your industry expertise.

A solid understanding of how the insurance industry works puts you in a much better position to succeed. If you don’t have much industry knowledge, now is the time to start laying the groundwork. Do your research and get enough experience to give yourself a fighting chance.

Ideally, you need several years of experience as an insurance professional to build the necessary expertise to run an agency. This will also give you a clear idea of which insurance lines to specialize in.

If you have been working as an insurance agent or broker, you can use your existing roster of partner carriers to build your network of insurance providers. These insurers can help you build your client base, which will also serve as your agency’s lifeline.

2. Prepare a solid business plan.

Apart from industry experience, having a deep understanding of how companies operate is a must if you want to run a successful insurance agency. Strong business acumen helps you create a solid business plan. The plan serves as your guide as you steer your insurance agency into profitability. It also helps you gain investors’ trust and confidence, so you can raise sufficient capital for your company.

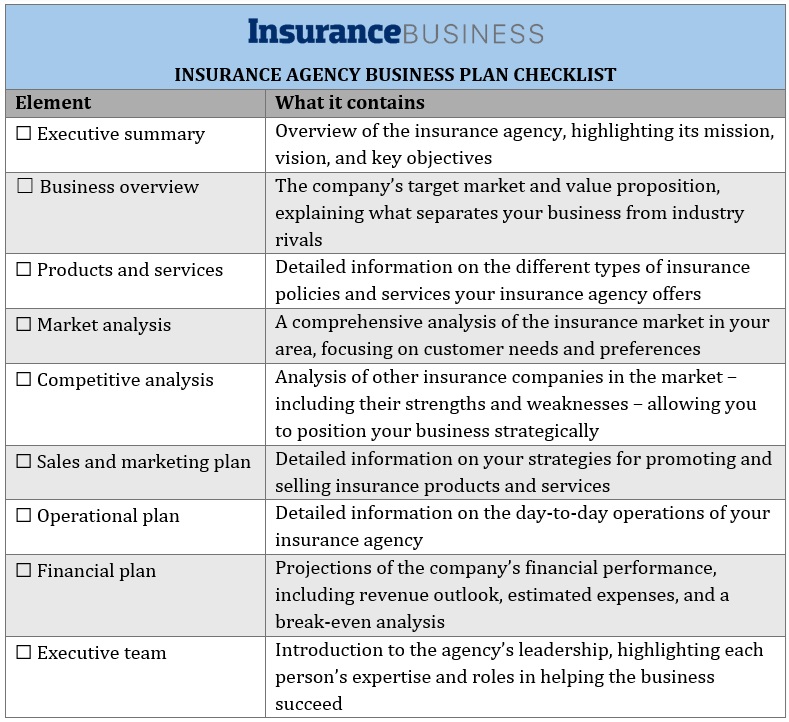

But what does a sound business plan consist of? Here’s a checklist. You can download and save the file for quick reference.

Part of creating a strong business plan is choosing your insurance agency’s business structure. This will play a key role in how your profits will be taxed. It will also determine if your personal assets will be treated separately from your business assets. You can choose from the following business structures:

Sole proprietorship: This is where the ownership and management of the agency is yours exclusively.

Partnership: Two or more individuals share ownership of the insurance agency.

Limited liability company (LLC): This structure protects the owners against personal liability for the company’s debts and claims. An LLC can be managed by the owners or an outsider.

Limited liability partnership (LLP): This works like an LLC but managed exclusively by the owners.

C corporation: This is where the owners and the insurance agency are taxed separately.

S corporation: This structure gives businesses the same legal protections as a C corporation but are taxed as a pass-through entity.

Each business structure comes with its own share of pros and cons, so it pays to pick the one that suits your financial situation and business experience.

3. Raise your capital investment.

Starting an insurance agency in Texas can be an expensive project. You need adequate financing to sustain your daily operations. You also need a lot of funds to maintain a positive cash flow, especially in the first few years of your business.

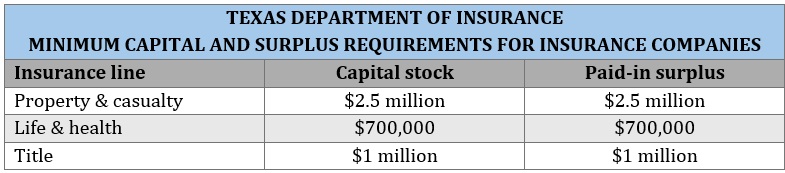

The Texas Department of Insurance (TDI) has set minimum capital and surplus requirements for those wanting to open an insurance company in the state. The amount varies depending on the insurance line.

You will be required to submit an explanation of your compliance with the minimum capital and surplus requirements, along with other documents, to the department.

If you don’t have the means to meet the required financing, you can take out a business loan, look for government-sponsored grants, or turn to crowdfunding.

4. Meet the insurance licensing and business requirements.

Before your insurance agency can operate legally in Texas, there are several licensing and business requirements you must meet.

Licensing requirements

All businesses involved in selling insurance products and services in Texas need to get the proper licenses to operate legally. If your business is based in the state, you will need to secure a resident insurance agency license. If the company is based out-of-state, you will be required to get a non-resident insurance agency license.

The good news is that Texas has reciprocity agreements with certain states. This agreement allows insurance professionals to apply for licenses without having to take the state licensure exam.

TDI groups insurance agencies into different categories, with each needing to secure the corresponding licenses:

County mutuals: what the TDI defines as an insurance company that “qualifies to write casualty lines for statewide operation”

General lines insurance agencies – property and casualty: sell policies under the P&C line

General lines insurance agencies – life, accident, health & HMO: offer life, accident, and health (LA&H) insurance policies, and offer health maintenance organization (HMO) services

Life insurance agencies: specialize in selling life insurance policies

Life insurance agencies for policies not exceeding $25,000: authorized to sell life insurance policies worth $25,000 or less

Funeral pre-arrangement life insurance agencies: write life insurance policies and fixed annuity contracts designed to deliver funeral services and merchandise

Personal lines insurance agencies: sell policies that combine LA&H and P&C elements

Title insurance agencies: provide policies that protect homebuyers and lenders from financial losses stemming from issues with the ownership title of the property

Limited lines insurance agencies: sell policies other than the six general lines defined by the National Association of Insurance Commissioners (NAIC), including credit, crop, farm, and travel insurance

Surplus lines insurance agencies: offer policies for highly complex risks that traditional insurers aren’t willing to cover

Managing general agents (MGA): contracted by insurers and reinsurer for certain tasks, including claims handling, underwriting, binding, policy administration, and distribution

Learn more about the different insurance agency licensing requirements in Texas in this guide.

Business requirements

If you’re starting an insurance agency in Texas, you will also need to apply for a certificate of authority. This is a legal requirement for all insurance companies operating in the state.

As a member of NAIC’s Uniform Certificate of Authority Application (UCAA) program, Texas requires you to submit your application to the UCAA website. To apply, you need to submit a cover letter summarizing the information about the proposed incorporation and the type of insurance you plan to offer. The TDI also lists several documents that you need to submit along with your application, including:

application form and UCAA form attachments (UCAA Forms 1P, 2P, and 3)

explanation of your compliance with the minimum capital and surplus requirements

explanation of how you met or will meet the statutory deposit requirement

name approval

plan of operation (business plan)

holding company form “B” registration statement

SEC filings or consolidated GAAP financial statement

debt-to-equity ratio statement

custody agreements

public records package, including proposed articles of incorporation, by-laws, and balance sheet representing proposed initial capitalization

biographical affidavits (UCAA Form 11) and independent third-party verifications

fingerprinting

Here’s a detailed list of filing requirements from the TDI. If you feel that one or more requirements can be omitted, you can also submit an explanation justifying the exclusion.

Ideally, the processing period lasts 90 days. This is if you have submitted the complete requirements and there are no more clarifications from the department. Once your application has been approved, you can start your insurance agency in Texas.

Texas law requires any company or professional selling insurance in the state to secure the right licenses. Selling insurance products and services without the necessary licenses can result in a felony charge. Individuals and businesses can also face stiff financial and legal penalties, including:

blocked commissions

monetary fines

revocation or suspension of insurance and business licenses

The state insurance regulation department may also issue cease-and-desist orders to prevent your insurance agency from doing business. If this happens, you may be required to pay any unsettled insurance claims.

Apart from ensuring that businesses meet licensing requirements, the TDI investigates misconduct and takes enforcement action against insurers and agents. The department may also fine insurance professionals and companies that delay claims payments, misrepresent policies, charge inappropriate rates, or commit other unlawful acts.

Here are some practical steps on how you can keep your Texas insurance agency profitable:

Set clear goals: Having clear goals steers your business in the right direction and, if set correctly, can help you measure your profitability.

Identify your niche: Constantly evolving client needs present an opportunity for your insurance agency to find a niche market that will help you boost profitability.

Be proactive in getting leads: Your success in the industry relies heavily on how you can keep driving leads. Always explore creative and innovative strategies that can help your agency to tap new leads.

Take advantage of the latest technology: With the industry’s shift to digitalization, the only way for your insurance agency to move forward is to embrace technology. Leverage new technologies such as artificial intelligence, telematics, and cloud computing. These can help you manage risks, reduce operating expenses, and improve customer experience.

Another way to reach profitability is to find industry players to model success from. You don’t have to go far to find one. Our Best in Insurance Special Reports page is the place to go if you’re searching for insurance professionals and companies to look up to.

Did you find our guide on how to start an insurance company in Texas helpful? Let us know in the comments.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!